S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on May 12, 2023

As filed with the Securities and Exchange Commission on May 12, 2023

Registration No. 333-271699

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Kiora Pharmaceuticals, Inc.

(Exact name of registrant as specified in its Charter)

| Delaware | 2834 | 98-0443284 | ||||||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification No.)

|

||||||

332 Encinitas Boulevard, Suite 102, Encinitas, California 92024

(858) 224-9600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Brian M. Strem, Ph.D.

President and Chief Executive Officer

Kiora Pharmaceuticals, Inc.

332 Encinitas Boulevard, Suite 102, Encinitas, California 92024

(858) 224-9600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Robert A. Petitt, Esq. Burns & Levinson LLP 125 High Street Boston, MA 02110 (617) 345-3000 |

Michael Nertney, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105

(212) 370-1300

|

||||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (check one)

| Large Accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||

| Non-accelerated filer | ☒ |

Smaller reporting company | ☒ |

||||||||

| Emerging growth company | ☐ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act .

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED MAY 12, 2023

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

5,905,512 Shares of Common Stock

15,000 Shares of Series F Convertible Preferred Stock

(5,905,512 shares of Common Stock underlying the Series F Convertible Preferred Stock) and

Warrants to Purchase up to 2,952,756 Shares of Common Stock

(2,952,756 shares of Common Stock underlying the Warrants)

We are offering 5,905,512 shares of common stock, including shares of common stock underlying shares of Series F Convertible Preferred Stock that we may issue as described below, together with warrants, with each warrant to purchase one-half of a share of common stock (and the shares issuable from time to time upon exercise of the warrants) at an assumed combined purchase price of $2.54 per share of common stock and warrant pursuant to this prospectus. The shares and warrants will be separately issued but will be purchased together in this offering. Each warrant will have an exercise price of $ per share, will be exercisable upon issuance and will expire five years from the date on which such warrants were issued.

We are also offering to those purchasers, whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if they so choose, in lieu of the shares of our common stock that would result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%), shares of Series F Convertible Preferred Stock (“Series F Preferred Stock”), convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by the combined public offering price per share of common stock (the “Conversion Price”), at a public offering price of $1,000 per share of Series F Preferred Stock. Each share of Series F Preferred Stock is being sold together with the same warrants described above being sold with each share of common stock. For each share of common stock underlying a share of Series F Preferred Stock that we sell, the number of shares of common stock that we are selling will be decreased on a one-for-one basis.

The price of our common stock on The Nasdaq Capital Market during recent periods will only be one of many factors in determining the final combined public offering price. Other factors to be considered in determining the final combined public offering price include our history, our prospects, the industry in which we operate, our past and present operating results, the general condition of the securities markets at the time of this offering and discussions between the underwriters and prospective investors. The recent market price used throughout this prospectus may not be indicative of the final combined public offering price. All share numbers included in this prospectus are based upon an assumed combined public offering price per share of common stock and warrant of $2.54, the closing price of our common stock on The Nasdaq Capital Market on May 11, 2023.

Our common stock is listed on The Nasdaq Capital Market under the symbol “KPRX.” On May 11, 2023, the last reported sale price of our common stock on The Nasdaq Capital Market was $2.54 per share. The warrants and any shares of Series F Preferred Stock that we issue are not and will not be listed for trading on The Nasdaq Capital Market.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in our common stock.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 18 of this prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Share and Warrant(1)

|

Total | |||||||||||||

| Public offering price | $ | $ | ||||||||||||

Underwriter discounts and commissions (2)

|

$ | $ | ||||||||||||

| Proceeds, before expenses, to us | $ | $ | ||||||||||||

__________________

(1)The public offering price and underwriting discount corresponds to (i) a public offering price per share of common stock of $ ($ net of the underwriting discount) and (ii) a public offering price per warrant of $ ($ net of the underwriting discount).

(2)We have agreed to pay certain expenses of the underwriters in this offering. We refer you to “Underwriting” on page 64 for additional information regarding underwriting compensation.

The offering is being underwritten on a firm commitment basis. We have granted a 45-day option to the underwriters to purchase up to an additional 885,827 shares of common stock and/or warrants to purchase an additional 442,913 shares of common stock at the public offering price, less the underwriting discounts payable by us, to cover over-allotments, if any.

The underwriters expect to deliver the securities to investors on or about , 2023.

Sole Book-Running Manager

Ladenburg Thalmann

The date of this prospectus is , 2023

TABLE OF CONTENTS

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

|

|||||

ABOUT THIS PROSPECTUS

We have not, and the underwriters have not, authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information contained in or incorporated by reference in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the United States: We have not, and the underwriters have not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We have proprietary rights to trademarks used in this prospectus, including Kiora®. Solely for our convenience, trademarks and trade names referred to in this prospectus may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name, or service mark of any other company appearing in this prospectus is the property of its respective holder.

i

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our securities under the heading “Risk Factors,” before investing in our securities. All references to “Company” “we,” “our” or “us” refer solely to Kiora Pharmaceuticals, Inc. and its subsidiaries and not to the persons who manage us or sit on our Board of Directors.

Overview

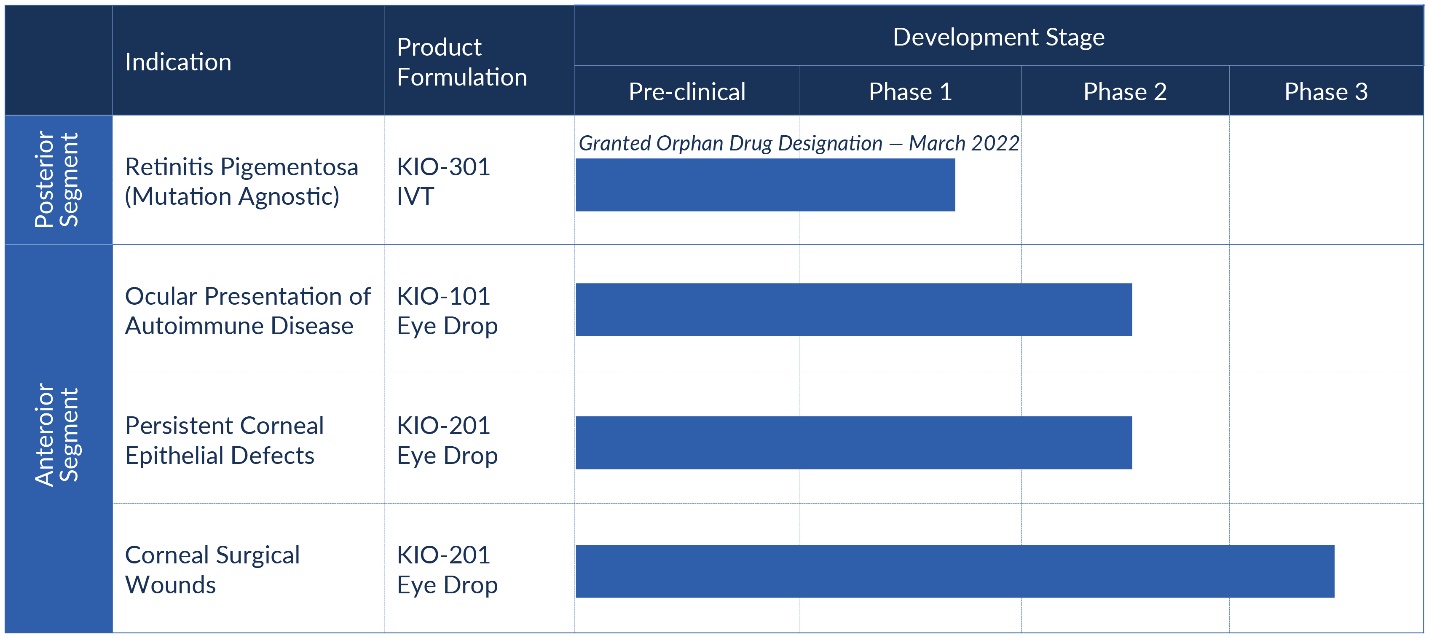

We are a clinical-stage specialty pharmaceutical company developing and commercializing therapies for the treatment of ophthalmic diseases. We were formed as a Delaware corporation on December 26, 2004, under the name of EyeGate Pharmaceuticals, Inc., and changed our name to Kiora Pharmaceuticals, Inc. effective November 8, 2021. We were originally incorporated in 1998 under the name of Optis France S.A. in Paris, France. Our lead product is KIO-301, with an initial focus on patients with later stages of vision loss due to retinitis pigmentosa (RP, any and all sub-forms). KIO-301 is a potential vision-restoring small molecule that acts as a “photoswitch” specifically designed to restore vision in patients with inherited and age-related degenerative retinal diseases, including RP. The molecule is designed to restore the eyes’ ability to perceive and interpret light in visually impaired patients through selectively entering viable downstream retinal ganglion cells (no longer receiving electrical input due to degenerated rods and cones) and turning them into light sensing cells, capable of signaling the brain as to the presence or absence of light. We initiated a Phase 1b clinical trial in the third quarter of 2022 and dosed the first patient in November 2022. On March 17, 2022, we were granted orphan drug designation (ODD) by the United States Food and Drug Administration (FDA) for the active pharmaceutical ingredient (API) in KIO-301. KIO-301 (formerly known as B-203) was acquired through the Bayon Therapeutics, Inc. (Bayon) transaction which closed October 21, 2021.

KIO-101 focuses on treating the ocular manifestation of patients with autoimmune diseases, including rheumatoid arthritis and, as such, is termed the Ocular Presentation of Rheumatoid Arthritis and Other Autoimmune Diseases (OPRA+). KIO-101 is a next-generation, non-steroidal, immuno-modulatory, small-molecule inhibitor of dihydroorotate dehydrogenase (DHODH). We believe KIO-101 to be best-in-class with picomolar potency and a validated immune modulating mechanism designed to overcome the off-target side effects and safety issues associated with commercially available DHODH inhibitors. In the fourth quarter of 2021, we reported top-line safety and tolerability data from a Phase 1b proof-of-concept (POC) study evaluating KIO-101 in patients with ocular surface inflammation. As a further sign of safety, there were zero clinically significant laboratory (including liver enzymes) findings observed in both healthy patients and those with ocular surface inflammation. We initiated a Phase 2 clinical trial in the first quarter of 2023. KIO-101 (formerly known as PP-001) was acquired through the acquisition of Panoptes Pharma GmbH (Panoptes) in the fourth quarter of 2020.

We are developing KIO-201 for patients with persistent corneal epithelial defects (PCED). PCED is an orphan disease and as such, we are currently seeking orphan drug designation (ODD). KIO-201 is also being considered for patients recovering from surgical wounds, such as those undergoing the laser vision correction procedure, photorefractive keratectomy (PRK). KIO-201 is a modified form of the natural polymer hyaluronic acid, designed to protect the ocular surface to permit re-epithelialization of the cornea and improve and maintain ocular surface integrity. KIO-201 has unique properties that help hydrate and protect the ocular surface. We completed a Phase 2 clinical trial in patients with PCEDs and released top-line data in Q1 2023. We expect to release full data in Q2 2023. We are in planning stages of a Phase 3b trial for patients recovering from PRK and plan to initiate the study before the end of 2023.

1

Market Opportunity

Retinitis Pigmentosa Market Overview

More than 5.5 million patients globally are estimated to have an inherited retinal disease leading to significant or permanent vision loss. RP is the largest family of these inherited diseases. RP affects about 1 in 3,500 people worldwide. Thus, with a population of about 330 million in the U.S. as of February 2021, about 96,250 people in the U.S. would be expected to have RP. With a worldwide population presently estimated at over 7.7 billion, it can be estimated that approximately 2.3 million people around the world have RP.

RP is a group of hereditary progressive disorders that may be inherited as autosomal recessive, autosomal dominant or X-linked recessive traits. Maternally inherited variants of RP transmitted via the mitochondrial DNA can also exist. About half of all RP cases are isolated (that is, they have no family history of the condition). RP may appear alone or in conjunction with one of several other rare disorders. Patients with RP have a progressive loss of photoreceptors (rods and cones) and therefore patients with late-stage RP have a substantial loss of peripheral and central visual function.

While no approved therapies are available for the treatment of RP, current therapeutics in development primarily rely on genetic approaches to introduce light sensing channels into viable downstream cells, a field termed optogenetics. KIO-301 is a small molecule photoswitch, that confers light sensitivity to downstream cells, specifically the retinal ganglion cells (RGCs), potentially triggering the same phototransduction signaling as if the photoreceptors were present and viable.

Our Solution: KIO-301

KIO-301 is a novel small molecule with the potential to confer light sensitivity to patients with degenerated retinas due to either inherited or age-related diseases, which has received orphan drug designation from the FDA. Many retinal diseases result in the death of the retinal photoreceptors, the light sensing cells in the retina. However, downstream retinal neurons, such as the bipolar and RGCs remain viable for long periods after photoreceptor death. KIO-301 selectively enters these cells and non-covalently resides on the intracellular domains of potassium and hyperpolarization-activated, cyclic nucleotide-gated (HCN) voltage gated ion channels. As KIO-301 has an azobenzene core, visible light causes a rapid and reversible change in the isomeric state of the molecule, transforming from a linear molecule to an orthogonal molecule. When this happens, the voltage gated ion channels and current efflux are blocked, causing cellular depolarization and signaling to the brain as to the presence of light. When light is no longer touching the molecule, it reverts back to its linear state, allowing ion efflux from the cells and thus promoting repolarization and a turning “off” of the brain signaling.

This novel mechanism of action enables potential application to multiple diseases. RP is a group of inherited eye diseases that cause photoreceptor cell death. In the U.S., RP is considered an orphan disease with a prevalence of fewer than 200,000. This prevalence enables consideration for KIO-301 to qualify for orphan drug designation in the treatment of RP, conferring increased regulatory collaboration with the FDA, and market exclusivity if clinical trials demonstrate safety and efficacy. On March 17, 2022, we were granted orphan drug designation by the FDA for the active ingredient in KIO-301. Currently, no therapeutics are approved to treat patients with RP.

A possible market expansion from RP would be to evaluate KIO-301 in patients with geographic atrophy (GA), the late stage of age-related dry macular degeneration. There are about 1,000,000 patients in the U.S. with GA and to date, only one therapeutic has been approved to treat this disease (Syfovre) which is intended to slow the disease progression but not return vision that was lost due to disease.

Ocular Presentation of Rheumatoid Arthritis Market Overview

Patients with systemic autoimmune diseases including Rheumatoid Arthritis (RA), are known to suffer from ocular presentation of their underlying autoimmune conditions. Secondary to inflammation and associated pathologies in the joint synovium, the eye carries significant morbidity and impact on eye health and quality of life. These ocular presentations can include signs and symptoms similar to keratoconjunctivitis sicca (KCS), episcleritis, scleritis, peripheral ulcerative keratitis (PUK), anterior uveitis, as well as retinal vasculitis. In patients with OPRA+,

2

the surface of the eye often has significant irritation accompanied by symptoms of soreness, grittiness, light sensitivity, and dryness. Patients with RA suffer from ocular signs and symptoms at a rate reported to be 2-3X that of the general population. Furthermore, in those OPRA+ patients, up to 50% report moderate to severe signs and symptoms. Today, there are approximately 1.8 million RA patients in the U.S. Approximately one-third of these patients present with OPRA+ (more than 0.5 million in the U.S.), with more than 90% seeking prescription medication to address these ophthalmic manifestations. Unfortunately, today's ocular surface anti-inflammatory medicines are usually not sufficient to treat OPRA+ as they are broad and not targeted to the underlying pathophysiology.

As noted above, KIO-101 is a member of a family of DHODH inhibitors, known to be disease modifying agents in autoimmune diseases. RA, as well as OPRA+, are T-cell mediated auto-inflammatory diseases and whilst rheumatologists are helping the systemic manifestations of this disease with approved targeted t-cell modulators, including DHODH inhibitors, ophthalmologists do not have the same toolbox of treatments designed specifically to help patients with ocular presentation.

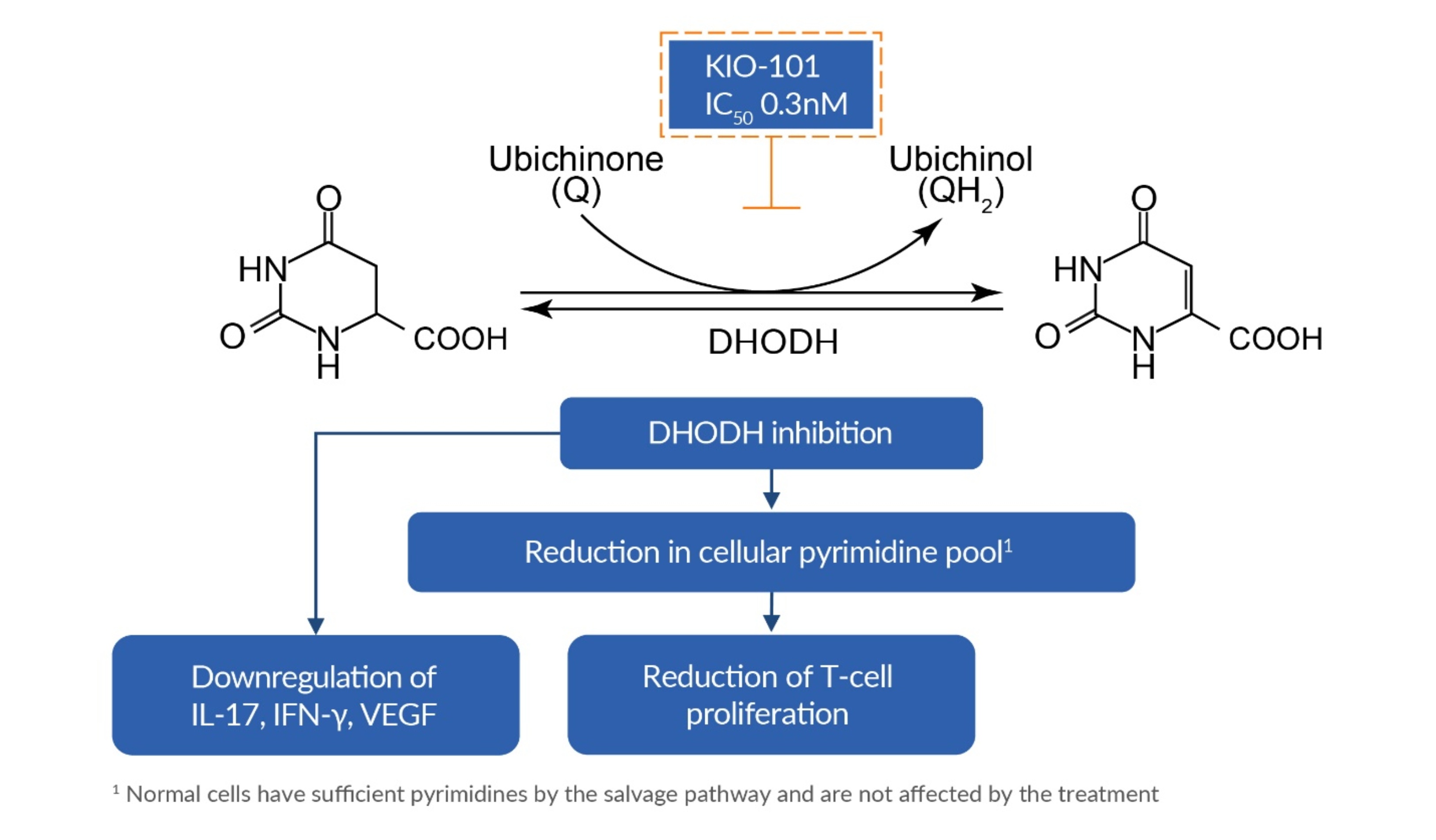

Our Solution: KIO-101

KIO-101 is a third-generation small molecule DHODH inhibitor. DHODH is extensively exploited as potential drug targets for immunological disorders, oncology, and infectious diseases. DHODH is a key enzyme in the de novo pyrimidine synthesis pathway. This enzyme is located in the mitochondria and catalyzes the conversion of dihydroorotate (DHO) to orotate as the fourth step in the de novo synthesis of pyrimidines that are ultimately used in the production of nucleotides.

Nucleotides are required for cell growth and replication. Nucleotides are the activated precursors of nucleic acids and are necessary for the replication of the genome and the transcription of the genetic information into RNA. Nucleotides also serve as an energy source for a more select group of biological processes (ATP and GTP). They also play a role in the formation of glycogen, signal-transduction pathways, and as components of co-enzymes (NAD and FAD). An ample supply of nucleotides in the cell is essential for all cellular processes.

There are two pathways for the biosynthesis of nucleotides: salvage and de novo. The main difference is where the nucleotide bases come from. In the salvage pathway, the bases are recovered (salvaged) from RNA and DNA degradation. In the de novo pathway, the bases are assembled from simple precursor molecules (made from scratch).

One critical requirement of fast-growing or proliferating cells, such as the expansion of activated B- and T-cells, cancer cells, and pathogen infected host cells, is the requirement of an abundance of nucleotide bases. These metabolic activities will predominately utilize the de novo pathway for nucleotide biosynthesis. A key advantage of DHODH inhibition is the selectivity towards metabolically activated cells (with a high need for RNA and DNA production), which should mitigate any negative impact on normal cells. Depletion of cellular pyrimidine pools through the selective inhibition of DHODH has been shown to be a successful approach for therapeutic development.

Currently, two first generation DHODH inhibitors have been approved in the U.S. and abroad and are marketed by Sanofi as leflunomide (Arava®) and the active metabolite teriflunomide (Aubagio®). These oral tablets are approved for the treatment of rheumatoid and psoriatic arthritis and multiple sclerosis (MS), respectively. These diseases are autoimmune disorders. One potential explanation for the therapeutic effects of Arava® in arthritis is the reduction in the numbers or reactivity of activated T-cells, which are involved in the pathogenesis of arthritis. The generally accepted view of human MS pathogenesis implicates peripheral activation of myelin-specific autoreactive T-cells that lead to inflammatory disease in the central nervous system (CNS). By blocking the de novo pyrimidine synthesis pathway via DHODH inhibition, it is suggested that Aubagio® reduces T-cell proliferation in the periphery. Arava® and Aubagio® are formulated as oral drugs and it is established that leflunomide will be metabolized in the liver to the active metabolite teriflunomide. Hepatotoxicity was reported as a major side effect after oral administration, possibly as a result of the extent of liver metabolism. Moreover, it was shown that apart from DHODH, a series of protein kinases are inhibited by Arava® and Aubagio®.

3

Corneal Wounds Market Overview

Normal corneal epithelial wound healing relies on rapid migration and proliferation of epithelial cells from the wound edge and the limbus, followed by extracellular matrix deposition and remodeling. Persistent corneal epithelial defects (PCED) are corneal wounds, caused by injury or disease, that do not heal within the normal time frame (usually 7-14 days) but persist for weeks or even months. Several underlying disease states may result in PCED, including previous herpes simplex or herpes zoster infection, neurotrophic keratitis, diabetes, and severe dry eye states. Nonhealing corneal epithelial defects may also occur after ocular surgery or other physical injuries and/or trauma to the cornea. PCEDs require intervention as they can lead to infections, stromal ulceration, corneal scarring, and opacification and result in vision loss.

There is an unmet medical need for a simple treatment that could aid in the healing of PCEDs. Current methods of addressing PCEDs include debridement and patching, applying a bandage contact lens, human amniotic membrane, autologous serum, suturing the lids via a tarsorrhaphy, or in severe cases applying a conjunctival graft over the cornea. These methods are invasive, costly, and/or merely cover the wound; none have proven universally effective for healing PCEDs and often result in a recurrence of the defect. KIO-201, a crosslinked, modified hyaluronic acid, is applied topically as a gel eye drop formulation and works to stabilize the tear film and protect the ocular surface, providing a local tissue environment conducive to re-epithelialization and corneal wound healing.

Further, there are multiple surgical procedures involving the ocular surface that have long recovery, whereby acceleration of that period would benefit the patients. PRK surgery is an efficacious alternative to patients seeking surgical correction of refractive errors who are not suitable candidates for Laser-Assisted In Situ Keratomileusis (LASIK) due to inadequate corneal thickness, larger pupil size, history of KCS, or anterior basement membrane disease. PRK surgery involves controlled mechanical removal of corneal epithelium with subsequent excimer laser photoablation of the underlying Bowman’s layer and anterior stroma, including the subepithelial nerve plexus.

The military prefers PRK as a refractive procedure due to the stability of the PRK incision and the absence of risk for flap dislocation during military active duty. Although this procedure yields desirable visual acuity results, common complications of the procedure include post-operative pain secondary to the epithelial defects, risk of corneal infection prior to re-epithelization of the large epithelial defect, corneal haze formation, decreased contrast sensitivity, and slower visual recovery. The number of laser vision correction procedures is on the rise, estimated in 2021 at about 2 million in the U.S.. Whilst PRK comprises a fraction of these procedures, there are about 160,000 surgeries performed annually in the U.S. These surgeries are heavily consolidated to a few corporate umbrellas, such as TLC Laser Eye Centers, enabling a targeted commercial campaign once a therapeutic is approved.

Keratoconus is an orphan disease of the ocular surface, affecting approximately 170,000 patients in the U.S. alone according to NORD. Keratoconus progression involves the structure of the cornea which bulges outward, directly affecting vision. Whilst the etiology of the disease is unknown, there are multiple approaches to helping these patients, involving the use of vision correction prothesis such as contact lenses and glasses, to surgical approaches involving collagen cross-linking the corneal surface to provide more rigidity and slow progression. One of these corneal cross-linking approaches, termed epi-off, involves the removal of about 8 mm of the epithelium on the cornea and a riboflavin solution is applied to the exposed corneal stroma. This procedure is not free of side effects, which often include corneal infections, subepithelial haze, sterile infiltrates, reactivation of herpetic keratitis, and endothelial damage. Thus, accelerating the re-epithelialization would carry significant value.

Our Solution: KIO-201

KIO-201 is a synthetic modified hyaluronic acid (HA) capable of coating the ocular surface and designed to resist degradation under conditions present in the eye. This prolongs residence time of the bandage on the ocular surface, thereby addressing one of the limitations of current non-cross-linked HA formulations. Additionally, cross-linking allows the product’s viscosity to be modified to meet optimum ocular needs. The improved viscoelasticity and non-covalent muco-adhesive interfacial forces improve residence time in the tear film, thus providing a coating that aids re-epithelization of the ocular surface via physical protection. If KIO-201 is approved by the FDA, we expect that it will be the only wound healing prescription eye drop available in the U.S. based on HA.

4

KIO-201 exhibits significant shear thinning properties. This feature allows the modified HA to act as a more concentrated, viscous barrier at low shear rates in a resting tear film, but also as a lower resistance fluid (therefore thinned) during high shear events such as blinking. This property enables better residence time and a more favorable ocular surface coating with less optical blur. We have demonstrated in animal studies that KIO-201 remains on the ocular surface for up to two hours, and further demonstrated in a human clinical study that KIO-201 does not cause blurriness while on the ocular surface. This enhances ocular surface protection and patient comfort, while maintaining good visual function.

KIO-201 has been shown to provide a mechanical barrier that aids in the management of corneal epithelial defects and re-epithelization in both preclinical studies and in clinical ophthalmic use. Patients with PCEDs or those recovering from PRK surgery provide subject populations in need of safe and efficacious treatments to accelerate recovery. KIO-201 has already demonstrated statistical significance in a Phase 2a PCED clinical trial and in a pivotal clinical study for its ability to accelerate wound healing against the current standard-of-care, a bandage contact lens.

A possible market expansion would be to evaluate KIO-201 in patients with keratoconus, an ocular disease that affects the structure of the cornea and can cause blindness. Currently patients undergo a mechanical reshaping of the cornea, however this approach causes significant damage to the epithelial layer. As KIO-201 has demonstrated the ability to accelerate wound healing to the ocular surface, the underlying mechanism of action would be a congruent fit.

Our Strategy

Our goal is to develop products for treating disorders of the eye. The key elements of this strategy are to:

•Develop Core Assets

–Continue clinical development of KIO-301 in a Phase 1b clinical study in patients with mid to late stage retinitis pigmentosa.

–Continue clinical development of KIO-101 in a Phase 2 clinical study for the treatment of the ocular manifestations of autoimmune diseases (e.g., rheumatoid arthritis). In the first quarter of 2023, we received approval to initiate a Phase 2 study, slated to start enrollment in the second quarter of 2023.

–Continue clinical development of KIO-201 in patients with PCEDs and consider advancing our late stage program for patients undergoing surgical vision correction including PRK and certain types of keratoconus surgical procedures. These programs will benefit from discussions with the FDA regarding clinical trial designs and approvable endpoints.

•Expand Portfolio through Collaborations

–Pursue strategic collaborations to further the Company’s existing assets with respect to new indication potential and more detailed mechanism of action, which can result in new intellectual property.

5

Our Development Pipeline

Clinical Development

KIO-101: Ocular Presentation of Rheumatoid Arthritis and Other Autoimmune Diseases (OPRA+)

Mechanism of Action

KIO-101 is a promising novel third generation DHODH inhibitor, with a half-maximal inhibitory concentration IC50-value of 0.3 nM. Based on internal work completed, we believe this means that 1,000-fold more potent than teriflunomide (IC50 DHODH 415 nM). Furthermore, KIO-101 suppresses the expression of key pro-inflammatory cytokines such as IL-17, IFN-g, VEGF and others, potentially as a consequence of inhibiting DHODH. IL-17 and IFN-g are the hallmark cytokines expressed by Th1 and Th17 T-cells, respectively, and play a crucial role in initiating the inflammatory processes in several ocular diseases, including dry eye disease (including the association with autoimmune conditions such as rheumatoid arthritis) and non-noninfectious uveitis. KIO-101 is structurally and mechanistically different from Arava®, a drug currently approved by the FDA for the treatment of rheumatoid arthritis. The IC50 of KIO-101 on selected tyrosine kinases, such as PI3K, AKT and JAK, is more than 10,000-fold above the IC50 of KIO-101 for DHODH. In general, side effects are not expected and have not been observed to date in animal and human studies after KIO-101 administration

6

The postulated mode of action of KIO-101 is depicted below.

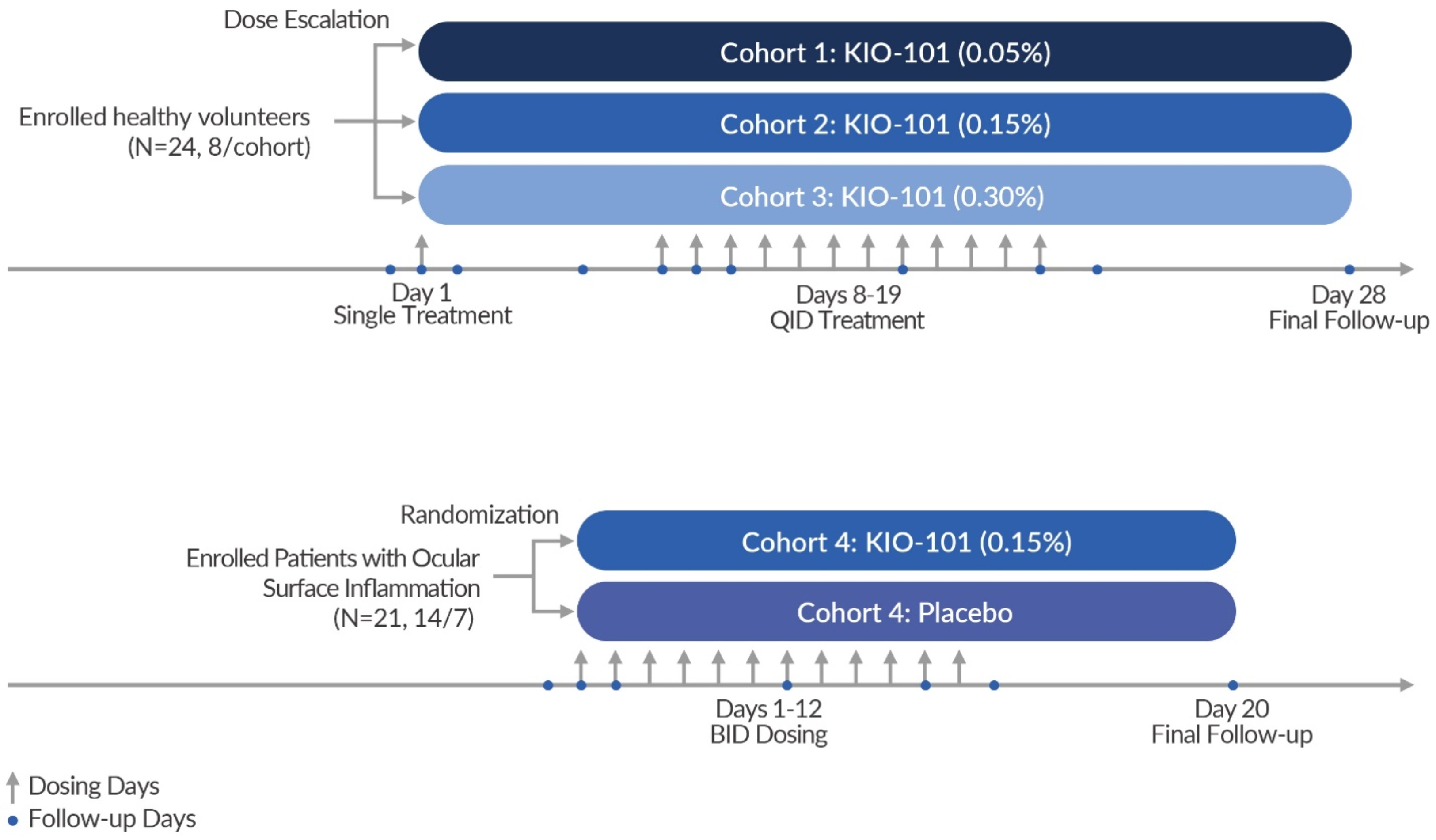

Phase 1b Study:

The results of a Phase 1b study of KIO-101 eye drops in adults with and without ocular surface inflammation were reported in Q4 2021.

Design

The first part of this single center, randomized, double-masked study was to explore safety and tolerability of KIO-101 in a healthy population; and the second part was to investigate a potential efficacy signal in patients with ocular surface inflammation and hyperemia. Part 1 (cohorts 1 through 3) consisted of healthy volunteers receiving dose escalating concentrations of KIO-101 as noted on the figure below. Specifically, healthy volunteers were repeatedly treated with ascending doses of KIO-101 (0.05%, 0.15%, 0.30%) and placebo eyedrops. Subjects receiving 0.05% and 0.15% eyedrops showed excellent tolerability. Both doses can be used for future studies in patients having an infection or inflammation on the ocular surface. No Severe Adverse Events (SAEs) or severe ocular Adverse Events (AEs) were reported in any patients. In the 0.3% group, two patients withdrew for epistaxis and further dosing in the entire 0.3% group was stopped. No lab abnormalities in these two or any patients were observed and further toxicology studies are ongoing, including the 0.3% dose.

In the second part (cohort 4) of this study, 21 patients diagnosed with ocular surface inflammation, a key driver of ocular surface disease including dry eye disease, were evaluated. These patients were treated BID for 12 days with 0.15% of KIO-101 (n=14) or vehicle (n=7). The key inclusion criteria were conjunctival hyperemia score >2 (on the Efron scale of 0-5) and an Ocular Surface Disease Index© (OSDI) score of > 22. Primary endpoints included safety and tolerability. Secondary and exploratory endpoints included pharmacokinetics of KIO-101 as well as

7

change from baseline in OSDI, conjunctival hyperemia, tear break up time (TBUT), corneal staining (fluorescein), conjunctival staining (lissamine green), ocular discomfort, lid edema, and lid erythema.

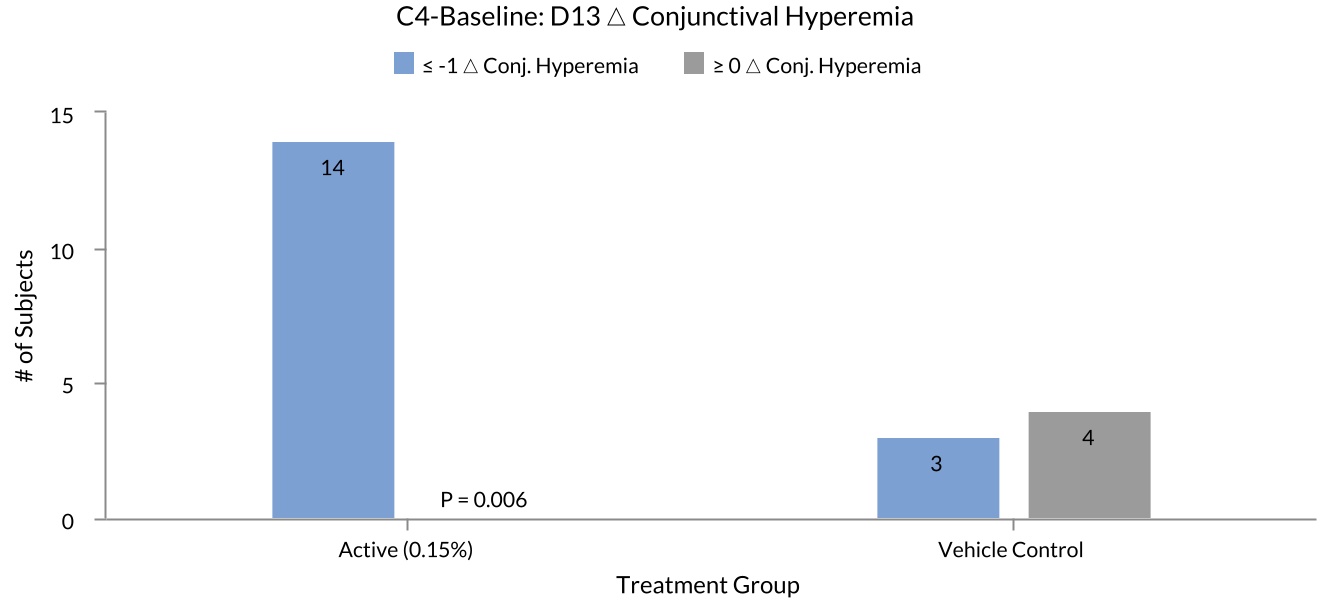

Study Results

The results demonstrated favorable safety and tolerability of KIO-101, as well as statistically significant improvements in conjunctival hyperemia, a key inclusion criterion for the 21 patients enrolled with ocular surface inflammation and a recognized clinical sign in patients with ocular surface inflammation. At Day 13, 100% (Figure 1 below) of patients treated with KIO-101 (14/14) saw a reduction >1 from baseline, measured on the Efron scale (0-5), versus only 42.8% with vehicle control (3/7) (p < 0.006). The mean reduction in conjunctival hyperemia score from baseline to Day 13 demonstrated statistically significant difference in active treatment vs. vehicle control groups (-1.055 vs. -0.604; p = 0.0316). This apparent drug effect on conjunctival hyperemia was lost when patients were assessed at the Day 20 post-treatment follow-up, which occurred 8 days after the last dose was administered, further supporting a potential positive drug effect. There was a numerical trend favoring KIO-101 in OSDI, but no statistically significant differences were observed in TBUT, corneal staining, conjunctival staining, or other

8

exploratory endpoints. A larger sample size and dosing period longer than two weeks will likely be necessary to effectively evaluate a statistical drug effect on these additional efficacy endpoints.

Figure 1: Percent of patients with reduction of >1

No SAEs or severe ocular AEs were reported. In the 0.3% group, 2 patients withdrew for epistaxis (nose bleeds) and dosing was stopped, with no lab abnormalities in these 2 or any patients observed. In cohort 4, no difference was observed in the frequency of ocular AEs in active vs. control.

Clinical Development Plan

In February 2023 we received investigational new drug application approval for a Phase 2 study of KIO-101 for the treatment of OPRA+ and initiated enrollment in Q2 2023. The study will enroll approximately 120 patients in a multi-center, controlled, randomized, double-masked trial assessing the safety and efficacy of KIO-101 eye drops in patients living with autoimmune disease who have signs and symptoms of ocular surface disease.

KIO-201: Persistent Corneal Epithelial Defects

Phase 2 Study:

In Q1 2022, we initiated a clinical trial of KIO-201 evaluating the potential to help patients with PCEDs. We completed this study in Q4 2022 and are presenting the results in Q2 2023.

Design

This single site clinical trial was designed to enroll up to 10 patients (20 eyes) with PCEDs, as defined by a duration of at least 14 days while on conventional therapies. The primary endpoint of the study is safety and tolerability with key secondary endpoints including assessing the number of patients with healing (defined by lesions being <0.5mm2).

Clinical Development Plan

PCED qualifies as a rare disease, and therefore we applied for orphan drug designation as part of our clinical development plan for KIO-201 in Q4 2022. We expect to pursue ODD in 2023 and with the results from the aforementioned clinical trial, we plan to meet with the FDA to discuss next steps.

9

KIO-201: PRK Surgical Recovery Pivotal Study

Pivotal Study:

In Q4 2019, we reported positive topline results from our corneal wound repair pivotal clinical trial of KIO-201 for the corneal re-epithelialization in patients having undergone PRK surgery.

Design

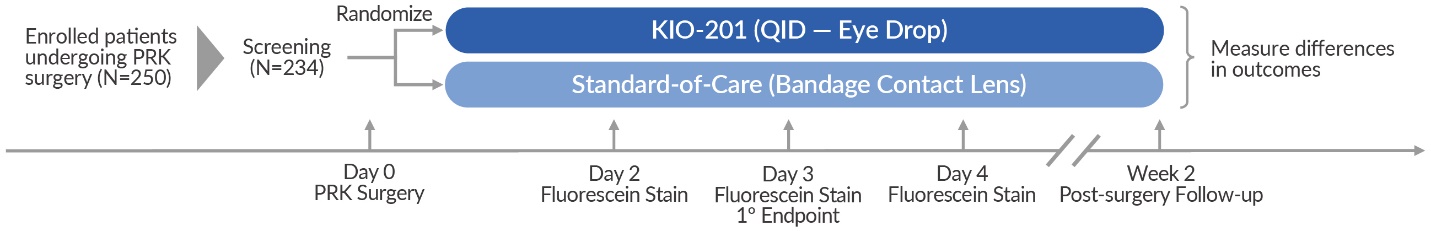

The prospective, controlled study randomized 234 patients undergoing bilateral PRK surgery and was designed to assess safety and efficacy by comparing KIO-201 to the current standard-of-care, a bandage contact lens (BCL). The primary endpoint was the proportion of study eyes achieving complete wound closure on Day 3 (and remaining closed). This assessment was evaluated by an independent masked reading center, using digital slit-lamp photographs of fluorescein staining in all treated eyes, and a protocol-driven method to quantify the outcomes.

The enrolled patients were randomized into one of two study groups, with patients receiving the same treatment in both eyes:

•Cohort 1 (n=117) was comprised of KIO-201 QID for two weeks after surgery.

•Cohort 2 (n=117) was comprised of BCL administered four times daily.

Study Results

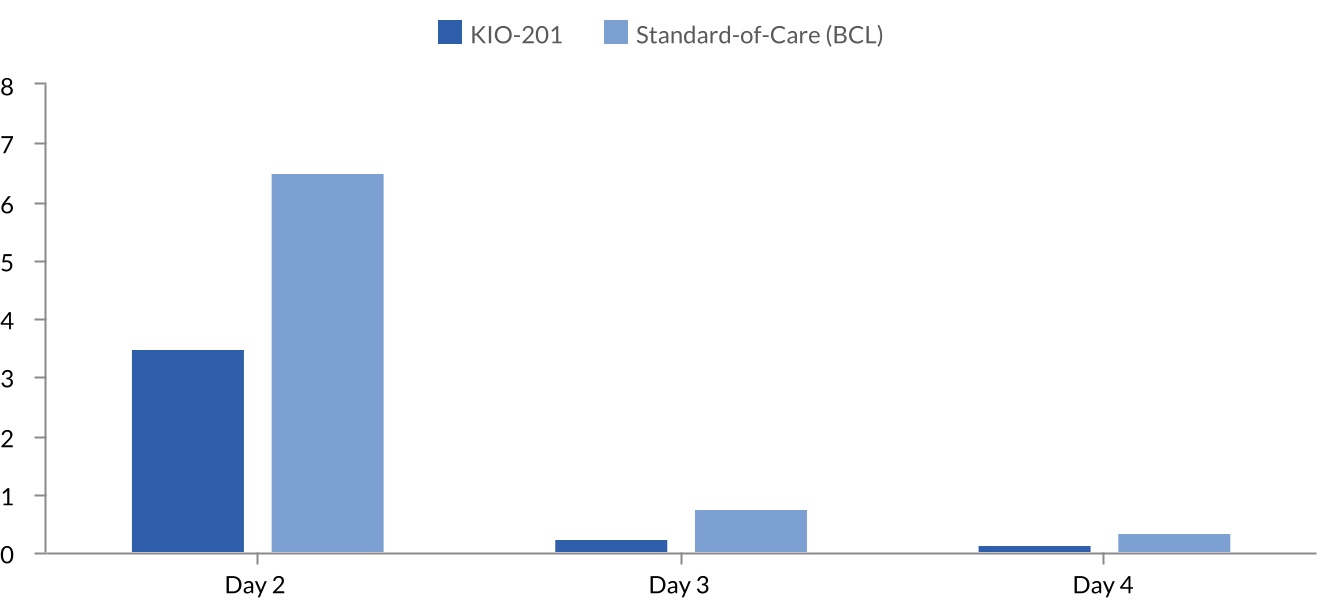

KIO-201 demonstrated superiority for the primary endpoint with a p-value of 0.0203. The statistical significance measurement was based on the number of patients in each arm that achieved complete corneal defect closure three days post refractive surgery. At Day 3, 80.2% of eyes receiving the KIO-201 treatment regimen were completely healed, compared with 67.0% for BCL. Additionally, at Day 2, the average wound size for all eyes treated with KIO-201 was 3.61 mm2, compared to 6.66 mm2 for eyes treated with BCL, which is 46% smaller than the standard-of-care as noted in Figure 4. As described further, the use of KIO-201 resulted in smaller wounds in the

10

acute healing phase after PRK surgery compared to the standard-of-care (BCL). This data gives confidence that patients will be able to resume normal activities earlier when treated with KIO-201 compared to BCL.

Figure 4: Mean wound size (mm2)

Clinical Development Plan

We are currently assessing the requirements on a registration clinical trial as well as evaluating the market opportunity. We expect to begin further clinical work in 2023.

KIO-301: Retinitis Pigmentosa

Phase 1b Study:

In Q4 2022, we initiated a clinical trial of KIO-301 in patients with later stage Retinitis Pigmentosa. We expect results from this study in late 2023.

Design

This is a Phase 1b open-label, single ascending dose clinical trial for people living with retinitis pigmentosa. The study will enroll six patients and evaluate 12 eyes. The first cohort of three patients will include individuals with no or bare light perception due to the progression of RP. The second cohort will include patients able to detect hand motion and count fingers. Dose escalations will be performed in each patient's contralateral eye. The primary endpoints are safety and tolerability, with secondary efficacy endpoints including objective and subjective evaluations, such as object identification and contrast assessment, navigation, perimetry, functional MRI and other ophthalmic and quality-of-life assessments. This multi-site study is being conducted at The Royal Adelaide Hospital (RAH) in Adelaide, South Australia as well as multiple private ophthalmology clinics in Adelaide, South Australia.

Clinical Development Plan

Retinitis pigmentosa is a rare inherited disease where patients typically present with loss of low light/night vision, followed by reduced visual field (loss of peripheral vision) and eventually loss of central vision. In Q1 2022, we received ODD from the FDA. We will assess the results from the Phase 1b clinical trial and determine next steps in the development of KIO-301 in late 2023.

11

Intellectual Property and Proprietary Rights

Overview

We are building an intellectual property portfolio for our KIO-101, KIO-201, and KIO-301 platforms and any other product candidates that we may develop, as well as other devices and product candidates for treatment of ocular indications in the U.S. and abroad. We currently seek, and intend to continue to seek, patent protection in the U.S. and internationally for our product candidates, methods of use, and processes for manufacture, and for other technologies, where appropriate. Our current policy is to actively seek to protect our proprietary position by, among other things, filing patent applications in the U.S. and abroad relating to proprietary technologies that are important to the development of our business. We also rely on, and will continue to rely on, trade secrets, know-how, continuing technological innovation and in-licensing opportunities to develop and maintain our proprietary position. We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our technology.

Our success will depend significantly on our ability to obtain and maintain patent and other proprietary protection for the technologies that we consider important to our business, our ability to defend our patents, and our ability to preserve the confidentiality of our trade secrets and operate our business without infringing the patents and proprietary rights of third parties.

Patent Portfolio

Our patent portfolio includes patents covering KIO-101 including composition-of-matter, formulations thereof and its therapeutic uses in the treatment of ocular disorders and diseases and more. In addition, we hold a patent portfolio covering KIO-301 consisting of composition-of-matter, methods of use, and formulations thereof patents. Our KIO-201 portfolio of patents covers composition-of-matter and methods of use claims. These issued patents will expire between 2023 and 2036. Given the amount of time required for the development, testing and regulatory review of new product candidates, patents protecting such candidates might expire before or shortly after such candidates are commercialized. As a result, our owned and licensed patent portfolio may not provide us with sufficient rights to exclude others from commercializing products similar or identical to ours. In the future, we intend to apply for restorations of patent term for some of our currently owned or licensed patents to add patent life beyond their current expiration date, depending on the expected length of clinical trials and other factors involved in the submission of the relevant new drug application or NDA. See “Government Regulation — Patent Term Restoration and Marketing Exclusivity” below.

Globally, we hold 26 active and valid patents.

License Agreements

We are a party to seven license agreements as described below. These license agreements require us to pay or receive royalties or fees to or from the licensor based on revenue or milestones related to the licensed technology.

On July 2, 2013, we (through our subsidiary, Kiora Pharmaceuticals, GmbH) entered into a patent and know-how assignment agreement with 4SC Discovery GmbH (4SC) transferring to us all patent rights and know-how to the compound KIO-101. We are responsible for paying royalties of 3.25% on net sales of KIO-101.

On July 2, 2013, we (through our subsidiary, Kiora Pharmaceuticals, GmbH) entered into an out-license agreement with 4SC granting 4SC the exclusive worldwide right to commercialize the compound KIO-101 for rheumatoid arthritis and inflammatory bowel disease, including Crohn’s disease and ulcerative colitis. We are eligible to receive milestone payments totaling up to €155 million, upon and subject to, the achievement of certain specified developmental and commercial milestones. We have not received any milestones from 4SC. In addition, we are eligible to receive royalties of 3.25% on net sales of KIO-101.

12

On September 12, 2013, we (through our subsidiary, Jade Therapeutics, Inc.) entered into an agreement with Lineage Cell Therapeutics, Inc. (Lineage), formerly known as BioTime, Inc., granting to us the exclusive worldwide right to commercialize cross-linked thiolated carboxymethyl hyaluronic acid (modified HA) for ophthalmic treatments in humans. The agreement requires us to pay an annual fee of $30,000 and a royalty of 6% on net sales of KIO-201 to Lineage based on revenue relating to any product incorporating the modified HA technology. The agreement expires when patent protection for the modified HA technology lapses in August 2027.

On November 17, 2014, we (through our subsidiary Kiora Pharmaceuticals GmbH) entered into an intellectual property and know-how licensing agreement with Laboratoires Leurquin Mediolanum S.A.S. (Mediolanum) for the commercialization of KIO-101 (the “Mediolanum Agreement”) in specific territories. Under the Mediolanum agreement, we out-licensed rights to commercialize KIO-101 for uveitis, dry eye, and viral conjunctivitis in Italy and France. This agreement was amended on December 10, 2015, to also include Belgium and The Netherlands. Under the Mediolanum Agreement, Mediolanum would be obligated to pay up to approximately €20 million in development and commercial milestones, and a 7% royalty on net sales of KIO-101 in the territories through the longer of the expiry of the valid patents covering KIO-101 or 10 years from the first commercial sale. The royalty would be reduced to 5% after patent expiry. During February 2023, we terminated the Mediolanum Agreement as permitted under its terms. Mediolanum has disputed the validity of the termination notice, and we are currently in communication with Mediolanum regarding the termination.

On September 26, 2018, we entered into an intellectual property licensing agreement (the “SentrX Agreement”) with SentrX, a veterinary medical device company that develops and manufactures veterinary wound care products. Under the SentrX Agreement, we in-licensed the rights to trade secrets and know-how related to the manufacturing of KIO-201. The SentrX Agreement enables us to pursue a different vendor with a larger capacity for manufacturing and an FDA-inspected facility for commercialization of a product for human use. Under the SentrX Agreement, SentrX is eligible to receive milestone payments totaling up to $4.75 million, upon and subject to the achievement of certain specified developmental and commercial milestones. The term of the agreement is until the Product is no longer in the commercial marketplace.

On May 1, 2020, we (through our subsidiary, Bayon Therapeutics, Inc.) entered into an agreement with the University of California (UC) granting to us the exclusive rights to its pipeline of photoswitch molecules. The agreement requires us to pay an annual fee to UC of $5,000, as well as payments to UC upon the achievement of certain development milestone and royalties based on revenue relating to any product incorporating KIO-301. The Company is obligated to pay royalties on net sales of 2% of the first $250 million of net sales, 1.25% of net sales between $250 million and $500 million, and 0.5% of net sales over $500 million. The agreement expires on the date of the last-to-expire patent included in the licensed patent portfolio which is January 2030.

On May 1, 2020, we (through our subsidiary, Bayon Therapeutics, Inc) entered into an agreement with Photoswitch Therapeutics, Inc. (Photoswitch) granting to us access to certain patent applications and IP rights with last-to-expire patent terms of January 2030. The agreement calls for payments to Photoswitch upon the achievement of certain development milestones and upon first commercial sale of the product.

Recent Developments

Reverse Stock Split

On September 23, 2022, we filed a Certificate of Amendment to our Restated Certificate of Incorporation (the “Amendment”) with the Secretary of State of the State of Delaware to effect a one-for-forty (1-for-40) reverse stock split of our outstanding common stock. The Amendment became effective at 12:01 a.m. Eastern Time on September 27, 2022. The Amendment was approved by our stockholders at our 2022 Annual Meeting of Stockholders held on September 23, 2022, and by our board of directors.

The Amendment provided that, at the effective time of the Amendment, every forty (40) shares of our issued and outstanding common stock automatically combined into one issued and outstanding share of common stock, without any change in par value per share. The reverse stock split affected all shares of our common stock outstanding immediately prior to the effective time of the Amendment. As a result of the reverse stock split, proportionate adjustments were made to the per share exercise price and/or the number of shares issuable upon the

13

exercise or vesting of all stock options, and restricted stock awards issued by us and outstanding immediately prior to the effective time of the Amendment, which resulted in a proportionate decrease in the number of shares of our common stock reserved for issuance upon exercise or vesting of such stock options, and restricted stock awards, and, in the case of stock options, a proportionate increase in the exercise price of all such stock options. In addition, the number of shares reserved for issuance under our equity compensation plans immediately prior to the effective time of the Amendment was reduced proportionately. The reverse stock split did not affect the number of shares or par value of common stock authorized for issuance under our Restated Certificate of Incorporation, which remained at 50,000,000 shares.

All share and per share amounts in this prospectus have been adjusted retroactively to reflect the reverse stock split as if it had occurred at the beginning of the earliest period presented. Our common stock began trading on The Nasdaq Capital Market on a split-adjusted basis when the market opened on September 27, 2022.

Warrant Inducement Transaction

On November 17, 2022, we entered into warrant exercise inducement offer letters (“Inducement Letters”) with certain of the investors from our July 2022 public offering, pursuant to which such investors agreed to exercise for cash all of their Class A Warrants to purchase 654,609 shares of our common stock originally issued in the Public Offering in exchange for our agreement to issue new warrants (the “Inducement Warrants”) on substantially the same terms as the Class A Warrants, except as described below, to purchase up to 654,609 shares of common stock (such issuance, the “Private Placement”). Each Inducement Warrant is exercisable at a price per share of common stock of $5.97. Each Inducement Warrant will initially be exercisable six months following its date of issuance, and will expire on the 18 month anniversary of their initial exercise date. We received aggregate gross proceeds of approximately $3.12 million from the exercise of the Class A Warrants by the selling stockholders and the sale of the Inducement Warrants.

Private Placement and Committed Equity Financing

On February 2, 2023, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”), pursuant to which we issued and sold to Lincoln Park (i) 52,798 shares of common stock and (ii) warrants to purchase an aggregate of up to 105,596 shares of common stock at an exercise price of $3.538 per share. The combined purchase price for each share of common stock and two warrants was $3.788. The private placement closed on February 3, 2023.

On February 2, 2023, and in connection with the Securities Purchase Agreement, we entered into a customary registration rights agreement with Lincoln Park, which requires us to, at the election of Lincoln Park, register the shares issued in the private placement on any registration statement that we file during the six-month period following the closing, subject to certain exceptions. However, the registration rights agreement does not afford any registration rights with respect to the warrants that we issued and sold to Lincoln Park in the private placement, or with respect to the underlying shares of common stock.

On February 3, 2023, we entered into a purchase agreement and a registration rights agreement with Lincoln Park. Under the terms and subject to the conditions of the purchase agreement, we have the right, but not the obligation, to sell to Lincoln Park, and Lincoln Park is obligated to purchase up to $10.0 million of our common stock. Such sales of common stock by us, if any, will be subject to certain limitations set forth in the purchase agreement, and may occur from time to time, at our sole discretion, over the 36-month period commencing on the date that the conditions to Lincoln Park’s purchase obligation set forth in the purchase agreement are satisfied, including that a registration statement covering the resale by Lincoln Park of shares of common stock that have been and may be issued to Lincoln Park under the Purchase Agreement, is declared effective by the SEC and a final prospectus relating thereto is filed with the SEC, which occurred on February 13, 2023 (the “Commencement Date”).

14

From and after the Commencement Date, we may from time to time on any business day, by written notice delivered by us to Lincoln Park, direct Lincoln Park to purchase up to 35,000 shares of common stock on such business day, at a purchase price per share that will be determined and fixed in accordance with the purchase agreement at the time we deliver such written notice to Lincoln Park (each, a “Regular Purchase”). The maximum number of shares we may sell to Lincoln Park in a Regular Purchase may be increased to up to 50,000 shares, with the applicable maximum share limit determined by whether the closing price for common stock on the applicable purchase date exceeds certain price thresholds set forth in the purchase agreement, in each case, subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction as provided in the purchase agreement. Lincoln Park’s maximum purchase commitment in any single Regular Purchase may not exceed $1,000,000. The purchase price per share of common stock sold in each such Regular Purchase, if any, will be based on prevailing market prices of the common stock immediately preceding the time of sale as computed under the Purchase Agreement.

In addition to Regular Purchases, provided that we have directed Lincoln Park to purchase the maximum amount of shares that we are then able to sell to Lincoln Park in a Regular Purchase and the closing sale price of the common stock is not below $1.00 per share on such date, we may, in our sole discretion, also direct Lincoln Park to purchase additional shares of common stock in “accelerated purchases,” and “additional accelerated purchases” as set forth in the purchase agreement. The purchase price per share of common stock sold in each such accelerated purchase and additional accelerated purchase, if any, will be based on prevailing market prices of the common stock at the time of sale as computed under the purchase agreement. There are no upper limits on the price per share that Lincoln Park must pay for shares of common stock in any purchase under the purchase agreement.

Our Corporate Information

Kiora Pharmaceuticals, Inc. was formed in Delaware on December 26, 2004 under the name EyeGate Pharmaceuticals, Inc. On November 8, 2021, we completed a merger of our wholly owned Delaware subsidiary, Kiora Pharmaceuticals, Inc. (incorporated in October 2021) into EyeGate Pharmaceuticals, Inc., which merger resulted in the amendment of our restated certificate of incorporation to change our name to “Kiora Pharmaceuticals, Inc.” effective November 8, 2021 (the “Name Change”). In connection with the name change, we changed our symbol on the Nasdaq Capital Market to “KPRX” and began using a new CUSIP number for shares of our common stock (49721T101) effective at the market open on November 8, 2021.We were originally incorporated in 1998 under the name of Optis France S.A. in Paris, France. We have four wholly owned subsidiaries: Jade Therapeutics, Inc., Kiora Pharmaceuticals, GmbH (formerly known as Panoptes Pharma Ges.m.b.H), Bayon Therapeutics, Inc., and Kiora Pharmaceuticals Pty Ltd (formerly known as Bayon Therapeutics Pty Ltd). Our former subsidiary, EyeGate Pharma S.A.S. was dissolved effective December 31, 2020. Our principal executive offices are located at 332 Encinitas Boulevard, Suite 102, Encinitas, California 92024, and our telephone number is (858) 224-9600. Our website address is www.kiorapharma.com. Our website and the information contained in, or accessible through, our website will not be deemed to be incorporated by reference into this prospectus and does not constitute part of this prospectus. You should not rely on any such information in making your decision whether to purchase our securities.

15

THE OFFERING

Securities offered by us |

5,905,512 shares of our common stock.

15,000 shares of Series F Preferred Stock that are convertible into an aggregate of up to 5,905,512 shares of common stock, subject to certain adjustments. For each share of common stock underlying a share of Series F Preferred Stock that we sell, the number of shares of common stock that we are selling will be decreased on a one-for-one basis.

|

||||

| Warrants | Warrants to purchase up to 2,952,756 shares of common stock. The warrants will be exercisable at an initial exercise price of $ per share. The warrants will be exercisable beginning on the date of issuance, and will expire on the five year anniversary of the initial exercise date. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. | ||||

Series F Preferred Stock |

Each share of Series F Preferred Stock is convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by the Conversion Price. Notwithstanding the foregoing, we shall not effect any conversion of Series F Preferred Stock, to the extent that, after giving effect to an attempted conversion, the holder of shares of Series F Preferred Stock (together with such holder’s affiliates, and any persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares of our common stock in excess of 4.99% of the shares of our common stock then outstanding after giving effect to such exercise. For additional information, see “Description of The Securities We Are Offering—Series F Convertible Preferred Stock” on page 59 of this prospectus. | ||||

Common stock outstanding after this offering |

7,929,782 shares, assuming that we sell all securities offered pursuant to this prospectus and assuming conversion of all shares of Series F Preferred Stock but no exercise of the warrants issued in this offering. | ||||

Price per share of common stock |

$2.54 per share of common stock based upon an assumed combined public offering price of $2.54, the closing price of our common stock on May 11, 2023. | ||||

Price per share of Series F Preferred Stock and warrants |

$1,000 | ||||

Underwriters’ option to purchase additional shares |

We have granted the underwriters an option, exercisable for forty-five (45) days after the date of this prospectus, to purchase up to an additional 885,827 shares of common stock and/or warrants to purchase 442,913 shares of common stock at the assumed combined public offering price per share of common stock and warrant set forth on the cover page hereto less the underwriting discounts and commission. |

||||

Use of proceeds |

We intend to use the net proceeds from this offering to support our operations, including for clinical trials, for working capital and for other general corporate purposes. See “Use of Proceeds” on page 55.

|

||||

16

Risk factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 18 of this prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of information that should be considered in connection with an investment in our securities. | ||||

| Nasdaq Capital Market symbol | KPRX. We do not plan on applying to list the warrants or the Series F Preferred Stock on Nasdaq, any national securities exchange or any other nationally recognized trading system. Without an active trading market, the liquidity of the warrants and the Series F Preferred Stock will be limited. |

||||

The number of shares of our common stock to be outstanding after this offering is based on 2,024,270 shares of our common stock outstanding as of May 11, 2023, assumes no exercise of the underwriters’ over-allotment option, and assumes that the shares of Series F Preferred Stock sold in the offering have been converted, but does not include, as of such date:

•211,578 shares of common stock issuable upon exercise of options outstanding under our 2005 and 2014 Equity Incentive Plans, at a weighted-average exercise price of approximately $17.01 per share;

•70,550 shares of common stock granted through a restricted stock award subject to release under our 2005 and 2014 Equity Incentive Plans, at a weighted-average exercise price of approximately $0 per share.

•1,613,483 shares of our common stock issuable upon the exercise of outstanding warrants to purchase shares of our common stock with a weighted-average exercise price of $42.17 per share;

•11,175 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan;

•191 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan;

•52 shares of common stock issuable upon the conversion of outstanding shares of Series D Convertible Preferred Stock; and

•2,952,756 shares of common stock issuable upon the exercise of warrants to be issued to investors in this offering at an exercise price of $ per share.

17

RISK FACTORS

Summary of Risk Factors

Below is a summary of the principal factors that make an investment in our securities speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below under the heading “Risk Factors” and should be carefully considered, together with other information in this prospectus and the documents incorporated by reference herein before making an investment decision regarding our securities.

•We have incurred significant operating losses since our inception, which have caused management to determine there is substantial doubt regarding our ability to continue as a going concern. We expect to incur losses for the foreseeable future and may never achieve or maintain profitability.

•We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce, or eliminate our product development programs or commercialization efforts.

•Raising additional capital may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

•Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

•Our future success depends on our ability to retain key executives and to attract, retain, and motivate qualified personnel.

•The coronavirus pandemic could adversely impact our business, including clinical trials.

•We depend heavily on the success of KIO-101, KIO-201, and KIO-301. If we are unable to successfully obtain marketing approval for KIO-101, KIO-201, or KIO-301, or experience significant delays in doing so, or if after obtaining marketing approvals, we fail to commercialize KIO-101, KIO-201, or KIO-301, our business will be materially harmed.

•If clinical trials of KIO-101, KIO-201, KIO-301, or any other product candidate that we develop fail to demonstrate safety and efficacy to the satisfaction of the FDA or foreign regulatory authorities or do not otherwise produce favorable results, we may incur additional costs or experience delays in completing, or ultimately be delayed or unable to complete, the development and commercialization of KIO-101, KIO-201, KIO-301, or any other product candidate.

•Even if KIO-101, KIO-201, KIO-301, or any other product candidate that we develop receives marketing approval, it may fail to achieve the degree of market acceptance by physicians, patients, third-party payors and others in the medical community necessary for commercial success and the market opportunity for our product candidates may be smaller than we estimate.

•If we are unable to establish sales, marketing, and distribution capabilities, we may not be successful in KIO-101, KIO-201, KIO-301, or any other product candidates that we may develop if and when they are approved.

•We face substantial competition, which may result in others discovering, developing, or commercializing products before or more successfully than we do.

•Even if we are able to commercialize KIO-101, KIO-201, KIO-301, or any other product candidate that we may develop, the products may become subject to unfavorable pricing regulations, third-party coverage or reimbursement practices, or healthcare reform initiatives which could harm our business.

•We rely, and expect to continue to rely, on third parties to conduct our clinical trials, and those third parties may not perform satisfactorily, including failing to meet deadlines for the completion of such trials.

18

•If we are unable to obtain and maintain patent protection for our technology and products or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize technology and products similar or identical to ours, and our ability to successfully commercialize our technology and products may be impaired.

•We may become involved in lawsuits to protect or enforce our patents or other intellectual property, which could be expensive, time consuming, and unsuccessful.

•Third parties may initiate legal proceedings alleging that we are infringing their intellectual property rights, the outcome of which would be uncertain and could have a material adverse effect on the success of our business.

•If we are not able to obtain required regulatory approvals, we will not be able to commercialize KIO-101, KIO-201, KIO-301, or any other product candidate that we may develop; and our ability to generate revenue will be materially impaired.

•We incur increased costs as a result of operating as a public company, and our management is required to devote substantial time to new compliance initiatives and corporate governance practices.

•Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain.

•We have identified a material weakness in our internal control over financial reporting. If we are unable to remediate this material weakness, or if we experience additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls, we may not be able to accurately or timely requirements applicable to public companies, which may adversely affect investor confidence in us, and, as a result, the market price of our common stock.

Risk Factors

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties and all other information contained in or incorporated by reference in this prospectus. All of these risk factors are incorporated by reference herein in their entirety. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described herein and in the documents incorporated herein by reference.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred significant operating losses since our inception, which have caused management to determine there is substantial doubt regarding our ability to continue as a going concern. We expect to incur losses for the foreseeable future and may never achieve or maintain profitability.

Since inception, we have incurred significant operating losses. Our net loss was approximately $13.6 million for the year ended December 31, 2022, $13.8 million for the year ended December 31, 2021 and $134.5 million from the period of inception (December 26, 2004) through December 31, 2022. To date, we have financed our operations primarily through private placements and public offerings of our securities, and payments from our license agreements. We have devoted substantially all of our financial resources and efforts to research and development, including pre-clinical studies and, beginning in 2008, clinical trials. We are still in the development stage of our product candidates and we have not completed development of any drugs. We expect to continue to incur significant expenses and operating losses for the foreseeable future. Our net losses may fluctuate significantly from quarter to quarter and year to year. Our recurring losses from operations have caused management to determine there is substantial doubt regarding our ability to continue as a going concern, and as a result, our independent registered

19

public accounting firm included an explanatory paragraph in its report on our consolidated financial statements as of and for the year ended December 31, 2022, with respect to this uncertainty.

We anticipate that our expenses will continue to be significant with the clinical trials for the ongoing development of our KIO-101, KIO-201, and KIO-301 products.

Our expenses will also increase if and as we:

•seek marketing approval for KIO-101, KIO-201, and KIO-301, whether alone or in collaboration with third parties;

•continue the research and development of KIO-101, KIO-201, KIO-301, and any of our other product candidates;

•seek to develop additional product candidates;

•in-license or acquire the rights to other products, product candidates, or technologies;

•seek marketing approvals for any product candidates that successfully complete clinical trials;

•establish sales, marketing, and distribution capabilities and scale up and validate external manufacturing capabilities to commercialize any products for which we may obtain marketing approval;

•maintain, expand and protect our intellectual property portfolio;

•hire additional clinical, quality control, scientific and management personnel;

•expand our operational, financial and management systems, and personnel, including personnel to support our clinical development, manufacturing, and planned future commercialization efforts and our operations as a public company; and

•increase our insurance coverage as we expand our clinical trials and commence commercialization of KIO-101, KIO-201, and KIO-301.

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. Our expenses will increase if:

•we are required by the FDA or foreign equivalents to perform studies or clinical trials in addition to those currently expected; and

•there are any delays in enrollment of patients in or completing our clinical trials or the development of KIO-101, KIO-201, KIO-301, or any other product candidates that we may develop.