EX-99.2

Published on January 31, 2024

Kiora Pharmaceuticals, Inc. NASDAQ: KPRX Strategic Collaboration with Théa | January 31, 2024

2 Forward Looking Statements Some of the statements in this presentation are "forward-looking" and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These "forward-looking" statements include statements relating to, among other things, the development and commercialization efforts and other regulatory or marketing approval efforts pertaining to Kiora's development-stage products, including KIO-301 and KIO-104, as well as the success thereof, with such approvals or success may not be obtained or achieved on a timely basis or at all, the potential ability of KIO-301 to restore vision in patients with RP, the expecting timing of enrollment, dosing and topline results for the ABACUS study, the ability to develop KIO-301 for Choroideremia and Stargardt Disease and KIO-104 for posterior non-infectious uveitis, the ability to utilize strategic relationships to develop certain product candidates, Kiora’s ability to maintain the listing of our common stock on a national securities exchange, and Kiora's ability to achieve the specific milestones described herein. These statements involve risks and uncertainties that may cause results to differ materially from the statements set forth in this presentation, including, among other things, the ability to conduct clinical trials on a timely basis, the ability to obtain any required regulatory approvals, market and other conditions and certain risk factors described under the heading "Risk Factors" contained in Kiora's Annual Report on Form 10-K filed with the SEC on March 23, 2023, or described in Kiora's other public filings. Kiora's results may also be affected by factors of which Kiora is not currently aware. The forward-looking statements in this presentation speak only as of the date of this presentation. Kiora expressly disclaims any obligation or undertaking to release publicly any updates or revisions to such statements to reflect any change in its expectations with regard thereto or any changes in the events, conditions, or circumstances on which any such statement is based, except as required by law.

3 Kiora is developing retinal therapeutics to improve sight in patients with severe vision loss due to inherited or age-related diseases Sharpened Focus on Orphan Retinal Diseases Patient Perspective Individual’s burden of disease Physicians Perspective Efficient, cost-effective treatments Societal Perspective Pharma industry obligation to help 70% of blind patients are unemployed

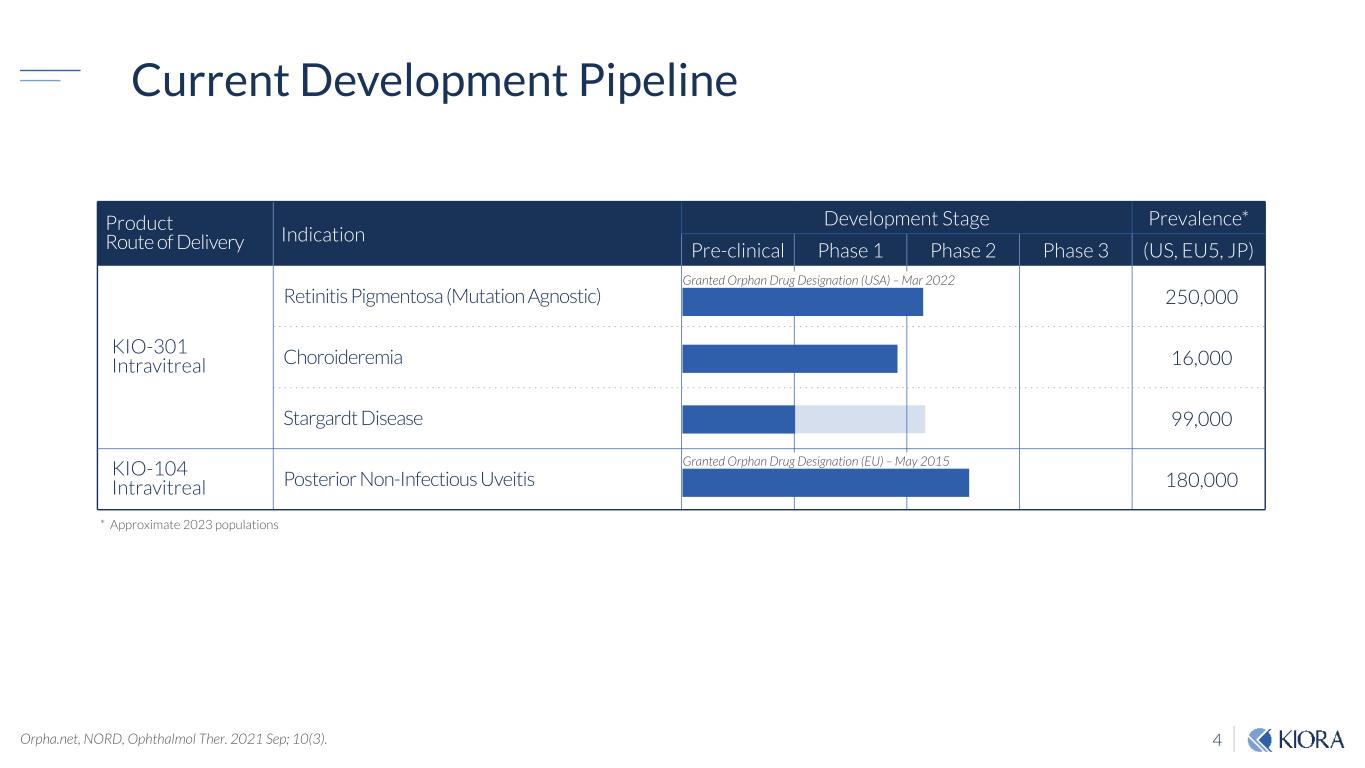

4 Current Development Pipeline Product Route of Delivery Indication Development Stage Prevalence* Pre-clinical Phase 1 Phase 2 Phase 3 (US, EU5, JP) KIO-301 Intravitreal Retinitis Pigmentosa (Mutation Agnostic) 250,000 Choroideremia 16,000 Stargardt Disease 99,000 KIO-104 Intravitreal Posterior Non-Infectious Uveitis 180,000 Granted Orphan Drug Designation (USA) – Mar 2022 Granted Orphan Drug Designation (EU) – May 2015 Orpha.net, NORD, Ophthalmol Ther. 2021 Sep; 10(3). * Approximate 2023 populations

5 Théa Partnership: Co-Development & Commercialization Transaction Highlights Théa granted exclusive development & commercialization rights to KIO-301 for IRDs (≠ Asia) $16M cash upfront payment to Kiora Kiora eligible for up to an additional $285M in clinical development, regulatory and commercial milestones Kiora to conduct and be reimbursed for Phase 2 trials Théa to conduct and fund Phase 3 trials Kiora to receive tiered royalties up to low 20%

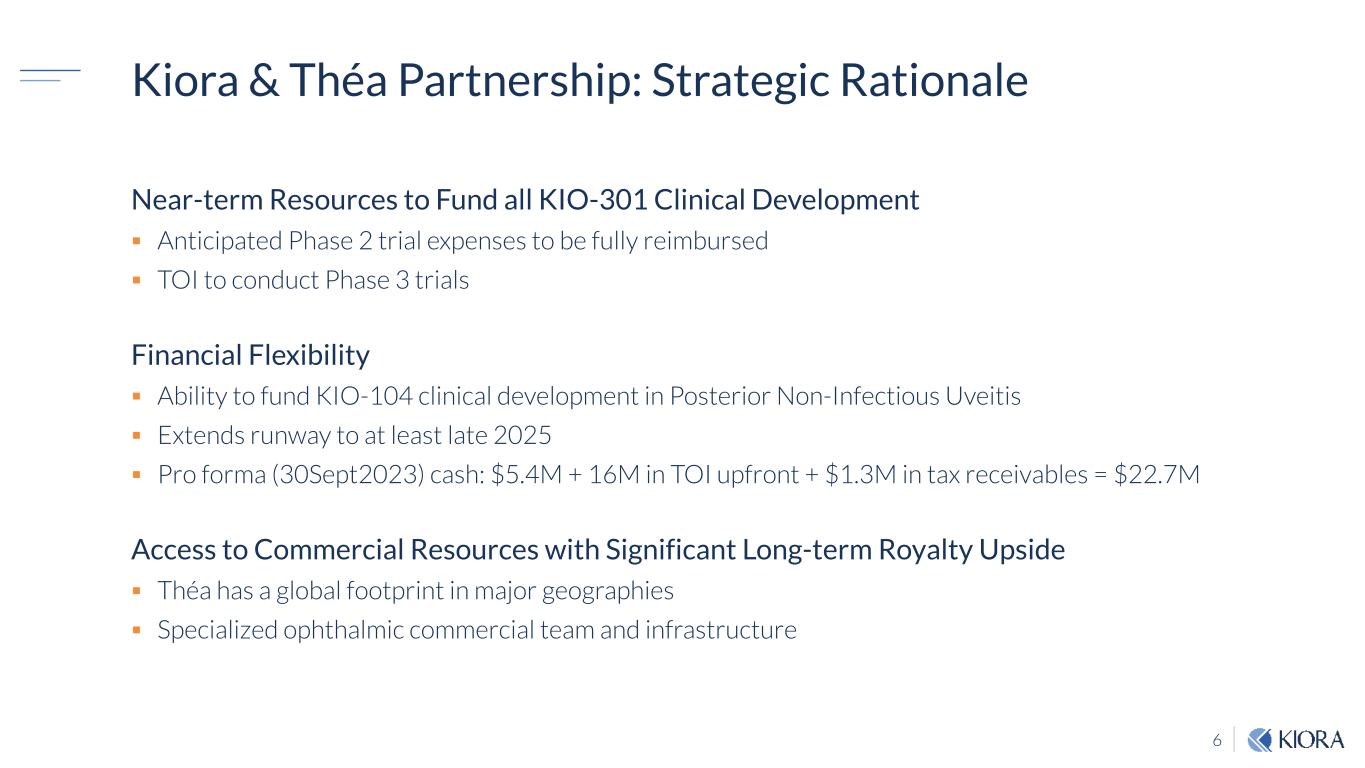

6 Kiora & Théa Partnership: Strategic Rationale Near-term Resources to Fund all KIO-301 Clinical Development Anticipated Phase 2 trial expenses to be fully reimbursed TOI to conduct Phase 3 trials Financial Flexibility Ability to fund KIO-104 clinical development in Posterior Non-Infectious Uveitis Extends runway to at least late 2025 Pro forma (30Sept2023) cash: $5.4M + 16M in TOI upfront + $1.3M in tax receivables = $22.7M Access to Commercial Resources with Significant Long-term Royalty Upside Théa has a global footprint in major geographies Specialized ophthalmic commercial team and infrastructure

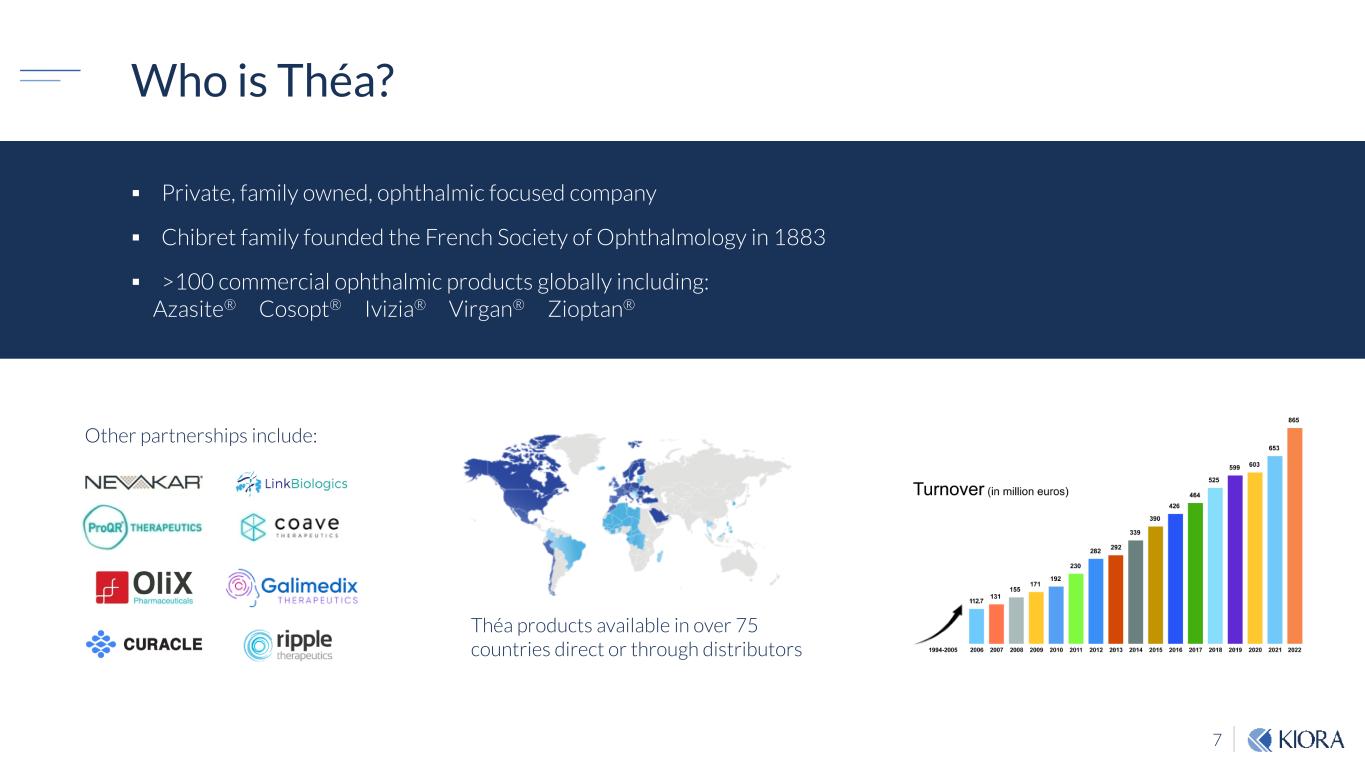

7 Private, family owned, ophthalmic focused company Chibret family founded the French Society of Ophthalmology in 1883 >100 commercial ophthalmic products globally including: Azasite® Cosopt® Ivizia® Virgan® Zioptan® Other partnerships include: Théa products available in over 75 countries direct or through distributors Who is Théa?

8 KIO-301 Small Molecule Targeting Vision Restoration Inherited Retinal Diseases

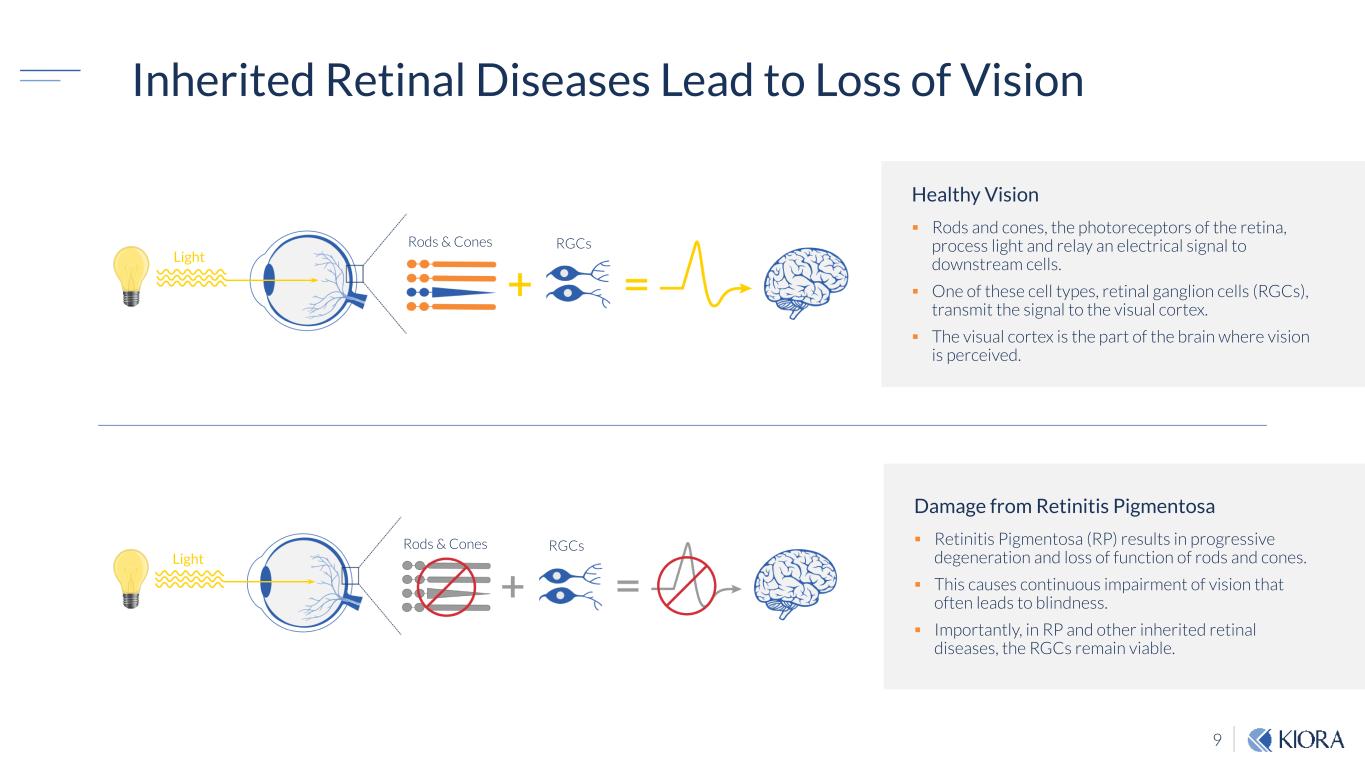

9 Inherited Retinal Diseases Lead to Loss of Vision Healthy Vision Rods and cones, the photoreceptors of the retina, process light and relay an electrical signal to downstream cells. One of these cell types, retinal ganglion cells (RGCs), transmit the signal to the visual cortex. The visual cortex is the part of the brain where vision is perceived. Damage from Retinitis Pigmentosa Retinitis Pigmentosa (RP) results in progressive degeneration and loss of function of rods and cones. This causes continuous impairment of vision that often leads to blindness. Importantly, in RP and other inherited retinal diseases, the RGCs remain viable. Rods & Cones Light RGCs Rods & Cones Light RGCs

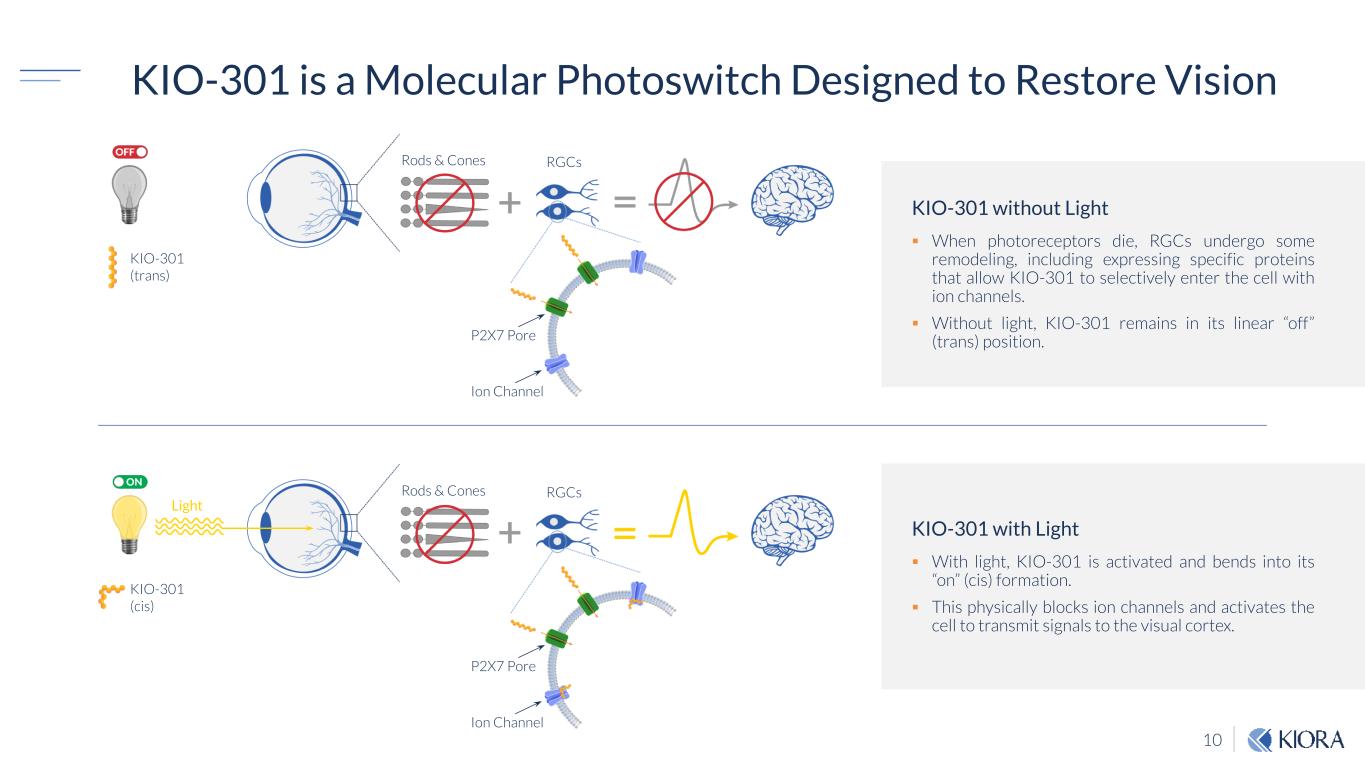

10 KIO-301 is a Molecular Photoswitch Designed to Restore Vision KIO-301 without Light When photoreceptors die, RGCs undergo some remodeling, including expressing specific proteins that allow KIO-301 to selectively enter the cell with ion channels. Without light, KIO-301 remains in its linear “off” (trans) position. KIO-301 with Light With light, KIO-301 is activated and bends into its “on” (cis) formation. This physically blocks ion channels and activates the cell to transmit signals to the visual cortex. Rods & Cones RGCs KIO-301 (trans) P2X7 Pore Ion Channel Rods & Cones Light RGCs KIO-301 (cis) P2X7 Pore Ion Channel

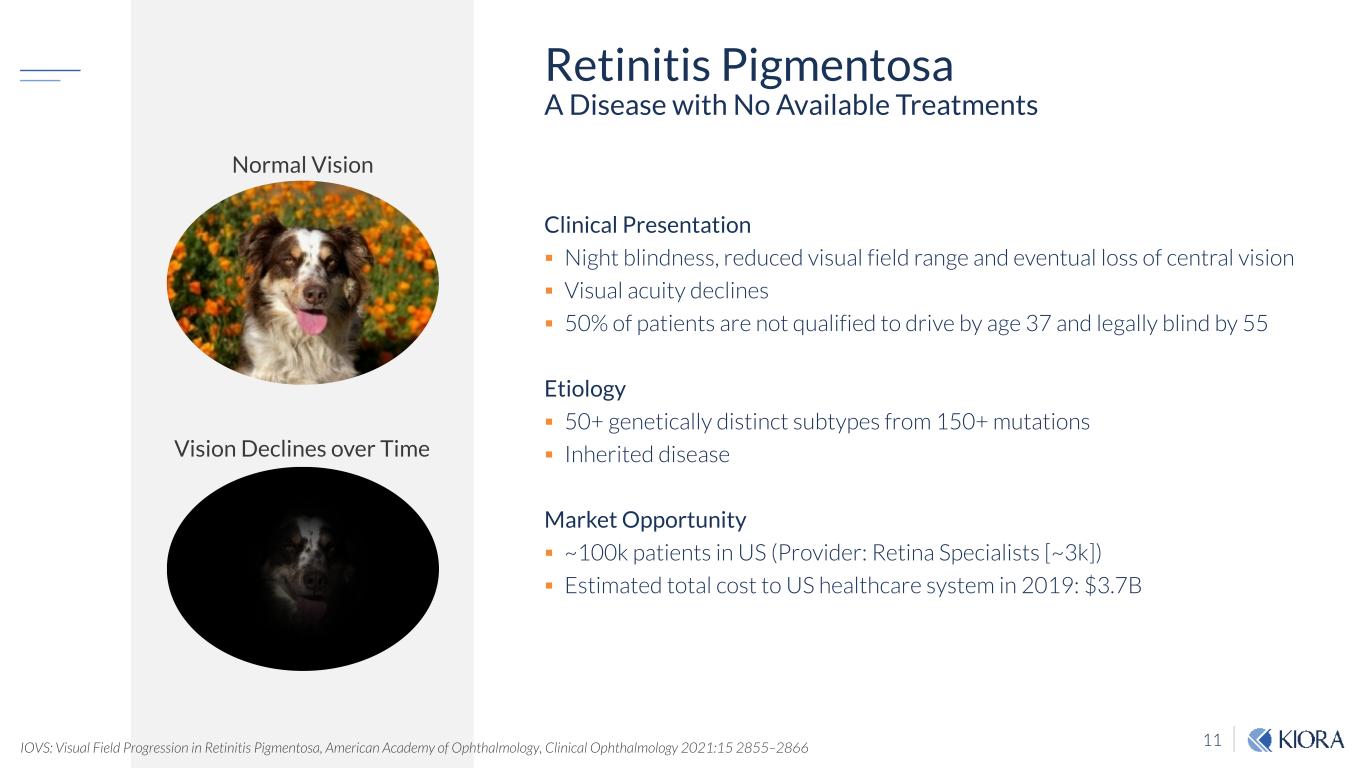

11 Clinical Presentation Night blindness, reduced visual field range and eventual loss of central vision Visual acuity declines 50% of patients are not qualified to drive by age 37 and legally blind by 55 Etiology 50+ genetically distinct subtypes from 150+ mutations Inherited disease Market Opportunity ~100k patients in US (Provider: Retina Specialists [~3k]) Estimated total cost to US healthcare system in 2019: $3.7B Retinitis Pigmentosa A Disease with No Available Treatments Normal Vision Vision Declines over Time IOVS: Visual Field Progression in Retinitis Pigmentosa, American Academy of Ophthalmology, Clinical Ophthalmology 2021:15 2855–2866

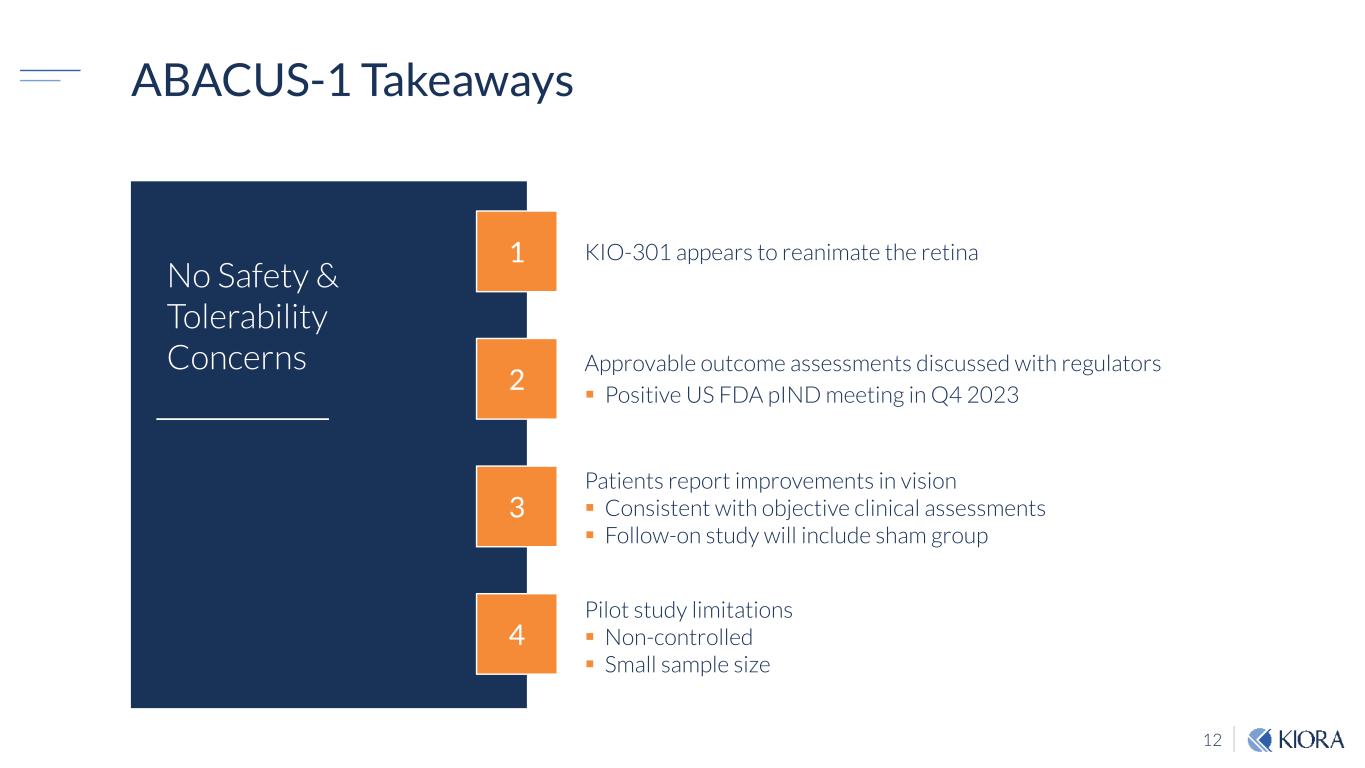

12 ABACUS-1 Takeaways Patients report improvements in vision Consistent with objective clinical assessments Follow-on study will include sham group Pilot study limitations Non-controlled Small sample size Approvable outcome assessments discussed with regulators Positive US FDA pIND meeting in Q4 2023 KIO-301 appears to reanimate the retina 4 3 2 1 No Safety & Tolerability Concerns

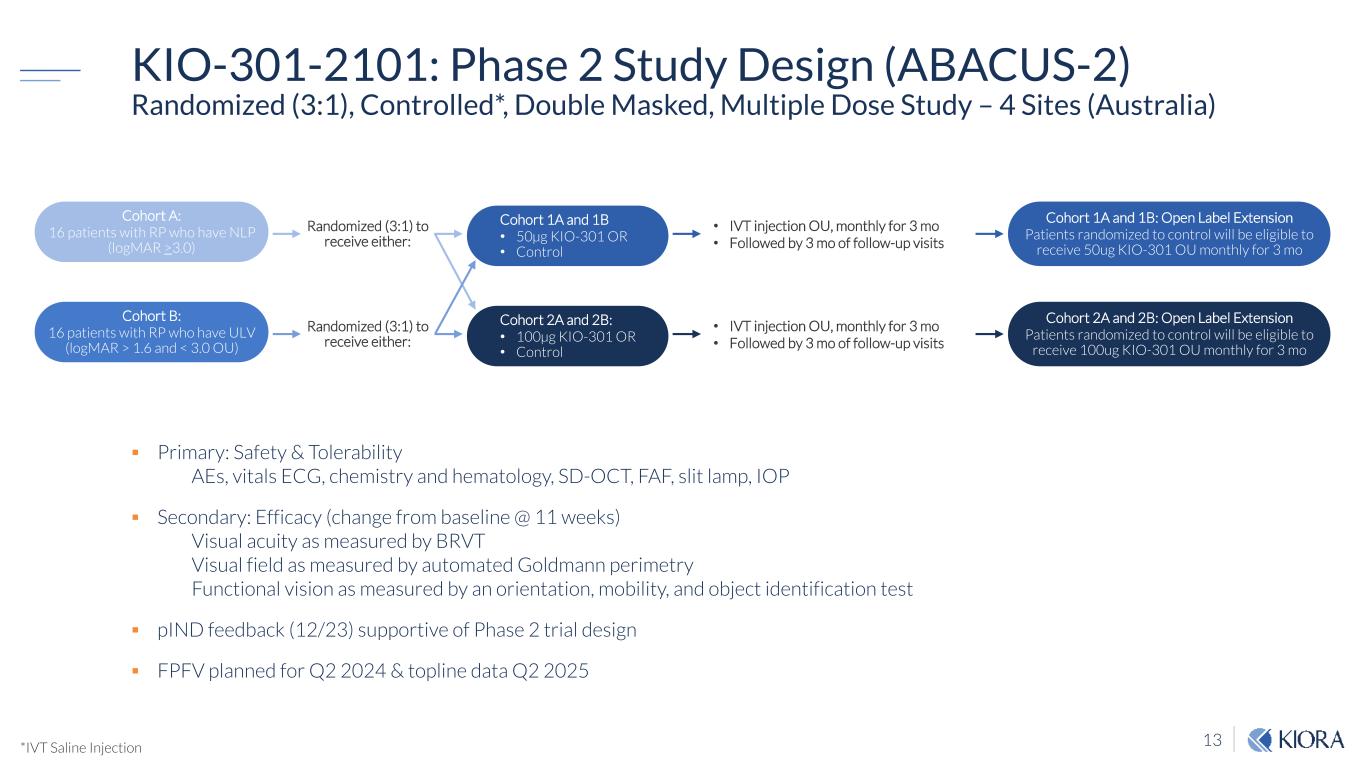

13 KIO-301-2101: Phase 2 Study Design (ABACUS-2) Randomized (3:1), Controlled*, Double Masked, Multiple Dose Study – 4 Sites (Australia) Primary: Safety & Tolerability ᵯ� AEs, vitals ECG, chemistry and hematology, SD-OCT, FAF, slit lamp, IOP Secondary: Efficacy (change from baseline @ 11 weeks) ᵯ� Visual acuity as measured by BRVT ᵯ� Visual field as measured by automated Goldmann perimetry ᵯ� Functional vision as measured by an orientation, mobility, and object identification test pIND feedback (12/23) supportive of Phase 2 trial design FPFV planned for Q2 2024 & topline data Q2 2025 Cohort A: 16 patients with RP who have NLP (logMAR >3.0) Cohort B: 16 patients with RP who have ULV (logMAR > 1.6 and < 3.0 OU) Cohort 1A and 1B • 50µg KIO-301 OR • Control Cohort 2A and 2B: • 100µg KIO-301 OR • Control Cohort 1A and 1B: Open Label Extension Patients randomized to control will be eligible to receive 50ug KIO-301 OU monthly for 3 mo Cohort 2A and 2B: Open Label Extension Patients randomized to control will be eligible to receive 100ug KIO-301 OU monthly for 3 mo Randomized (3:1) to receive either: Randomized (3:1) to receive either: • IVT injection OU, monthly for 3 mo • Followed by 3 mo of follow-up visits • IVT injection OU, monthly for 3 mo • Followed by 3 mo of follow-up visits *IVT Saline Injection

14 KIO-104 Intravitreal Small Molecule DHODH Inhibitor Steroid Sparing Approach to Retinal Inflammation

15 KIO-104 is an intravitreal, non-steroidal, novel small molecule which mitigates: Metabolic activity and proliferation of T-cells Secretion of IL-17, VEGF and IFN-ᵯ� KIO-104 Overview (DHODH Inhibitor) Existing immunosuppressive agents have a fundamentally different mode of action on T-cells compared to KIO-104 KIO-104 is best-in-class inhibitor of DHODH (lowest IC50)* KIO-104 is first-in-class in ophthalmology *1,000x more potent than Teriflunomide (Aubagio© - Sanofi) DHODH - dihydroorotate dehydrogenase

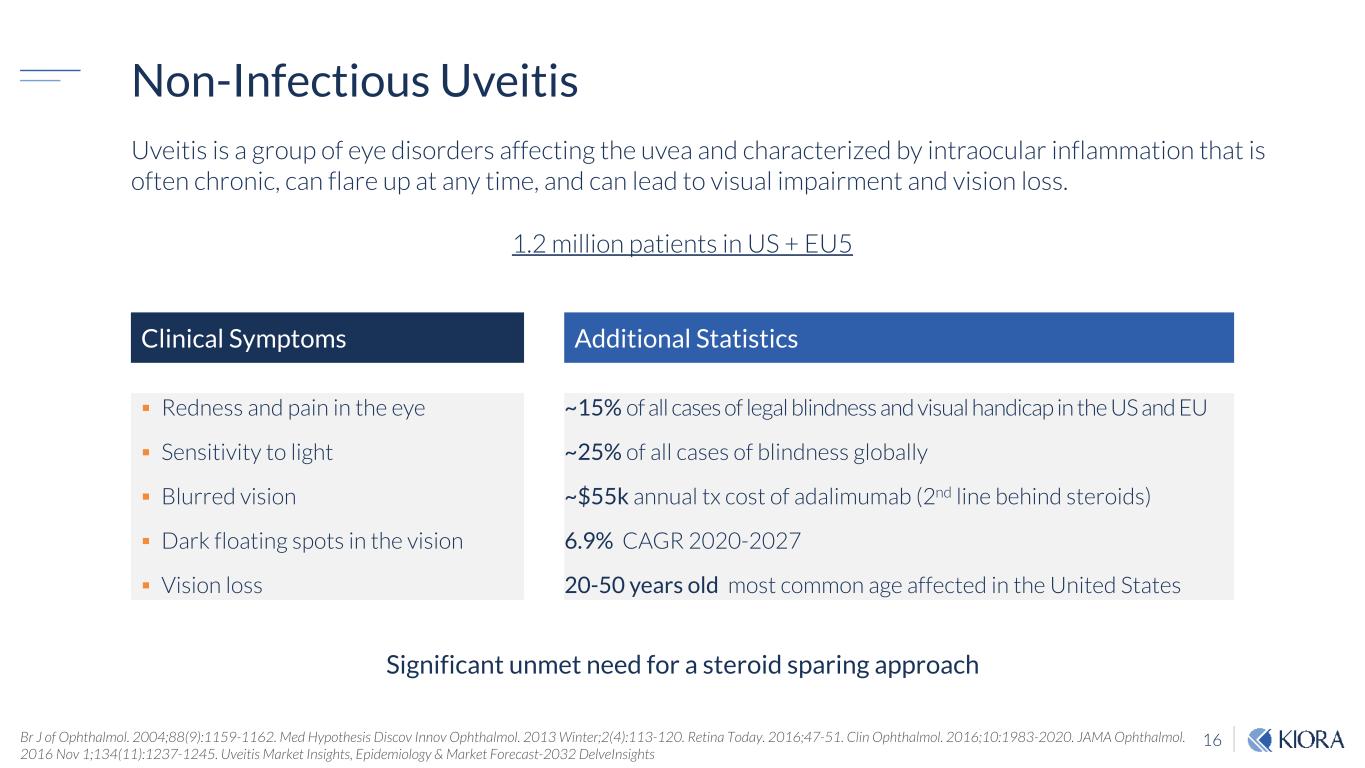

16 Non-Infectious Uveitis Br J of Ophthalmol. 2004;88(9):1159-1162. Med Hypothesis Discov Innov Ophthalmol. 2013 Winter;2(4):113-120. Retina Today. 2016;47-51. Clin Ophthalmol. 2016;10:1983-2020. JAMA Ophthalmol. 2016 Nov 1;134(11):1237-1245. Uveitis Market Insights, Epidemiology & Market Forecast-2032 DelveInsights Redness and pain in the eye Sensitivity to light Blurred vision Dark floating spots in the vision Vision loss Clinical Symptoms Additional Statistics ~15% of all cases of legal blindness and visual handicap in the US and EU ~25% of all cases of blindness globally ~$55k annual tx cost of adalimumab (2nd line behind steroids) 6.9% CAGR 2020-2027 20-50 years old most common age affected in the United States Uveitis is a group of eye disorders affecting the uvea and characterized by intraocular inflammation that is often chronic, can flare up at any time, and can lead to visual impairment and vision loss. Significant unmet need for a steroid sparing approach 1.2 million patients in US + EU5

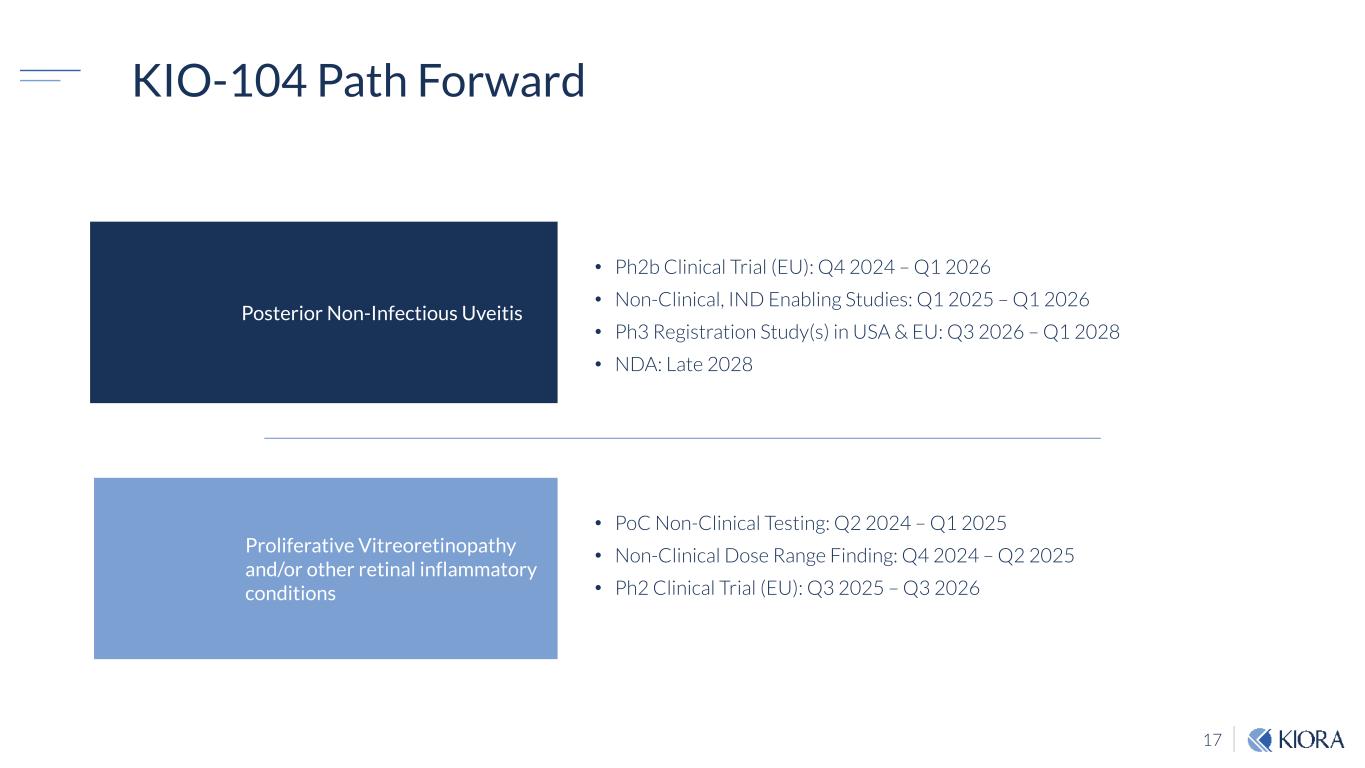

17 KIO-104 Path Forward Posterior Non-Infectious Uveitis • Ph2b Clinical Trial (EU): Q4 2024 – Q1 2026 • Non-Clinical, IND Enabling Studies: Q1 2025 – Q1 2026 • Ph3 Registration Study(s) in USA & EU: Q3 2026 – Q1 2028 • NDA: Late 2028 Proliferative Vitreoretinopathy and/or other retinal inflammatory conditions • PoC Non-Clinical Testing: Q2 2024 – Q1 2025 • Non-Clinical Dose Range Finding: Q4 2024 – Q2 2025 • Ph2 Clinical Trial (EU): Q3 2025 – Q3 2026

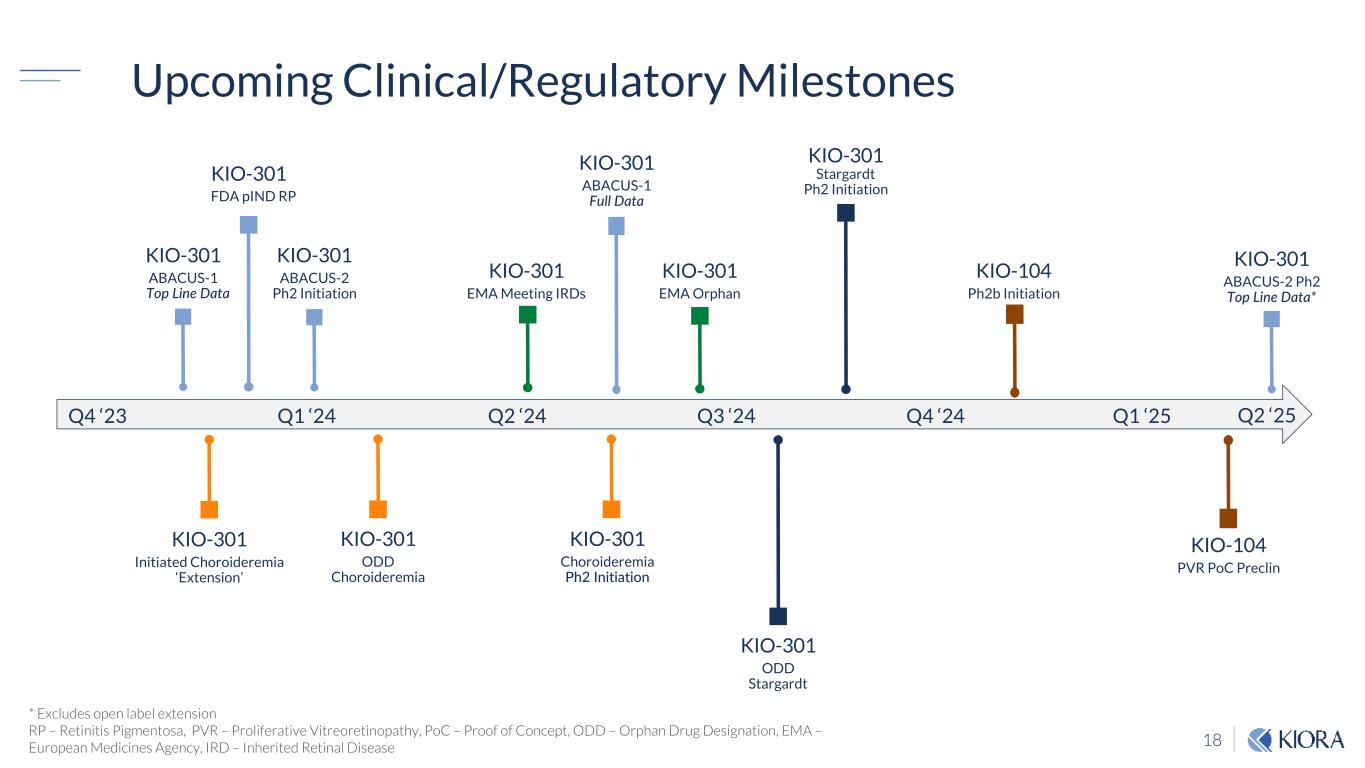

18 Q4 ‘23 Q1 ‘24 Q2 ‘24 Q3 ‘24 Q4 ‘24 KIO-301 ABACUS-1 ✓ Top Line Data KIO-301 ABACUS-2 Ph2 Initiation KIO-301 ABACUS-2 Ph2 Top Line Data* KIO-301 Initiated Choroideremia ‘Extension’ KIO-301 Stargardt Ph2 Initiation KIO-301 ✓ FDA pIND RP KIO-301 EMA Meeting IRDs KIO-301 ODD Choroideremia KIO-301 ODD Stargardt Q1 ‘25 * Excludes open label extension RP – Retinitis Pigmentosa, PVR – Proliferative Vitreoretinopathy, PoC – Proof of Concept, ODD – Orphan Drug Designation, EMA – European Medicines Agency, IRD – Inherited Retinal Disease Upcoming Clinical/Regulatory Milestones KIO-301 Choroideremia Ph2 Initiation KIO-301 EMA Orphan KIO-301 ABACUS-1 Full Data Q2 ‘25 KIO-104 Ph2b Initiation KIO-104 PVR PoC Preclin

19 Highlights KIO-301 Strategic Partnership Théa reimburses clinical development through Phase 2 Théa conducts Phase 3 Significant achievable milestone payments Long-term upside from Théa commercial capabilities, milestones and royalties Pipeline Opportunities KIO-301 Asia licensing KIO-104 has potential as best-in-class treatment for Uveitis and other indications Potential to cost-effectively in-license new assets Financial Flexibility Cash to fund current pipeline into late 2025 (before KIO-301 milestones) Pro forma (30Sept2023) cash: $22.7M