CORRESP: Correspondence

Published on June 20, 2025

June 20, 2025 VIA EDGAR United States Securities and Exchange Commission Division of Corporation Finance Office of Life Sciences Washington, D.C. 20549 Attention: Jenn Do Re: Kiora Pharmaceuticals, Inc. Form 10-K for the fiscal year ended December 31, 2024 Filed March 25, 2025 File No. 001-36672 Dear Ms. Do, This letter (this “Letter”) is sent by Kiora Pharmaceuticals, Inc. (the “Company”) in response to the comments of the staff (the “Staff”) of the United States Securities and Exchange Commission (the “SEC”), included in a letter (the “Comment Letter”) dated June 10, 2025 regarding the Company’s Annual Report on Form 10-K as filed with the SEC on March 25, 2025 (the “Form 10-K”). The Company has summarized in italicized type the text of the Staff’s comments outlined in the Comment Letter, followed by the Company’s response: 1. In your future filings, please revise the roll-forward on page F-24 to present the amount of impairment charges for in-process research and development, such as the $2.0 million impairment recorded during 2024. Company Response: The Company respectfully acknowledges the Staff’s comment regarding the presentation of impairment charges related to in-process research and development in the roll-forward schedule on page F-24. In future filings, the Company will revise the schedule to separately disclose these impairment charges for improved transparency and to align with the presentation of our intangible asset roll-forward, which includes this level of detail in the same table. 2. Regarding the license agreement with TOI, you state on page F-34 that you recorded offsetting expense credits of $2.9 million related to reimbursable KIO-301 expenses. However, we note from the fourth quarter of 2024 earnings release that you received $3.3 million in such reimbursable expenses. For the first quarter of 2025, it appears you received $1.8 million in these expenses but the amount you have recorded for the three months ended is $2.0 million. Please address the following in your response and provide revisions in future filings as deemed applicable: • We note from pages 7, 9 and 29 the disclosure that TOI is responsible for all research and development costs of KIO 301. If so, please separately quantify such as the foregoing R&D expenses that were reimbursed to you. • Tell us the amounts you have been reimbursed or received compared to what you have incurred for the recent periods. To the extent such amounts are material, provide a tabular presentation of such amounts in future filings, to be accompanied by a description of your accounting for such amounts. • Please describe the purpose and/or nature of the liability account, Accrued Collaboration Credit, and provide a roll forward thereof, identifying the transactions that increase or decrease this balance. Company Response:

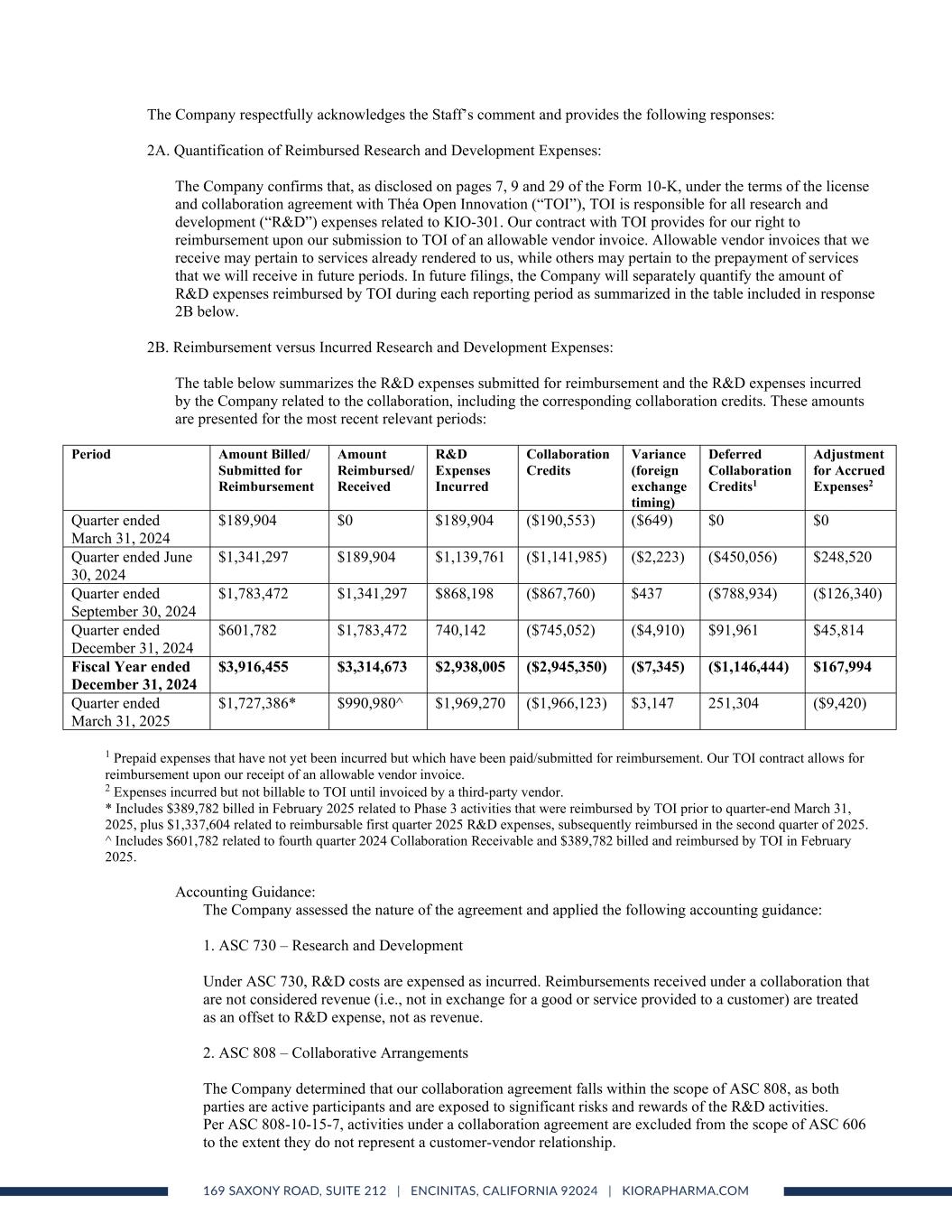

The Company respectfully acknowledges the Staff’s comment and provides the following responses: 2A. Quantification of Reimbursed Research and Development Expenses: The Company confirms that, as disclosed on pages 7, 9 and 29 of the Form 10-K, under the terms of the license and collaboration agreement with Théa Open Innovation (“TOI”), TOI is responsible for all research and development (“R&D”) expenses related to KIO-301. Our contract with TOI provides for our right to reimbursement upon our submission to TOI of an allowable vendor invoice. Allowable vendor invoices that we receive may pertain to services already rendered to us, while others may pertain to the prepayment of services that we will receive in future periods. In future filings, the Company will separately quantify the amount of R&D expenses reimbursed by TOI during each reporting period as summarized in the table included in response 2B below. 2B. Reimbursement versus Incurred Research and Development Expenses: The table below summarizes the R&D expenses submitted for reimbursement and the R&D expenses incurred by the Company related to the collaboration, including the corresponding collaboration credits. These amounts are presented for the most recent relevant periods: Period Amount Billed/ Submitted for Reimbursement Amount Reimbursed/ Received R&D Expenses Incurred Collaboration Credits Variance (foreign exchange timing) Deferred Collaboration Credits1 Adjustment for Accrued Expenses2 Quarter ended March 31, 2024 $189,904 $0 $189,904 ($190,553) ($649) $0 $0 Quarter ended June 30, 2024 $1,341,297 $189,904 $1,139,761 ($1,141,985) ($2,223) ($450,056) $248,520 Quarter ended September 30, 2024 $1,783,472 $1,341,297 $868,198 ($867,760) $437 ($788,934) ($126,340) Quarter ended December 31, 2024 $601,782 $1,783,472 740,142 ($745,052) ($4,910) $91,961 $45,814 Fiscal Year ended December 31, 2024 $3,916,455 $3,314,673 $2,938,005 ($2,945,350) ($7,345) ($1,146,444) $167,994 Quarter ended March 31, 2025 $1,727,386* $990,980^ $1,969,270 ($1,966,123) $3,147 251,304 ($9,420) 1 Prepaid expenses that have not yet been incurred but which have been paid/submitted for reimbursement. Our TOI contract allows for reimbursement upon our receipt of an allowable vendor invoice. 2 Expenses incurred but not billable to TOI until invoiced by a third-party vendor. * Includes $389,782 billed in February 2025 related to Phase 3 activities that were reimbursed by TOI prior to quarter-end March 31, 2025, plus $1,337,604 related to reimbursable first quarter 2025 R&D expenses, subsequently reimbursed in the second quarter of 2025. ^ Includes $601,782 related to fourth quarter 2024 Collaboration Receivable and $389,782 billed and reimbursed by TOI in February 2025. Accounting Guidance: The Company assessed the nature of the agreement and applied the following accounting guidance: 1. ASC 730 – Research and Development Under ASC 730, R&D costs are expensed as incurred. Reimbursements received under a collaboration that are not considered revenue (i.e., not in exchange for a good or service provided to a customer) are treated as an offset to R&D expense, not as revenue. 2. ASC 808 – Collaborative Arrangements The Company determined that our collaboration agreement falls within the scope of ASC 808, as both parties are active participants and are exposed to significant risks and rewards of the R&D activities. Per ASC 808-10-15-7, activities under a collaboration agreement are excluded from the scope of ASC 606 to the extent they do not represent a customer-vendor relationship.

The cost reimbursements between the parties represent a cost-sharing arrangement and are not in exchange for distinct goods or services. Therefore, collaboration credits do not meet the definition of revenue under ASC 606 and are accounted for as a reduction of R&D expense, consistent with ASC 730-20-25- 4 and ASC 808-10-45-1. 3. ASC 606 – Revenue from Contracts with Customers The Company evaluated whether any portion of the collaboration credits should be accounted for under ASC 606 and concluded that the collaboration partner does not qualify as a customer for these R&D reimbursements, as there is no transfer of control of goods or services per ASC 606-10-25-30. Therefore, ASC 606 does not apply to these reimbursements. Journal Entries: The Company records the following journal entries to reflect the reimbursement of R&D expenses via collaboration credits: Dr. R&D Expense (or Prepaid Expense when not yet incurred) Cr. Cash (or Accrued Expense when work has been performed but not yet invoiced) To record R&D expenses. Dr. Collaboration Credit Receivable Cr. Collaboration Credit (or Deferred Collaboration Credit when not yet incurred) To record the reimbursement billing to TOI and the offsetting expense credit. Dr. Cash Cr. Collaboration Credit Receivable To record the receipt of the reimbursement payment from TOI. This treatment appropriately reflects the nature of the transaction as a reduction to the cost incurred, rather than revenue earned. In future filings, to the extent such amounts are material, the Company will include a tabular reconciliation of such data along with a narrative description of the related accounting treatment. 2C. Nature of Accrued Collaboration Credit: The “Accrued Collaboration Credit” liability on the balance sheet represents the cumulative amount of: (i) Deferred Collaboration Credits, which are prepaid R&D expenses that are eligible for reimbursement but for which the related services have not yet been provided to the Company and are currently recognized as “Collaboration Credit” on the Statement of Operations as the expenses are incurred, and (ii) Accrued Expense Adjustments, which are R&D expenses that have been incurred but have not yet been invoiced by a third-party vendor and thereby are not yet paid/submitted for reimbursement. The balances of these activities have been included in the table above for reference in reconciling the Amount Billed/Submitted for Reimbursement compared to the amount of R&D Expenses Incurred. We supplementarily advise the Staff that, prior to TOI’s reimbursement of our expenses, it is our understanding that each vendor invoice we submit is reviewed and approved by the appropriate parties at TOI. To date, there have been no material differences between the invoices we have submitted for reimbursement and the reimbursements we have received from TOI. In future filings, the Company will provide a roll-forward of this liability account and describe the nature and accounting treatment, to the extent material to our financial statements. Should the Staff have any additional questions or comments regarding this letter, please contact me at 858-224-9600. Best Regards, /s/ Melissa Tosca, CPA Melissa Tosca, CPA Chief Financial Officer