DEF 14A: Definitive proxy statements

Published on March 25, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material Pursuant to §240.14a-12

KIORA PHARMACEUTICALS, INC.

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐Fee paid previously with preliminary materials

☐Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14A-6(i)(1) and 0-11

KIORA PHARMACEUTICALS, INC.

332 Encinitas Boulevard, Suite 102

Encinitas, CA 92024

March 25, 2024

Dear Stockholder:

I am pleased to invite you to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Kiora Pharmaceuticals, Inc. (“Kiora”) to be held on Wednesday, May 1, 2024 at 10:00 a.m. Pacific Time, at the offices of Kiora at 332 Encinitas Boulevard, Suite 102, Encinitas, California 92024.

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and Proxy Statement.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet, by mailing a proxy card, by telephone, or in person at the Annual Meeting. Please review the instructions on the Notice or on the proxy card regarding your voting options.

Thank you for your ongoing support of Kiora. We look forward to your participation our Annual Meeting.

Sincerely,

/s/ Brian M. Strem, Ph.D.

Brian M. Strem, Ph.D.

President and Chief Executive Officer

KIORA PHARMACEUTICALS, INC.

332 Encinitas Boulevard, Suite 102

Encinitas, CA 92024

(858) 224-9600

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 1, 2024

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Kiora Pharmaceuticals, Inc. (the “Company”) will be held on Wednesday, May 1, 2024, at 10:00 a.m. Pacific Time at the offices of the Company located at 332 Encinitas Boulevard, Encinitas, California 92024, for the following purposes:

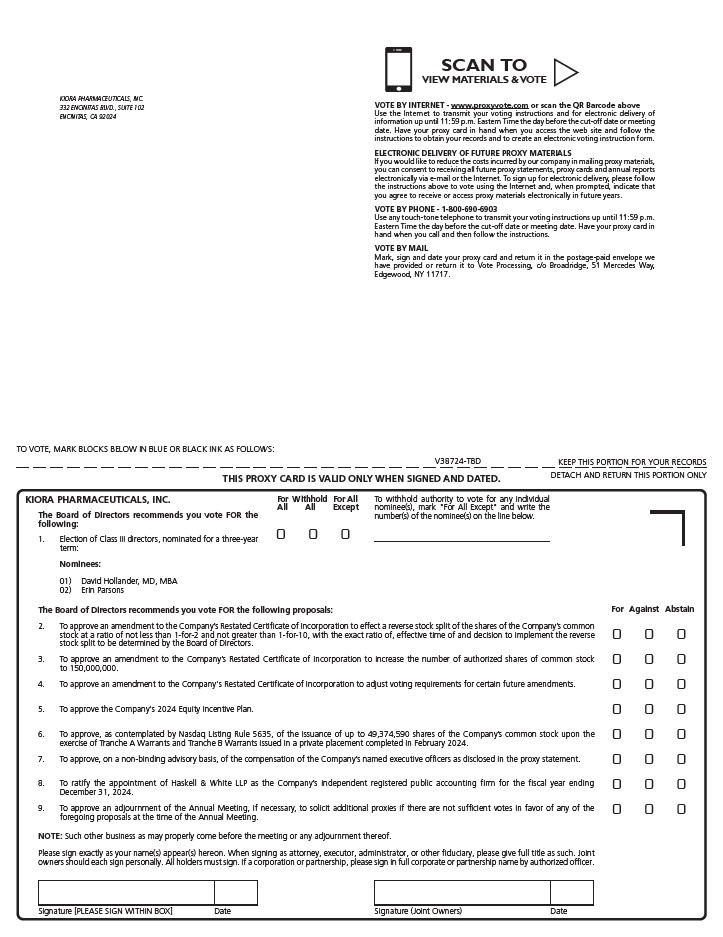

1.To elect two director nominees as Class III Directors, nominated by the board of directors, for a three-year term, such term to continue until the annual meeting of stockholders in 2027 or until such directors’ successors are duly elected and qualified or until their earlier resignation or removal;

2.To approve an amendment to the Company’s Restated Certificate of Incorporation to effect a reverse stock split of the shares of the Company’s Common Stock at a ratio of not less than 1-for-2 and not greater than 1-for-10, with the exact ratio of, effective time of and decision to implement the reverse stock split to be determined by the Board of Directors (the “Reverse Stock Split”);

3.To approve an amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock to 150,000,000;

4.To approve an amendment to the Company's Restated Certificate of Incorporation to adjust voting requirements for certain future amendments;

5.To approve the Company's 2024 Equity Incentive Plan;

6.To approve, as contemplated by Nasdaq Listing Rule 5635, the issuance of up to 49,374,590 shares of the Company’s common stock upon the exercise of Tranche A Warrants and Tranche B Warrants issued in a private placement completed in February 2024;

7.To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the proxy statement;

8.To ratify of the appointment of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024;

9.To consider and vote upon an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of any of the foregoing proposals at the time of the Annual Meeting; and

10.Such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

The board of directors has fixed the close of business on March 20, 2024 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Only holders of record of our common stock at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Each of the items of business listed above is more fully described in the proxy statement that accompanies this notice.

In the event there are not sufficient shares to be voted in favor of any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

The board of directors of Kiora Pharmaceuticals, Inc. recommends that you vote your shares as follows:

•“FOR” the election of the nominees of the board of directors as directors of Kiora Pharmaceuticals, Inc.'

•"FOR" the proposal to approve the Reverse Stock Split;

•"FOR" the proposal to approve an amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock to 150,000,000;

•"FOR" the proposal to approve an amendment to the Company's Restated Certificate of Incorporation to adjust voting requirements for certain future amendments;

•"FOR" the proposal to approve the Company's 2024 Equity Incentive Plan;

•"FOR the proposal to approve, as contemplated by Nasdaq Listing Rule 5635, the issuance of up to 49,374,590 shares of the Company’s common stock upon the exercise of Tranche A Warrants and Tranche B Warrants issued in a private placement completed in February 2024;

•“FOR” the proposal to approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in this proxy statement;

•“FOR” the proposal to ratify the appointment of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and

•"FOR" the proposal to approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of any of the foregoing proposals at the time of the Annual Meeting

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on Wednesday, May 1, 2024: The Proxy Statement and 2023 Annual Report to Stockholders, which includes the Annual Report on Form 10-K for the year ended December 31, 2023, are available at www.proxyvote.com. The Annual Report, however, is not part of the proxy solicitation material.

By order of the board of directors,

/s/ Brian M. Strem,Ph.D.

Brian M. Strem, Ph.D.

President and Chief Executive Officer

Encinitas, California

March 25, 2024

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE CAST YOUR VOTE ONLINE, BY TELEPHONE OR BY COMPLETING, DATING, SIGNING AND PROMPTLY RETURNING YOUR PROXY CARD OR VOTING INSTRUCTIONS CARD IN THE POSTAGE-PAID ENVELOPE BEFORE THE ANNUAL MEETING SO THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING.

KIORA PHARMACEUTICALS, INC.

Notice of 2024 Annual Meeting of Stockholders and Proxy Statement

Table of Contents

i | ||

KIORA PHARMACEUTICALS, INC.

332 Encinitas Boulevard, Suite 102

Encinitas, CA 92024

(858) 224-9600

PROXY STATEMENT

Annual Meeting of Stockholders to Be Held on Wednesday, May 1, 2024

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of Kiora Pharmaceuticals, Inc. (the “Company” or “we”) for use at the Annual Meeting of Stockholders of the Company to be held on Wednesday, May 1, 2024, at 10:00 a.m. Pacific Time, at the offices of the Company located at 332 Encinitas Boulevard, Encinitas, California 92024, and any adjournments or postponements thereof. At the Annual Meeting, the stockholders of the Company will be asked to consider and vote upon:

1.The election of two director nominees as Class III directors, nominated by the board of directors (or the “board”), for a three-year term, such term to continue until the annual meeting of stockholders in 2027 or until such directors’ successors are duly elected and qualified or until their earlier resignation or removal;

2.The approval of an amendment to our Restated Certificate of Incorporation to effect a reverse stock split of the shares of our common stock at a ratio of not less than 1-for-2 and not greater than 1-for-10, with the exact ratio of, effective time of and decision to implement the reverse stock split to be determined by the Board of Directors (the "Reverse Stock Split");

3.The approval of an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of common stock to 150,000,000;

4.The approval of an amendment to the Company's Restated Certificate of Incorporation to adjust voting requirements for certain future amendments;

5.The approval of the Company's 2024 Equity Incentive Plan;

6.The approval, as contemplated by Nasdaq Listing Rule 5635, of the issuance of up to 49,374,590 shares of the Company’s common stock upon the exercise of Tranche A Warrants and Tranche B Warrants issued in a private placement completed in February 2024;

7.The approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement;

8.To ratify the appointment of Haskell & White LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024;

9.The approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of any of the foregoing proposals at the time of the Annual Meeting; and

10.Such other business as may properly come before the Annual Meeting and any postponements thereof.

The Notice of Annual Meeting, Proxy Statement and Proxy Materials are first being mailed to stockholders of the Company on or about March 25, 2024, in connection with the solicitation of proxies for the Annual Meeting. The board of directors has fixed the close of business on March 20, 2024 as

1

the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting (the “Record Date”). Only holders of record of common stock, par value $0.01 per share, of the Company (the “Common Stock”) at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, there were 26,256,197 shares of Common Stock outstanding. As of the Record Date, there were approximately 59 stockholders of record. Each holder of a share of Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held of record with respect to each matter properly submitted at the Annual Meeting.

The presence, in person or by proxy, of holders of at least one third of the voting power of the outstanding shares of the Company entitled to vote generally in the election of directors is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Shares held of record by stockholders or their nominees who do not return a signed and dated proxy, properly deliver proxies via the Internet or telephone, or attend the Annual Meeting in person will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. Consistent with applicable law, we intend to count abstentions and broker non-votes for the purpose of determining the presence or absence of a quorum for the transaction of business. A broker “non-vote” refers to shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter. Applicable rules no longer permit brokers to vote in the election of directors if the broker has not received instructions from the beneficial owner. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares.

With respect to the election of two Class III directors in Proposal 1, such directors are elected by a plurality of the votes cast if a quorum is present. Votes may be cast for the directors or withheld. In a plurality election, votes may only be cast in favor of or withheld from the nominee; votes that are withheld will be excluded entirely from the vote and will have no effect. This means that the persons receiving the highest number of “FOR” votes will be elected as a director. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on the election of directors, except to the extent that the failure to vote for an individual results in another individual receiving a larger percentage of votes.

Approval of Proposal Nos. 2 and 3 requires the affirmative vote of the majority of the outstanding shares of common stock entitled to vote in the election of directors. Abstentions will have the effect of a vote against this proposal. The failure of a holder of record to vote will also have the effect of a vote against this proposal. While we anticipate that brokers will have discretionary authority to vote on these proposals in the absence of instructions from beneficial holders and thus there should be no broker non-votes, if a broker chooses not to exercise discretionary voting, it will have the effect of a vote against the proposal. Accordingly, it is critical that all holders vote on Proposal Nos. 2 and 3.

Approval of Proposal No. 4 requires the affirmative vote of two-thirds of the outstanding shares of common stock entitled to vote in the election of directors. Abstentions will have the effect of a vote against this proposal. The failure of a holder of record to vote will also have the effect of a vote against this proposal. Broker non-votes will have the effect of a vote against the proposal. Accordingly, it is critical that all holders vote on Proposal No. 4.

Approval of Proposal Nos. 5, 6, 7, 8 and 9 requires the affirmative vote of a majority of the voting power of the outstanding voting stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered votes present and entitled to vote on those proposals and thus, will have the same effect as a vote “against” such proposals. Broker non-votes will have no effect on the outcome of Proposal Nos. 5, 6, 7, 8 and 9.

The corporate actions described in this Proxy Statement will not afford stockholders the opportunity to dissent from the actions described herein or to receive an agreed or judicially appraised value for their shares.

2

We encourage you to vote either online, by telephone or by completing, signing, dating and returning a proxy card or if you hold your shares through a brokerage firm, bank or other financial institution, by completing and returning a voting instruction form. This ensures that your shares will be voted at the Annual Meeting and reduces the likelihood that we will be forced to incur additional expenses soliciting proxies for the Annual Meeting.

Voting over the Internet, by telephone or mailing a proxy card will not limit your right to vote in person or to attend the Annual Meeting in person. Any record holder as of the Record Date may attend the Annual Meeting and may revoke a previously provided proxy at any time by: (i) executing and delivering a later-dated proxy to the corporate secretary at Kiora Pharmaceuticals, Inc., 332 Encinitas Boulevard, Suite 102, Encinitas, CA 92024; (ii) delivering a written revocation to the corporate secretary at the address above before the meeting; or (iii) voting in person at the Annual Meeting.

Beneficial holders who wish to change or revoke their voting instructions should contact their brokerage firm, bank or other financial institution for information on how to do so. Beneficial holders who wish to attend the Annual Meeting and vote in person should contact their brokerage firm, bank or other financial institution holding shares of Common Stock on their behalf in order to obtain a “legal proxy”, which will allow them to vote in person at the meeting. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

Our board of directors recommends an affirmative vote on all proposals specified in the notice for the Annual Meeting. Proxies will be voted as specified. If your proxy is properly submitted, it will be voted in the manner you direct. If you do not specify instructions with respect to any particular matter to be acted upon at the meeting, proxies will be voted in accordance with the board of directors’ recommendations.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on Wednesday, May 1, 2024: The Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 are available at www.proxyvote.com. The Annual Report, however, is not part of the proxy solicitation material.

3

PROPOSAL 1

ELECTION OF DIRECTORS

The board of directors of the Company currently consists of seven members and is divided into three classes of directors, with two directors in Class I, three directors in Class II and two directors in Class III. Directors serve for three-year terms with one class of directors being elected by our stockholders at each annual meeting to succeed the directors of the same class whose terms are then expiring.

At the Annual Meeting, two Class III directors, nominated by the board of directors, will stand for election to serve until the 2027 annual meeting of stockholders or until their successors are duly elected and qualified or until their earlier resignation or removal.

At the recommendation of the nominating and corporate governance committee, the board of directors has nominated David Hollander, MD, MBA and Erin Parsons, for election as the Class III directors of the Company. Unless otherwise specified in the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy “FOR” the election of David Hollander, MD, MBA and Erin Parsons. The nominees have agreed to stand for election and, if elected, to serve as a directors. However, if any such person nominated by the board of directors is unable to serve or will not serve, the proxies will be voted for the election of such other person or persons as the nominating and corporate governance committee and the board of directors may recommend.

Vote Required

Directors are elected by a plurality of the votes cast, which means the three Class III director nominees receiving the most votes will be elected.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE FOLLOWING NOMINEES OF THE BOARD OF DIRECTORS: DAVID HOLLANDER, MD, MBA AND ERIN PARSONS. PROPERLY AUTHORIZED PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED “FOR” THE NOMINEES UNLESS INSTRUCTIONS TO WITHHOLD OR TO THE CONTRARY ARE GIVEN.

4

INFORMATION REGARDING DIRECTORS

Set forth below is certain information regarding the directors of the Company based on information furnished to the Company by each director. The biographical description below for each director includes his/ her age, all positions he/she holds with the Company, his/her principal occupation and business experience over the past five years, and the names of other publicly-held companies for which he/she currently serves as a director or has served as a director during the past five years. The biographical description below for each director also includes the specific experience, qualifications, attributes and skills that led to the conclusion by the board of directors that such person should serve as a director of the Company. In addition to such specific information, we also believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. Further, they have each demonstrated business acumen and an ability to exercise sound judgment as well as a commitment of service to the Company and our board.

The board of directors has determined that the director nominees and all the incumbent directors listed below are “independent” as such term is currently defined by applicable Nasdaq rules, except for

Dr. Strem, who is also an executive officer of the Company, and Aron Shapiro. The following information is current as of March 15, 2024, based on information furnished to the Company by each director:

Directors of Kiora Pharmaceuticals, Inc.

| Name | Age | Position with the Company | Director Since | |||||||||||||||||

| Class I Directors – Term expires 2025 | ||||||||||||||||||||

Brian M. Strem, Ph.D |

44 |

President, CEO and Director |

July 2021 | |||||||||||||||||

Carmine Stengone(2)(3)

|

48 |

Director |

August 2023 |

|||||||||||||||||

Class II Directors – Term expires 2026 |

||||||||||||||||||||

Kenneth Gayron(1)(3)

|

54 |

Director | April 2021 | |||||||||||||||||

Aron Shapiro |

46 |

Director | April 2021 | |||||||||||||||||

Praveen Tyle, Ph.D.(1)(3)

|

64 |

Chairman |

June 2008 | |||||||||||||||||

| Class III Directors – Term expires 2024 | ||||||||||||||||||||

David Hollander, MD, MBA(2)

|

50 |

Director | December 2021 | |||||||||||||||||

Erin Parsons(2)(1)

|

48 |

Director | January 2022 | |||||||||||||||||

(1)Member of the compensation committee

(2)Member of the nominating and corporate governance committee

(3)Member of the audit committee

Nominees for Class III Director — Term expires 2024

David Hollander, MD, MBA, Director, has served as a director since December 2021. Dr. Hollander is the Chief Medical Officer of Revance Therapeutics, Inc. and has served in this capacity since October 2022. Previously, Dr Hollander served as the Chief Research and Development Officer of Aerie Pharmaceuticals, Inc. between November 2019 and February 2022. Dr. Hollander began his career in industry in 2006 at Allergan as a Medical Director of Ophthalmology where he also held a number of leadership roles including Vice President of Eye Care for U.S. Medical Affairs, Vice President and Head of Eye Care for Global Medical Affairs, as well as Therapeutic Area Head in Clinical Development for Anterior Segment and Consumer Eye Care. During this time, Dr. Hollander continued to see patients and instruct residents and fellows in cataract surgery and corneal transplantation. Dr. Hollander previously served as Chief Medical Officer of Ora, Inc., the leading ophthalmic Contract Research Organization, from April 2016 to November 2019. While at Ora, Dr. Hollander oversaw medical operations across pharmaceutical and device clinical development, preclinical studies, as well as research and development into new regulatory endpoints, most notably the development of novel mobility courses for evaluating treatments for inherited retinal diseases. Dr. Hollander received his B.S. in chemistry with honors and distinction from Stanford University, and earned his medical degree at the University of

5

Pennsylvania School of Medicine. Dr. Hollander also obtained an M.B.A. in Health Care Management from the Wharton School at the University of Pennsylvania. Dr. Hollander completed his residency in ophthalmology at the University of California, San Francisco, and a Heed Fellowship in Cornea, External Disease and Refractive Surgery at the Jules Stein Eye Institute/University of California, Los Angeles.

We believe Dr. Hollander’s qualifications to sit on our board of directors include his clinical, research and operational experience with a variety of ophthalmology companies.

Erin Parsons, Director, has served as a director since February 2022. Ms. Parsons was the Founder of Parsons Medical Communications, LLC, an agency providing scientific and strategic consulting to small and large companies in the ophthalmic space, since its founding in 2010, where she served as Managing Director and previously served as President from February 2010 through September 2022. In September 2022, Fingerpaint Group, a full-service health and wellness agency, acquired Parsons Medical Communications. Ms. Parsons has served as a member of the board of directors of Alimera Sciences, Inc. (Nasdaq: ALIM), a pharmaceutical company concerned with retinal health and vision, since December 2021. Ms. Parsons received a BS in Biology from Wake Forest University.

We believe Ms. Parsons’ qualifications to sit on our board of directors include her extensive consulting experience with ophthalmology companies.

Class I Directors — Term expires 2025

Brian M. Strem, Ph.D., President, Chief Executive Officer and Director, has served in those positions since July 23, 2021. Dr. Strem co-founded Bayon Therapeutics, which designed KIO-301, a potential vision-restoring small molecule which acts as a ‘molecular photoswitch’ specifically designed to restore vision in patients with inherited and age-related degenerative retinal diseases. Kiora acquired Bayon Therapeutics in October 2021. Dr. Strem was Managing Director of Bayon from March 2020 until the acquisition. Dr. Strem is a co-founder of Okogen, Inc., a development stage ophthalmic company focused on a novel therapeutic for the treatment of viral infections of the eye, and served as its CEO from May 2015 through July 2021 and remains as a Board Director. Prior to founding Okogen, Dr. Strem worked at Sound Pharmaceuticals, Inc., Allergan, Inc. and Shire, Plc, where he was responsible for business development and corporate strategy in ophthalmology, otology and regenerative medicine. Dr. Strem began his career at Cytori Therapeutics with elevating roles within the commercial and research and development departments. Dr. Strem received a BS in bioengineering from Cornell University and a Ph.D. in biomedical engineering from the University of California, Los Angeles.

We believe Dr. Strem’s qualifications to sit on our board of directors include his executive leadership and business development experience and focus on corporate strategy.

Carmine Stengone, Director, has served as a director since August 2023. Mr. Stengone is currently President, Chief Executive Officer and a member of the board of directors for Contineum Therapeutics, Inc. Previously, he served as Senior Vice President, Business Development for COI Pharmaceuticals (now Avalon BioVentures Accelerator), and a member of its investment committee, where he helped co-found six new biopharmaceutical companies. While with Avalon Ventures, Carmine served as President and Chief Executive Officer of Avelas Biosciences, Inc. He also served as Vice President of Corporate Development for Afraxis Holdings, Inc. and co-founder and CEO of Afraxis, Inc., a spin-out company from Afraxis Holdings. Earlier in his career, he held positions of increasing responsibility with Phenomix Corporation, Anadys Pharmaceuticals, Inc., and Johnson & Johnson. Carmine received his MBA from the Johnson Graduate School of Management at Cornell University and his M.S. and B.S degrees in chemistry from Duke University and Wake Forest University, respectively.

We believe Mr. Stengone's qualifications to sit on our board of directors include his executive leadership experience, including over 20 years of experience as an executive in the life science industry where he has in founded, operated, financed, transacted and negotiated strategic alliances for the companies he has served.

6

Class II Directors — Term expires in 2026

Kenneth Gayron, Director, has served as a director since April 2021. Mr. Gayron has served as Chief Financial Officer and Executive Vice President of Avid Technology, Inc., a leading technology provider for the media and entertainment industry, from May 2018 until November 2023. Mr. Gayron previously served as CFO and interim CEO for Numerex Corporation, a single source, leading provider of managed enterprise solutions enabling the Internet of Things, from March 2016 to February 2018. Prior to his tenure with Numerex, Mr. Gayron served as CFO of Osmotica Pharmaceutical Corp., a global specialty pharmaceutical company, from October 2013 to February 2016. Prior to Osmotica, Mr. Gayron acted as Vice President — Finance and Treasurer for Sensus, Inc., a global smart grid communications company, from February 2011 until September 2013. From April 2009 until January 2011, Mr. Gayron served as Treasurer of Nuance Communications, a software/services company. From 1992 until 2009, Mr. Gayron held positions of increasing responsibility with investment banks, including UBS, Bank of America and CIBC. Mr. Gayron received a BS in Finance from Boston College and an MBA from Cornell University.

We believe that Mr. Gayron’s qualifications to sit on our board of directors include his executive leadership experience, financial experience and track record for enhancing operational capabilities to drive growth.

Aron Shapiro, Director, has served as a director since April 2021. Mr. Shapiro has served in positions of increasing responsibility at Ora, Inc., the world’s leading full-service ophthalmic drug and device development firm, since July 1999, most recently serving as Senior Vice President and Partner, Asset Development and Partnering since August 2019, as Senior Vice President and Chief Commercial Officer between August 2017 and August 2019, and as Vice President between October 2010 and August 2017. At Ora, Mr. Shapiro is responsible for investment and strategic partnering was previously responsible for worldwide business development and sales activities. Mr. Shapiro received a BS in Biological Chemistry from Bates College.

We believe that Mr. Shapiro’s qualifications to sit on our board of directors include his extensive clinical-regulatory strategy and business development experience in the ophthalmology space.

Praveen Tyle, Ph.D., Director, has served as a director since June 2008. Since April 2023, Dr. Tyle has served as founder of Potens Pharmaceuticals. From April 2021 to April 2023, Dr. Tyle has served as President, CEO and member of the board of directors of Invectys, Inc. and Invectys USA, Inc., a biopharmaceutical company focused on the development of innovative immunotherapy approaches to treat cancer. From May 2016 to April 2021, Dr. Tyle has served as Executive Vice President of Research and Development of Lexicon Pharmaceuticals. Dr. Tyle was previously a member of the executive management team at Osmotica Pharmaceutical Corp., serving as President, CEO and member of the board of directors from January 2013 through April 2016 and as Executive Vice President and Chief Scientific Officer from August 2012 to December 2012. He is also a member of the boards of directors of Orient EuroPharma Co., Ltd. of Taiwan. and of Skye Bioscience, Inc. (OTC: SKYE), a biopharmaceutical company developing synthetic cannabinoid molecules to treat glaucoma and other diseases. Dr. Tyle has nearly 38 years of experience in the pharmaceutical industry with the majority of his tenure in senior executive leadership positions in areas of research and development, manufacturing, quality, business development and operations. Prior to joining Osmotica Pharmaceutical Corp., Dr. Tyle served as Executive Vice President (from January 2012 to August 2012) and Chief Scientific Officer (from October 2011 to August 2012) for the United States Pharmacopeia, or USP. Prior to joining USP, Dr. Tyle from 2008 to 2011, served as the Senior Vice President and Global Head of Business Development and Licensing at Novartis Consumer Health from March 2009 to September 2011. At Novartis Consumer Health, Dr. Tyle also served as Senior Vice President & Global Head of Research and Development from March 2009 to February 2010. Dr. Tyle holds a doctorate in pharmaceutics and pharmaceutical chemistry from the Ohio State University and a BS in Pharmacy (honors) from the Institute of Technology, Banaras Hindu University in India.

7

We believe Dr. Tyle’s qualifications to sit on our board of directors include his executive research and development leadership experience and significant mergers and acquisitions and business development and licensing experience.

8

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

During the year ended December 31, 2023, our board of directors held five meetings. Each of the directors attended at least 75% of the total number of meetings of the board of directors and of the committees of which he or she was a member. The board of directors encourages directors to attend in person the Annual Meeting of Stockholders of the Company, or Special Meeting in lieu thereof, or, if unable to attend in person, to participate by other means, if practicable. In recognition of this policy, the board of directors typically schedules a regular meeting of the board of directors to be held on the date of, and immediately following, the Annual Meeting of Stockholders.

Board Leadership Structure

On July 26, 2021, Dr. Strem was appointed by our board of directors as our President and Chief Executive Officer. On January 31, 2022, Mr. Chaney resumed his position as non-executive chairman of the board. On September 20, 2023, Mr. Chaney resigned from the board, and Praveen Tyle was appointed as our non-executive chairman of the board.

The non-employee directors meet regularly in executive sessions outside the presence of management. Mr. Chaney serves as the chairman of the board of directors. Among other things, the chairman provides feedback to the Chief Executive Officer on executive sessions and facilitates discussion among the independent directors outside of meetings of the board of directors. The Chief Executive Officer is responsible for the day-to-day management of our Company and the development and implementation of our Company’s strategy. Our board of directors currently believes that separating the roles of Chief Executive Officer and chairman contributes to an efficient and effective board. Our board of directors does not have a current requirement that the roles of Chief Executive Officer and chairman of the board be either combined or separated, because the board currently believes it is in the best interests of our Company to make this determination based on the position and direction of our Company and the constitution of the board and management team. From time to time, the board will evaluate whether the roles of Chief Executive Officer and chairman of the board should be combined or separated. The board has determined that having separate roles of our Company’s Chief Executive Officer and chairman is in the best interest of our stockholders at this time.

Independent Directors

Our board of directors is currently composed of seven members. Under the published listing requirements of Nasdaq, independent directors must comprise a majority of a listed company’s board of directors within twelve months of the completion of an initial public offering. All of the members of our board except for Dr. Strem and Aron Shapiro qualify as independent directors in accordance with the published listing requirements of Nasdaq.

Classified Board

Our board of directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our directors are divided among the three classes as follows:

•The Class I directors are Brian M. Strem, Ph.D. and Carmine Stengone, and their terms expire at the annual meeting of stockholders to be held in 2025;

•The Class II directors are Kenneth Gayron, Aron Shapiro and Praveen Tyle, Ph.D., and their terms expire at the annual meeting of stockholders to be held in 2026; and

•The Class III directors are David Hollander, MD, MBA and Erin Parsons, and their terms expire at this Annual Meeting (and, if re-elected, the annual meeting of stockholders to be held in 2027)

9

The authorized number of directors may be changed only by resolution of the board of directors. This classification of the board of directors into three classes with staggered three-year terms may have the effect of delaying or preventing changes in our control or management.

Role of Board in Risk Oversight Process

Our board of directors has responsibility for the oversight of the company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board to understand the company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The audit committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The nominating and corporate governance committee manages risks associated with the independence of the board, corporate disclosure practices, and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board as a whole.

Board Diversity Matrix (As of March 20, 2024)

Total Number of Directors |

7 |

||||||||||||||||||||||

| Part I. Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender |

|||||||||||||||||||

Directors |

1 |

6 |

— |

— |

|||||||||||||||||||

Part II. Demographic Background |

|||||||||||||||||||||||

African American or Black |

— | — |

— |

— |

|||||||||||||||||||

Alaskan Native or Native American |

— | — |

— |

— |

|||||||||||||||||||

Asian |

— | 1 |

— |

— |

|||||||||||||||||||

Hispanic or Latinx |

— | — |

— |

— |

|||||||||||||||||||

Native Hawaiian or Pacific Islander |

— | — |

— |

— |

|||||||||||||||||||

White |

1 |

5 |

— |

— |

|||||||||||||||||||

Two or More Races or Ethnicities |

— | — |

— |

— |

|||||||||||||||||||

LGBTQ+ |

— | — | — |

— |

|||||||||||||||||||

Did Not Disclose Demographic Background |

— | — |

— |

— |

|||||||||||||||||||

The board diversity matrix for 2023 can be found in our definitive proxy statement filed with the Securities and Exchange Commission on April 28, 2023.

Corporate Governance

We believe our corporate governance initiatives comply with the Sarbanes-Oxley Act and the rules and regulations of the Securities and Exchange Commission adopted thereunder. In addition, we believe our corporate initiatives comply with the rules of The Nasdaq Capital Market. Our board of directors continue to evaluate our corporate governance principles and policies.

10

Our board of directors have adopted a code of business conduct that applies to each of our directors, officers and employees. The code addresses various topics, including:

•compliance with applicable laws, rules and regulations;

•conflicts of interest;

•public disclosure of information;

•insider trading;

•corporate opportunities;

•competition and fair dealing;

•gifts;

•discrimination, harassment and retaliation;

•health and safety;

•record-keeping;

•confidentiality;

•protection and proper use of company assets;

•payments to government personnel; and

•reporting illegal and unethical behavior.

The code of business conduct is posted on our website. Any waiver of the code of business conduct for an executive officer or director may be granted only by our board of directors or a committee thereof and must be timely disclosed as required by applicable law. The code of business conduct has implemented whistleblower procedures that establish format protocols for receiving and handling complaints from employees. Any concerns regarding accounting or auditing matters reported under these procedures will be communicated promptly to the audit committee.

Board Committees

Our board of directors has established an audit committee, a compensation committee and nominating and corporate governance committee, each of which operate under a charter that has been approved by our board. The directors serving as members of these committees meet the criteria for independence under, and the functioning of these committees complies with, the applicable requirements of the Sarbanes-Oxley Act and Securities and Exchange Commission rules and regulations. In addition, we believe that the functioning of these committees complies with the rules of The Nasdaq Capital Market. Each committee has the composition and responsibilities described below.

Audit Committee

Our board of directors has established an audit committee, which is comprised of Kenneth Gayron, Praveen Tyle, Ph.D. and Carmine Stengone, each of whom is a non-employee member of the board of directors. Kenneth Gayron serves as the chair of the audit committee. The audit committee met four times during 2023. The audit committee’s main function is to oversee our accounting and financial reporting processes, internal systems of control, independent registered public accounting firm relationships and the audits of our financial statements. Pursuant to the audit committee charter, the functions of the committee include, among other things:

•appointing, approving the compensation of, and assessing the independence of our registered public accounting firm;

•overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm;

11

•reviewing and discussing with management and the registered public accounting firm our annual and quarterly financial statements and related disclosures;

•monitoring our internal control over financial reporting and our disclosure controls and procedures;

•meeting independently with our registered public accounting firm and management;

•preparing the audit committee report required by Securities and Exchange Commission rules;

•reviewing and approving or ratifying any related person transactions; and

•overseeing our risk assessment and risk management policies.

All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the Securities and Exchange Commission. Our board of directors has determined that Kenneth Gayron is an “audit committee financial expert” as defined by applicable Securities and Exchange Commission rules. In addition, our board of directors has also determined that Mr. Gayron has the requisite financial sophistication under applicable Nasdaq rules and regulations.

Compensation Committee

Our board of directors has established a compensation committee, which is comprised of Praveen Tyle, Ph.D., Kenneth Gayron and Erin Parsons. Erin Parsons serves as the chair of the compensation committee. The compensation committee met two times during 2023. Our compensation committee reviews and recommends policies relating to compensation and benefits of our officers and employees. Pursuant to the compensation committee charter, the functions of this committee include:

•evaluating the performance of our chief executive officer and determining the chief executive officer’s salary and contingent compensation based on performance and other relevant criteria;

•identifying the corporate and individual objectives governing the chief executive officer’s compensation;

•in consultation with the chief executive officer, determining the compensation of our other officers;

•making recommendations to our board with respect to director compensation;

•reviewing and approving the terms of material agreements with our executive officers;

•overseeing and administering our equity incentive plans and employee benefit plans;

•reviewing and approving policies and procedures relating to the perquisites and expense accounts of our executive officers;

•if and as applicable, furnishing the annual compensation committee report required by Securities and Exchange Commission rules; and

•conducting a review of executive officer succession planning, as necessary, reporting its findings and recommendations to our board of directors, and working with the Board in evaluating potential successors to executive officer positions.

Our board of directors has determined that each of the members of the Compensation Committee is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act and is an “outside director” as that term is defined in Section 162(m) of the United States Internal Revenue Code of 1986, as amended, or Section 162(m).

12

Nominating and Corporate Governance Committee

Our board of directors has established a Nominating and Corporate Governance committee, which is comprised of David Hollander, MD, MBA, Erin Parsons and Carmine Stengone. David Hollander, MD, MBA serves as the chair of the Nominating and Corporate Governance. The Nominating and Corporate Governance committee met one time during 2023. Pursuant to the Nominating and Corporate Governance charter, the functions of this committee include, among other things:

•identifying, evaluating, and making recommendations to our board of directors and our stockholders concerning nominees for election to our board, to each of the board’s committees and as committee chairs;

•annually reviewing the performance and effectiveness of our board and developing and overseeing a performance evaluation process;

•annually evaluating the performance of management, the board and each board committee against their duties and responsibilities relating to corporate governance;

•annually evaluating adequacy of our corporate governance structure, policies, and procedures; and

•providing reports to our board regarding the committee’s nominations for election to the board and its committees.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is or has in the past served as an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

13

REPORT OF THE AUDIT COMMITTEE

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or any future filing with the Securities and Exchange Commission, in whole or in part, the following report shall not be deemed incorporated by reference into any such filing.

The undersigned members of the audit committee of the board of directors of the Company submit this report in connection with the committee’s review of the financial reports of the Company for the fiscal year ended December 31, 2023 as follows:

1.The audit committee has reviewed and discussed with management the audited financial statements of the Company for the fiscal year ended December 31, 2023.

2.The audit committee has discussed with representatives of Haskell & White LLP the matters required to be discussed with them by applicable requirements of Public Company Accounting Oversight Board Auditing Standard AS 1301: Communications with Audit Committees.

3.The audit committee has received the written disclosures and the letter from the independent accountant required by the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence.

Based on the review and discussions referred to above, the audit committee recommended to the board of directors that the audited financial statements be included in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023 for filing with the Securities and Exchange Commission.

Submitted by the audit committee:

Kenneth Gayron, Chairman

Praveen Tyle, Ph.D.

Carmine Stengone

14

EXECUTIVE OFFICERS

Biographical information regarding our executive officers is set forth below. Each executive officer is elected annually by our board and serves until his or her successor is appointed and qualified, or until such individual’s earlier resignation or removal.

| Name | Age | Position | ||||||||||||

| Brian M. Strem, Ph.D. | 44 | President and Chief Executive Officer | ||||||||||||

| Eric J. Daniels, MD, MBA | 51 | Chief Development Officer | ||||||||||||

| Melissa Tosca, CPA | 44 | Executive Vice President of Finance | ||||||||||||

Brian M. Strem, Ph.D., President and Chief Executive Officer — Please refer to “Proposal No. 1 — Election of Directors” section of this proxy statement for Dr. Strem’s biographical information.

Eric J. Daniels, MD, MBA has served as our Chief Development Officer since October 2021. Dr. Daniels is a co-founder of Bayon. Dr. Daniels is also a co-founder of Okogen, Inc., a development stage ophthalmic company focused on a novel therapeutic for the treatment of viral infections of the eye, and served as its Chief Operating Officer from 2015 through October 2021, and remains on Okogen's Board of Directors. Dr. Daniels served as Chief Executive Officer of OccuRx, a clinical stage biotechnology company targeting microvascular disease for ocular indications, from 2020 through October 2021. Dr. Daniels is a member and Chair of the medical advisory board of Bimini, LLC, a holding company with a portfolio of performing medtech assets, and served as its Consulting Chief Medical Officer from 2014 through October 2021. Dr. Daniels previously served as Vice President — Marketing & Sales of Tensys Medical, Inc. from 2012 through 2016, and in roles of increasing responsibility at Cytori Therapeutics from 2001 through 2012. Dr. Daniels received a BS in molecular and cell biology from the University of California Berkeley, an MD from the University of California Los Angeles School of Medicine, and an MBA from the University of California Los Angeles Anderson School of Management.

Melissa Tosca, CPA has served as our Executive Vice President of Finance since September 2022. Ms. Tosca previously served as Executive Director of Finance and Corporate Treasurer for Neomorph from 2021 to 2022, where she managed the finance and accounting functions. She also served as Director of Finance and Accounting at Omniome from 2017 to 2021, building the accounting and finance infrastructure and managing financial operations. Prior to Omniome, she spent nine years at Caris Life Sciences from 2008 to 2017, serving in various leadership roles including Director of Finance and Accounting, Director of Financial Planning and Analysis and Senior Director of Sales Operations. She began her professional career in public accounting at Clifton Gunderson and later moved to Ernst & Young as an Audit Manager. Melissa is a Certified Public Accountant and holds a BS in Accounting from the University of Arizona.

15

EXECUTIVE COMPENSATION

We are a “smaller reporting company” under Rule 405 of the Securities Act of 1933, as amended. As a result, we have elected to comply with the reduced disclosure requirements applicable to smaller reporting companies in accordance with Securities and Exchange Commission rules. Our named executive officers during the fiscal year ended December 31, 2023 were Brian M. Strem, Ph.D., our President and Chief Executive Officer, Eric J. Daniels, MD, MBA, our Chief Development Officer, and Melissa Tosca, our Executive Vice President of Finance. Dr. Strem was appointed as President and Chief Executive Officer on July 23, 2021. Melissa Tosca was appointed as Executive Vice President of Finance effective as of September 13, 2022.

Summary Compensation Table

The following table sets forth information concerning the compensation of our named executive officers during our fiscal years ended December 31, 2023 and December 31, 2022.

| Name and Principal Position | Year | Salary ($) | Bonus ($)1 | Stock Awards ($)2 | Option Awards ($)3 | All Other Compensation ($) |

Total ($) | ||||||||||||||||

| Brian M. Strem, Ph.D | 2023 | 416,000 | 170,000 | 102,498 | 113,776 | — | 802,274 | ||||||||||||||||

| President and Chief Executive Officer4 | 2022 | 400,000 | 64,932 | 84,750 | 164,500 | — | 714,182 | ||||||||||||||||

| Eric J. Daniels, MD, MBA | 2023 | 338,577 | 117,586 | 95,373 | 100,776 | — | 652,312 | ||||||||||||||||

| Chief Development Officer5 | 2022 | 350,463 | 21,008 | 67,800 | 107,638 | — | 546,909 | ||||||||||||||||

| Melissa Tosca | 2023 | 304,479 | 20,000 | 26,292 | 36,704 | — | 387,475 | ||||||||||||||||

| Executive Vice President of Finance6 | 2022 | 85,385 | — | 16,950 | 30,200 | — | 132,535 | ||||||||||||||||

1 The amounts in this column represent discretionary bonus payments granted by the board in the applicable fiscal year.

2 The amounts in this column represent the aggregate grant date fair value of stock awards granted to the officer in the applicable fiscal year, computed in accordance with FASB ASC Topic 718. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies and Significant Judgments and Estimates” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for a discussion of the assumptions made by us in determining the grant date fair value of our equity awards. In accordance with Securities and Exchange Commission rules, the grant date fair value of an award subject to performance conditions is based on the probable outcome of the conditions.

3 The amounts in this column represent the aggregate grant date fair value of option awards granted to the officer in the applicable fiscal year, computed in accordance with FASB ASC Topic 718. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies and Significant Judgments and Estimates” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for a discussion of the assumptions made by us in determining the grant date fair value of our equity awards. In accordance with Securities and Exchange Commission rules, the grant date fair value of an award subject to performance conditions is based on the probable outcome of the conditions.

4 Dr. Strem was appointed as our President and Chief Executive Officer as of July 23, 2021.

5 Mr. Daniels was appointed as our Chief Development Officer as of October 21, 2021.

6 Ms. Tosca was appointed as our Executive Vice President of Finance as of September 13, 2022.

16

Narrative Disclosure to Compensation Tables

Employment Agreements

Brian M. Strem, Ph.D.

In connection with Dr. Strem’s appointment as President and Chief Executive Officer, on July 22, 2021, we entered into an Employment Agreement with Dr. Strem. Pursuant to the agreement, Dr. Strem receives an annual base salary of $400,000 and he is entitled to receive a performance bonus with a target of up to 50% of his annual base salary for the applicable fiscal year. Dr. Strem also received an option to purchase up to 2,500 shares of the Company’s common stock, which vested respect to one-third of the underlying shares on the one-year anniversary of the grant date, and thereafter will vest in equal monthly installments over a two-year period. Dr. Strem is also entitled to receive two further options to purchase an aggregate of up to 2,500 shares of our common stock based on the achievement of market capitalization-based milestones as set forth in his agreement. Effective January 1, 2023, Dr. Strem's annual base salary was increased to $416,000.

Eric J. Daniels, MD, MBA

In connection with Dr. Daniels’ appointment as Chief Development Officer, on October 21, 2021, we and our Australian subsidiary entered into an Employment Agreement with Dr. Daniels. Pursuant to the employment agreement, Dr. Daniels receives an annual base salary of AUD$492,000 and he is entitled to receive a performance bonus with a target of up to 40% of his annual base salary for the applicable fiscal year. Pursuant to the employment agreement, we granted Dr. Daniels an option to purchase up to 1,250 shares of our common stock. The option vested with respect to one-third of the underlying shares on the one-year anniversary of the grant date, and thereafter will vest in equal monthly installments over a two-year period. Effective January 1, 2023, Dr. Daniels' annual base salary was increased to AUD$511,680.

Melissa Tosca

In connection with Ms. Tosca’s appointment as Executive Vice President of Finance, we entered into an Offer Letter with Ms. Tosca on August 18, 2022 and effective as of September 13, 2022. Pursuant to the offer letter, Ms. Tosca receives an annual base salary of $300,000 and she is entitled to receive a performance bonus with a target of up to 25% of her annual base salary for the applicable fiscal year. Additionally, the Company granted Ms. Tosca an option to purchase up to 7,500 shares of the Company’s common stock. The option will vest with respect to one-third of the underlying shares on the one-year anniversary of the grant date, and thereafter will vest in equal monthly installments over a two-year period. Effective January 1, 2023, Ms. Tosca's annual base salary was increased to $304,479. Effective January 1, 2024, Ms. Tosca's annual base salary was increased to $316,658.

Change of Control

Each of our named executive officers is eligible to receive certain benefits in the event of a change in control or if his or her employment is terminated under certain circumstances, as described under “Potential Payments Upon Termination or Change in Control” below.

Equity Compensation

We grant stock options and restricted shares to our named executive officers as the long-term incentive component of our compensation program. Stock options allow employees to purchase shares of our Common Stock at a price per share equal to the fair market value of our Common Stock on the date of grant and may or may not be intended to qualify as “incentive stock options” for United States federal income tax purposes. Generally, one third of the equity awards we grant vest on the first year anniversary, with the remainder vesting in equal monthly installments over 24 months. The Company

17

has also issued grants with a four-year vesting term, of which one-fourth of the underlying shares vested immediately, one-fourth on the one-year anniversary of the grant date and the remainder vest ratably over a 24-month period. All grants are subject to the employee’s continued employment with us on the vesting date and our board of directors has discretion to provide that granted options will vest on an accelerated basis if a change of control of our company occurs, either at the time such award is granted or afterward.

Potential Payments Upon Termination or Change in Control

Brian M. Strem, Ph.D.

Pursuant to his employment agreement, if we terminate the employment of Dr. Strem without Cause or if he resigns for Good Reason, then he would be eligible to receive:

•continued payment of base salary for 3 months, which period will be extended to 6 months if the termination date is between 18 and 36 months following his start date and will be extended to 12 months if the termination date is on or after the 36-month anniversary of his start date or if termination occurs following a Change of Control (as such term is defined in his agreement);

•a lump-sum cash payment, payable no later than the last installment of his severance, equal to 0.25 multiplied by the maximum performance bonus that he would have been eligible to receive in the year of termination, which multiple will be increased to 0.5 if the termination date is between 18 and 36 months following his start date and will be increased to 1.0 if the termination date is on or after the 36-month anniversary of his start date or if termination occurs following a Change of Control;

•payment by us of monthly premiums under COBRA for up to 3 months following termination, which period will be extended to 6 months if the termination date is between 18 and 36 months following his start date and will be extended to 12 months if the termination date is on or after the 36- month anniversary of his start date or if termination occurs following a Change of Control of us; and

•3 months of accelerated vesting of stock options and/or restricted stock awards that are unvested at the time of termination, which period will be extended to 6 months if the termination date is between 18 and 36 months following his start date and will be extended to 12 months if the termination date is on or after the 36-month anniversary of his start date.

“Cause” means (i) a willful failure to perform duties, (ii) a willful failure to comply with a valid directive of the board, (iii) engagement in dishonesty, illegal conduct, or misconduct that is materially injurious to us, (iv) embezzlement, misappropriation or fraud, (v) conviction or plea to a crime that constitutes a felony or misdemeanor involving moral turpitude, (vi) material violation of our written policies or code of conduct, or (vii) material breach of a material obligation under the employment agreement or other written agreement with us.

“Good Reason” means a resignation after one of the following conditions has come into existence without the officer’s consent: (i) a material reduction in duties, authority or responsibility; (ii) a material reduction in annual base salary; or (iii) a material breach by us of his employment agreement.

Upon a Change in Control, as defined in Dr. Strem’s employment agreement, all of Dr. Strem’s outstanding unvested stock options and/or restricted stock awards would have become fully vested and immediately exercisable.

18

Eric J. Daniels, MD, MBA

Pursuant to his employment agreement, if we terminate the employment of Dr. Daniels’ without Cause or he resigns for Good Reason (as such terms are defined in his employment agreement), then Dr. Daniels will be eligible to receive:

•continued payment of base salary for 3 months, which period will be extended to 6 months if the termination date is on or after the 18-month anniversary of the Effective Date or if termination occurs following a Change of Control (as such term is defined in his employment agreement);

•a lump-sum cash payment, payable no later than the last installment of his severance, equal to 0.25 multiplied by the maximum performance bonus that he would have been eligible to receive in the year of termination, which multiple will be increased to 0.5 if the termination date is on or after the 18-month anniversary of the relevant effective date or if termination occurs following a Change of Control; and

•continued coverage under a private health and dental insurance plan for up to 3 months following termination, which period will be extended to 6 months if the termination date is on or after the 18-month anniversary of the relevant effective date or if termination occurs following a Change of Control.

Additionally, if we terminate Dr. Daniels’ employment without Cause or he resigns for Good Reason, then that portion of his then unvested stock options and restricted stock awards that would have otherwise become vested over the 3 month period following termination will become fully vested and immediately exercisable on the date of such termination, which period will be extended to 6 months if the termination date is on or after the 18-month anniversary of the relevant effective date. In the event that a Change of Control occurs, all of Dr. Daniels’ unvested stock options and restricted stock awards will become fully vested and immediately exercisable.

“Cause” means (i) willful failure to perform his duties, (ii) willful failure to comply with any valid directive of the board of directors, (iii) engagement in dishonesty, illegal conduct, or serious misconduct, (iv) embezzlement, misappropriation, or fraud (v) conviction or plea of guilty or nolo contendere to a crime that constitutes a felony (or state law equivalent) or a crime that constitutes a misdemeanor involving moral turpitude, (vi) material violation of the employer’s written policies or codes of conduct, or (vii) material breach of any material obligation under the employment agreement, the confidentiality agreement or any other written agreement.

“Good Reason” means a resignation after one of the following conditions has come into existence without the officer’s consent: (i) a material reduction in duties, authority or responsibility; (ii) a material reduction in annual base salary; or (iii) a material breach by us of his employment agreement.

Melissa Tosca

Pursuant to her offer letter, Ms. Tosca is not entitled to any additional consideration in the event of her termination.

Change in Control Severance Plan

On November 27, 2017, we adopted a Change in Control Severance Plan, which we amended and restated on November 26, 2019 (as amended and restated, the “Change in Control Severance Plan”). The Change in Control Severance Plan provides us with assurance that we will have the continued dedication of, and the availability of objective advice and counsel from, executives and other employees and promotes certainty and minimize potential disruption for our employees in the event we are faced with or undergo a change in control. All of our full-time employees are participants in the Change in

19

Control Severance Plan, with the exception of Dr. Strem. Under the Change in Control Severance Plan, upon a termination of employment without Cause by us or for Good Reason by the employee (as such terms are defined in the Change in Control Severance Plan), in either case during the period starting on the date when the definitive agreement for a Change in Control (as defined in the Change in Control Severance Plan) is executed and ending on the six-month anniversary following the consummation of such Change in Control transaction, subject to the execution of a release of claims, our full-time employees (other than Dr. Strem) would be entitled to the following compensation and benefits:

•a lump sum severance payment equal to three weeks of such employee’s then-effective base salary rate for each year of service completed by the employee, subject to the following minimum and maximum amounts:

•for all participants that are executive officers or have the title of vice president or higher, a minimum amount equal to 26 weeks of base salary and a maximum amount equal to 52 weeks of base salary, and

•for all other participants, a minimum amount equal to eight weeks of base salary and a maximum amount equal to 26 weeks of base salary;

•a lump sum payment of the employee’s prorated annual incentive award for the year of termination, determined assuming achievement of target performance;

•the payment of any annual incentive that has been earned but not yet paid in respect of any performance period that has concluded as of the executive officer’s termination of employment; and

•payment of health insurance premiums under COBRA for six months following the date of termination, provided that all such premium payments will cease if the executive officer becomes entitled to receive health insurance coverage under another employer-provided plan.

In the event that any payments under the plan are subject to Section 280G of the Internal Revenue Code, such payments will be reduced, unless not reducing the amount would result in an after-tax benefit to the employee of at least 5% greater than the reduced amount. The Change in Control Severance Plan does not provide excise tax gross-ups on payments to participants.

Employee Benefits and Perquisites

Our named executive officers are eligible to participate in our health and welfare plans to the same extent as all full-time employees.

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table shows certain information regarding outstanding equity awards held by our named executive officers as of December 31, 2023.

Generally, one-third of the options and shares of restricted stock granted to our named executive officers vest on the one-year anniversary of grant, with the remaining options or shares, as applicable, vesting monthly for two years thereafter, subject to our repurchase right in the event that the executive’s service terminates before vesting in such shares. For information regarding the vesting acceleration provisions applicable to the options held by our named executive officers, please see “Employment Agreements” above.

20

Option Awards

| Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Vested | Number of Securities Underlying Unexercised Options (#) Unvested7 | Option Exercise Price ($) | Option Expiration Date | |||||||||||||||||||||||||||

| Brian M Strem, Ph.D. | 26-Jul-21 |

2,012 | 488 | 124.80 |

27-Jul-31 |

|||||||||||||||||||||||||||

1-Feb-22 |

1,143 | 733 | 30.62 |

1-Feb-32 |

||||||||||||||||||||||||||||

21-Oct-22 |

7,233 | 11,517 | 6.78 |

21-Oct-32 |

||||||||||||||||||||||||||||

3-Mar-23 |

— | 10,400 | 3.83 |

3-Mar-33 |

||||||||||||||||||||||||||||

29-Sep-23 |

37,500 | 112,500 | 0.57 |

29-Sep-33 |

||||||||||||||||||||||||||||

| Eric J. Daniels, MD, MBA | 21-Oct-21 |

900 | 350 | 79.60 |

21-Oct-31 |

|||||||||||||||||||||||||||

1-Feb-22 |

380 | 245 | 30.62 |

1-Feb-32 |

||||||||||||||||||||||||||||

21-Oct-22 |

5,787 | 9,213 | 6.78 |

21-Oct-32 |

||||||||||||||||||||||||||||

3-Mar-23 |

— | 10,400 | 3.83 |

3-Mar-33 |

||||||||||||||||||||||||||||

29-Sep-23 |

31,250 | 93,750 | 0.57 |

29-Sep-33 |

||||||||||||||||||||||||||||

Melissa Tosca, CPA |

21-Oct-22 |

2,068 | 2,932 | 6.78 |

21-Oct-32 |

|||||||||||||||||||||||||||

3-Mar-23 |

— | 1,600 | 3.83 |

3-Mar-33 |

||||||||||||||||||||||||||||

29-Sep-23 |

15,000 | 45,000 | 0.57 |

29-Sep-33 |

||||||||||||||||||||||||||||

Restricted Stock Awards

| Name | Grant Date | Number of Shares of Units That Have Not Vested (#)8 | Market Value of Shares or Units of Stock That Have Not Vested ($)9 | Equity Incentive Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |||||||||||||||||||||||||||

| Brian M Strem, Ph.D. | 21-Oct-22 |

8,333 | 4,350 | — | — | |||||||||||||||||||||||||||

3-Mar-23 |

15,600 | 8,143 | ||||||||||||||||||||||||||||||

29-Sep-23 |

56,250 | 29,363 | ||||||||||||||||||||||||||||||

| Eric J. Daniels, MD, MBA | 21-Oct-22 |

6,666 | 3,480 | — | — | |||||||||||||||||||||||||||

3-Mar-23 |

15,600 | 8,143 | ||||||||||||||||||||||||||||||

29-Sep-23 |

46,875 | 24,469 | ||||||||||||||||||||||||||||||

Melissa Tosca, CPA |

21-Oct-22 |

1,666 | 870 | — | — | |||||||||||||||||||||||||||

3-Mar-23 |

2,400 | 1,253 | ||||||||||||||||||||||||||||||

29-Sep-23 |

22,500 | 11,745 | ||||||||||||||||||||||||||||||

All restricted share awards were granted under the 2014 Plan.

7 For all grants excluding the September 29, 2023 grants, one-third of these options vest on the one-year anniversary of the grant date, with the remainder vesting in equal monthly installments over the remaining two years, subject to continued service through each applicable vesting date. For the September 29, 2023 grants, one-fourth of the restricted shares vested on the grant date, one-fourth on the one-year anniversary, and the remainder vesting in twenty-four equal installments monthly thereafter, subject to continued service through each applicable vesting date.

8 For all grants excluding the September 29, 2023 grants, one-third of the restricted shares vest on each of the one-year, two-year and three-year anniversaries of the grant date, subject to continued service through each applicable vesting date. For the September 29, 2023 grants, one-fourth of the restricted shares vested on the grant date, and each one-year, two-year and three-year anniversaries of the grant date thereafter, subject to continued service through each applicable vesting date.

9 Based on a closing price of $0.5220 as of December 29, 2023.

21

Limitations of Liability and Indemnification Matters

Our restated certificate of incorporation and our amended and restated bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by the Delaware General Corporation Law, which prohibits our restated certificate of incorporation from limiting the liability of our directors for the following:

•any breach of the director’s duty of loyalty to us or our stockholders;

•acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

•unlawful payment of dividends or unlawful stock repurchases or redemptions; or

•any transaction from which the director derived an improper personal benefit.

Our restated certificate of incorporation and our amended and restated bylaws also provide that if Delaware law is amended to authorize corporate action further eliminating or limiting the personal liability of a director, then the liability of our directors will be eliminated or limited to the fullest extent permitted by Delaware law, as so amended. This limitation of liability does not apply to liabilities arising under the federal securities laws and does not affect the availability of equitable remedies such as injunctive relief or rescission.

Our restated certificate of incorporation and our amended and restated bylaws also provide that we shall have the power to indemnify our employees and agents to the fullest extent permitted by law. Our amended and restated bylaws also permit us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in this capacity, regardless of whether our amended and restated bylaws would permit indemnification. We have obtained directors’ and officers’ liability insurance.

We entered into separate indemnification agreements with our directors and executive officers, in addition to indemnification provided for in our restated certificate of incorporation and amended and restated bylaws. These agreements, among other things, provide for indemnification of our directors and executive officers for certain expenses, judgments, fines and settlement amounts, among others, incurred by such person in any action or proceeding arising out of such person’s services as a director or executive officer in any capacity with respect to any employee benefit plan or as a director, partner, trustee or agent of another entity at our request. We believe that these provisions in our restated certificate of incorporation and amended and restated bylaws and indemnification agreements are necessary to attract and retain qualified persons as directors and executive officers.

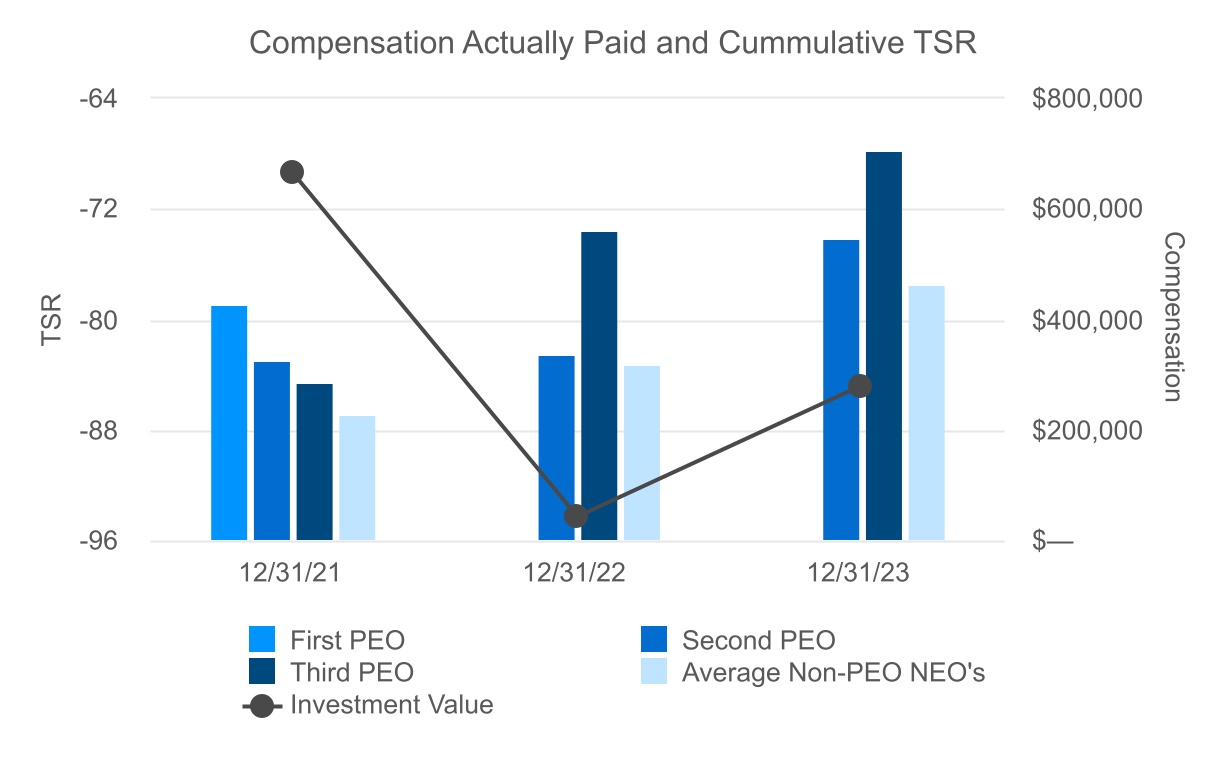

The above description of the indemnification provisions of our restated certificate of incorporation, our amended and restated bylaws and our indemnification agreements is not complete and is qualified in its entirety by reference to these documents.