FWP: Filing under Securities Act Rules 163/433 of free writing prospectuses

Published on April 9, 2018

NASDAQ: EYEG EyeGate Pharmaceuticals, Inc. 271 Waverley Oaks Road, Suite 108 Waltham, MA 02452 www.eyegatepharma.com Two Versatile Platforms Moving Towards Commercialization Follow us on Facebook, LinkedIn and Twitter Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration No. 333 - 223887

Free Writing Prospectus Statement 2 • We have filed a Registration Statement on Form S - 1 with the Securities and Exchange Commission (the “SEC”) , including a preliminary prospectus dated April 9, 2018 (the “Prospectus”), with respect to the offering of our securities to which this communication relates. Before you invest, you should read the Prospectus (includ ing the risk factors described therein) and, which available, the final prospectus relating to the offering, and the other documents filed with the SEC and incorporated by reference into the Prospe ctu s, for more complete information about us and the offering. You may obtain these documents, including the Prospectus, for free by visited EDGAR on the SEC website at http://www.sec.gov. • Alternatively, we and the placement agent for the offering will arrange to send you the prospectus if you request it by contacting H.C. Wainwright & Co., LLC, 430 Park Avenue, 3 rd Floor, New York, NY 10022, by telephone at (646) 975 - 6996 or by email at placements@hcwcocom . • This presentation highlights basic information about us and the offering. Because it is a summary that has been prepared sole ly for informational purposes, it does not contain all of the information that you should consider before investing in our company. Except as otherwise noted, this presentation speaks only as of the date her eof. • This presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities by any person i n a ny jurisdiction in which it is unlawful for such person to make such an offering or solicitation. • Neither the SEC nor any other regulatory body has approved or disapproved of our securities or passed upon the accuracy or ad equ acy of this presentation. Any representation to the contrary is a criminal offense. • This presentation includes industry and market data that we obtained from industry publications and journals, third - party studie s and surveys, internal company studies and surveys, and other publicly available information. Industry publications and surveys generally state that the information contained therein has been obta ine d from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this presentation, this information could prove to be inaccurate. Industry a nd market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availa bil ity and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions that were used in prepari ng the data from the sources relied upon or cited herein.

Forward Looking Statements Some of the matters discussed in this presentation contain forward - looking statements that involve significant risks and uncerta inties, including statements relating to the prospects for the Company’s lead product EGP - 437, for the timing and outcome of the Company’s clinical trials, the potential approval to market EGP - 437, and the Company’ s capital needs. Actual events could differ materially from those projected in this presentation and the Company cautions investors not to rely on the forward - looking statements contained in, or made in connectio n with, the presentation. Among other things, the Company’s clinical trials may be delayed or may eventually be unsuccessful. The Company may consume mor e cash than it currently anticipates and faster than projected. Competitive products may reduce or eliminate the commercial opportunities of the Company’s product candidates. If the U.S. Food and Drug Ad ministration or foreign regulatory agencies determine that the Company’s product candidates do not meet safety or efficacy endpoints in clinical evaluations, they will not receive regulatory approval and th e C ompany will not be able to market them. Operating expense and cash flow projections involve a high degree of uncertainty, including variances in future spending rate due to changes in corporate priorities, the ti ming and outcomes of clinical trials, regulatory and developments and the impact on expenditures and available capital from licensing and strategic collaboration opportunities. If the Company is unable to rai se additional capital when required or on acceptable terms, it may have to significantly alter, delay, scale back or discontinue operations. Additional risks and uncertainties relating to the Company and its business can be found in the “Risk Factors” section of the Co mpany’s Annual Report on Form 10 - K filed with the SEC on March 02 , 2018. The Company undertakes no duty or obligation to update any forward - looking statements contained in this presentation as a result of new info rmation, future events or changes in the Company’s expectations, except as required by applicable law. The Company uses its website ( www.EyeGatePharma.com ), Facebook page ( https://www.facebook.com/ EyeGatePharma/ ), corporate Twitter account ( https://twitter.com/EyeGatePharma ), and LinkedIn page ( https://www.linkedin.com/company/135892/ ) as channels of distribution of information about the Company and its product candidates. Such information may be deemed mat eri al information, and the Company may use these channels to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor the Co mpany’s website and its social media accounts in addition to following its press releases, SEC filings, public conference calls, and webcasts. The social media channels that the Company intends to use as a me ans of disclosing the information described above may be updated from time to time as listed on the Company’s investor relations website. 3

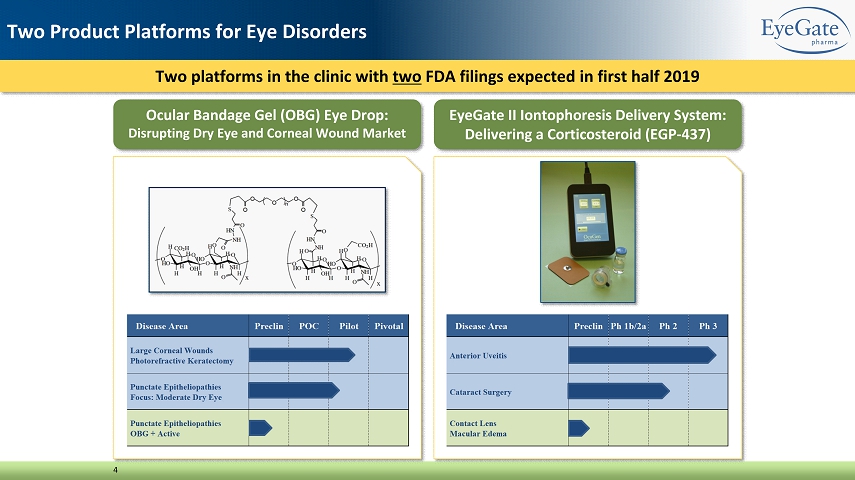

Two platforms in the clinic with two FDA filings expected in first half 2019 4 Two Product Platforms for Eye Disorders Ocular Bandage Gel (OBG) Eye Drop: Disrupting Dry Eye and Corneal Wound Market EyeGate II Iontophoresis Delivery System: Delivering a Corticosteroid (EGP - 437)

Ocular Bandage Gel (OBG) Eye Drop • A crosslinked hyaluronic acid (CMHA - S) for corneal wounds and epitheliopathies

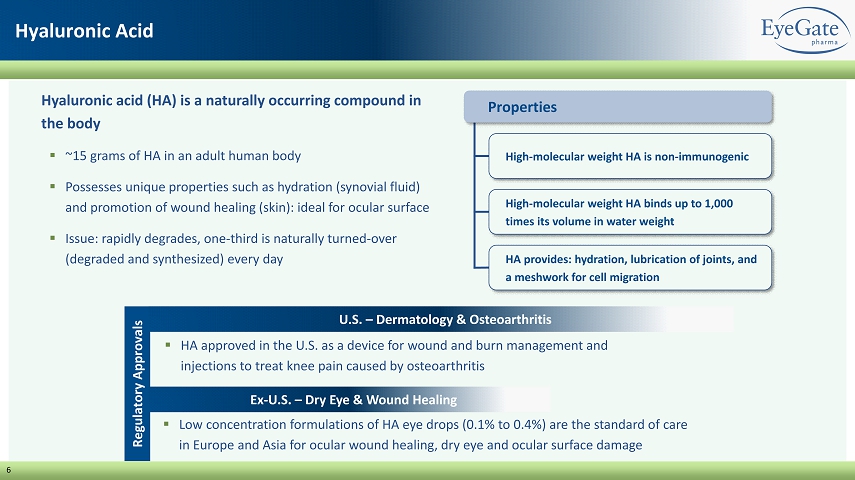

6 Hyaluronic Acid Properties High - molecular weight HA is non - immunogenic High - molecular weight HA binds up to 1,000 times its volume in water weight HA provides: hydration, lubrication of joints, and a meshwork for cell migration Regulatory Approvals U.S. – Dermatology & Osteoarthritis Ex - U.S. – Dry Eye & Wound Healing ▪ HA approved in the U.S. as a device for wound and burn management and injections to treat knee pain caused by osteoarthritis ▪ Low concentration formulations of HA eye drops (0.1% to 0.4%) are the standard of care in Europe and Asia for ocular wound healing, dry eye and ocular surface damage Hyaluronic acid (HA) is a naturally occurring compound in the body ▪ ~15 grams of HA in an adult human body ▪ Possesses unique properties such as hydration (synovial fluid) and promotion of wound healing (skin): ideal for ocular surface ▪ Issue: rapidly degrades, one - third is naturally turned - over (degraded and synthesized) every day

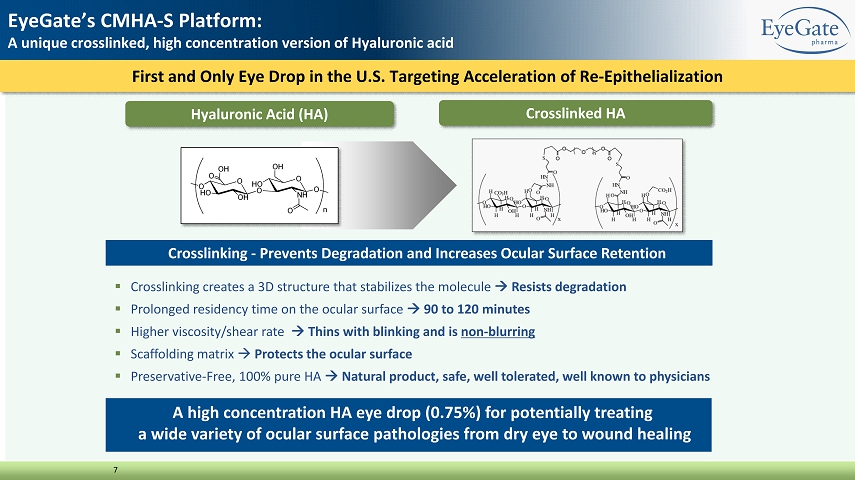

First and Only Eye Drop in the U.S. Targeting Acceleration of Re - Epithelialization 7 EyeGate’s CMHA - S Platform: A unique crosslinked, high concentration version of Hyaluronic acid ▪ Crosslinking creates a 3D structure that stabilizes the molecule R esists degradation ▪ Prolonged residency time on the ocular surface 90 to 120 minutes ▪ Higher viscosity/shear rate T hins with blinking and is non - blurring ▪ Scaffolding matrix P rotects the ocular surface ▪ Preservative - Free, 100% pure HA Natural product, safe, well tolerated, well known to physicians Crosslinking - Prevents Degradation and Increases Ocular Surface Retention Crosslinked HA Hyaluronic Acid (HA) A high concentration HA eye drop (0.75%) for potentially treating a wide variety of ocular surface pathologies from dry eye to wound healing

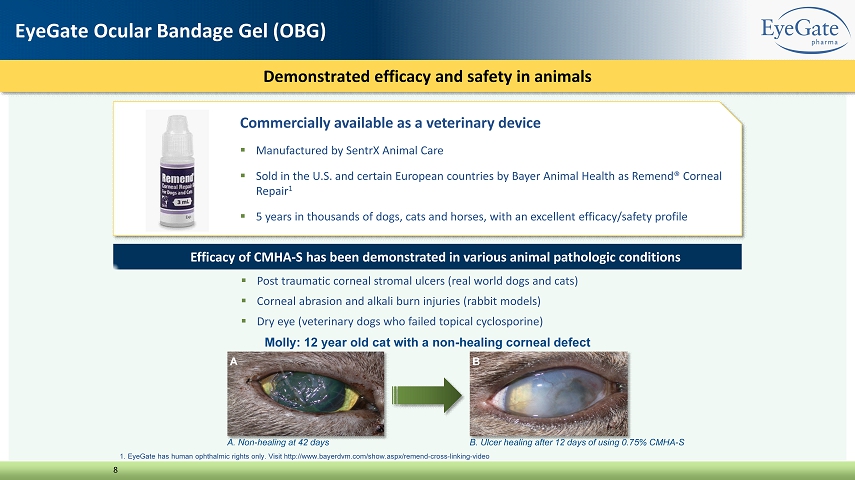

Commercially available as a veterinary device ▪ Manufactured by SentrX Animal Care ▪ Sold in the U.S. and certain European countries by Bayer Animal Health as Remend® Corneal Repair 1 ▪ 5 years in thousands of dogs, cats and horses, with an excellent efficacy/safety profile 1. EyeGate has human ophthalmic rights only. Visit http://www.bayerdvm.com/show.aspx/remend - cross - linking - video Demonstrated efficacy and safety in animals 8 EyeGate Ocular Bandage Gel (OBG) A. Non - healing at 42 days Efficacy of CMHA - S has been demonstrated in various animal pathologic conditions ▪ Post traumatic corneal stromal ulcers (real world dogs and cats) ▪ Corneal abrasion and alkali burn injuries (rabbit models) ▪ Dry eye (veterinary dogs who failed topical cyclosporine) B A Molly: 12 year old cat with a non - healing corneal defect B. Ulcer healing after 12 days of using 0.75% CMHA - S

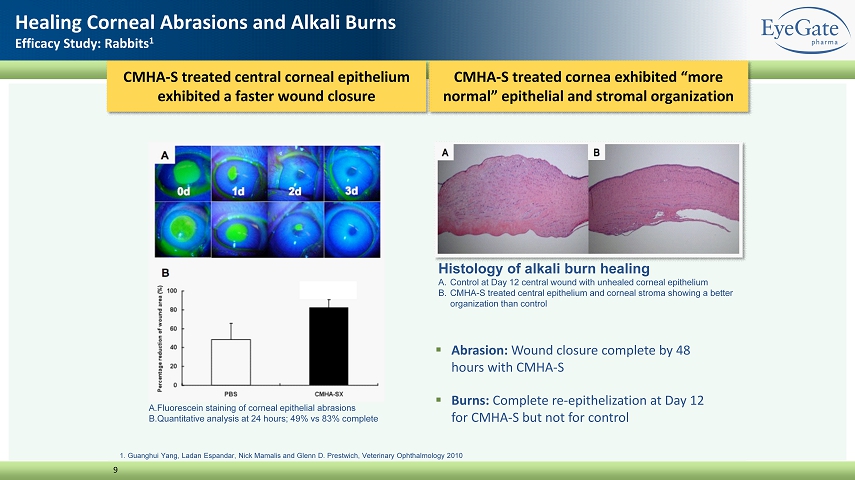

CMHA - S treated cornea exhibited “more normal” epithelial and stromal organization 9 Healing Corneal Abrasions and Alkali Burns Efficacy Study: Rabbits 1 1. Guanghui Yang, Ladan Espandar, Nick Mamalis and Glenn D. Prestwich, Veterinary Ophthalmology 2010 Histology of alkali burn healing A. Control at Day 12 central wound with unhealed corneal epithelium B. CMHA - S treated central epithelium and corneal stroma showing a better organization than control P < 0.01 ▪ Abrasion: Wound closure complete by 48 hours with CMHA - S ▪ Burns: Complete re - epithelization at Day 12 for CMHA - S but not for control CMHA - S treated central corneal epithelium exhibited a faster wound closure A. Fluorescein staining of corneal epithelial abrasions B. Quantitative analysis at 24 hours; 49% vs 83% complete

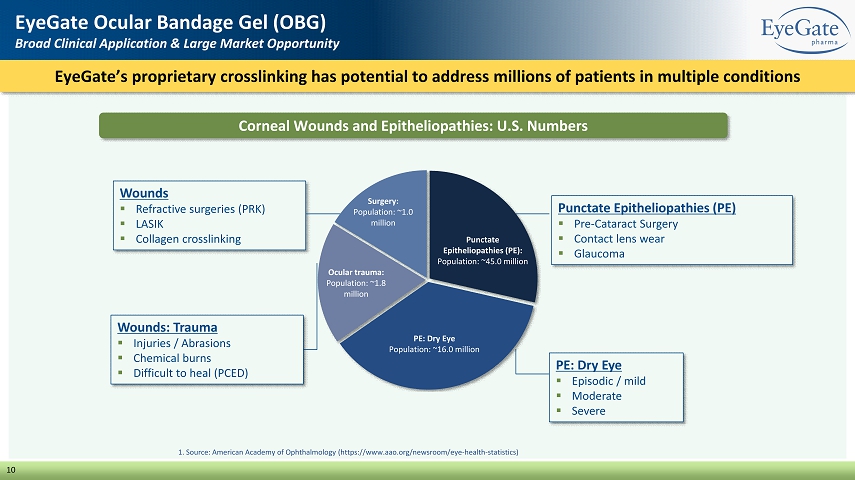

Wounds: Trauma ▪ Injuries / Abrasions ▪ Chemical burns ▪ Difficult to heal (PCED) EyeGate’s proprietary crosslinking has potential to address millions of patients in multiple conditions EyeGate Ocular Bandage Gel (OBG) Broad Clinical Application & Large Market Opportunity 10 Wounds ▪ Refractive surgeries (PRK) ▪ LASIK ▪ Collagen crosslinking Corneal Wounds and Epitheliopathies: U.S. Numbers Punctate Epitheliopathies (PE): Population: ~45.0 million PE: Dry Eye Population: ~16.0 million Ocular trauma: Population: ~1.8 million Surgery : Population: ~1.0 million 1. Source: American Academy of Ophthalmology (https://www.aao.org/newsroom/eye - health - statistics) Punctate Epitheliopathies (PE) ▪ Pre - Cataract Surgery ▪ Contact lens wear ▪ Glaucoma PE: Dry Eye ▪ Episodic / mild ▪ Moderate ▪ Severe

Initial Indications: PRK & Punctate Epitheliopathies Initial Patient Applications & Label Expansion 11 Focus At launch ▪ Dry Eye – patients not controlled on OTC treatments • With or without concomitant use in patients on Restasis or Xiidra ▪ Wound: Post Surgical healing in PRK (strategic) Clinical program to expand the label ▪ Cataract surgery – surface improvement to optimize biometry measurements and outcomes Additional areas of interest from physician research ▪ Acute corneal wounds ▪ Chronic corneal wounds and ulcers ▪ Post LASIK

CMHA - S a device combined with a therapeutic expands upon wound and dry eye franchises Potential for Future Growth as a Combination Product 12 EyeGate Research Labs currently developing: ▪ CMHA - S + corticosteroid (loteprednol etabonate or dexamethasone) ▪ CMHA - S + antibiotic (fluoroquinolone) ▪ Leveraging the 505(b)(2) regulatory pathway for rapid and economical development ▪ Longer residence time improves upon efficacy and drug uptake

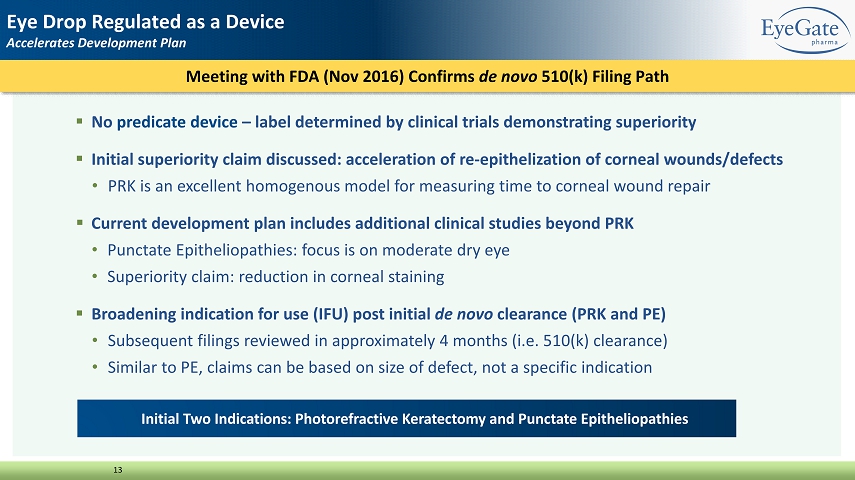

Meeting with FDA (Nov 2016) Confirms de novo 510(k) Filing Path 13 Eye Drop Regulated as a Device Accelerates Development Plan Initial Two Indications: Photorefractive Keratectomy and Punctate Epitheliopathies ▪ No predicate device – label determined by clinical trials demonstrating superiority ▪ Initial superiority claim discussed: acceleration of re - epithelization of corneal wounds/defects • PRK is an excellent homogenous model for measuring time to corneal wound repair ▪ Current development plan includes additional clinical studies beyond PRK • Punctate Epitheliopathies: focus is on moderate dry eye • Superiority claim: reduction in corneal staining ▪ Broadening indication for use (IFU) post initial de novo clearance (PRK and PE) • Subsequent filings reviewed in approximately 4 months (i.e. 510(k) clearance) • Similar to PE, claims can be based on size of defect, not a specific indication

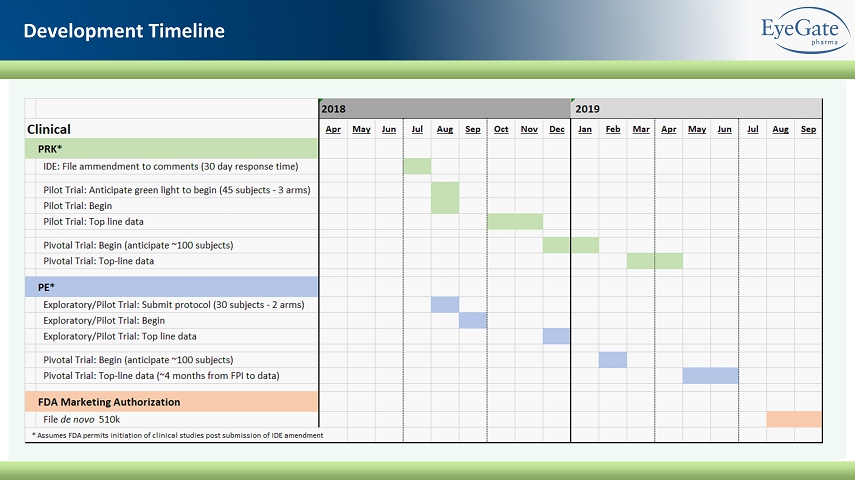

Development Timeline

OBG: Proprietary Crosslinked HA 15 Clinical Development

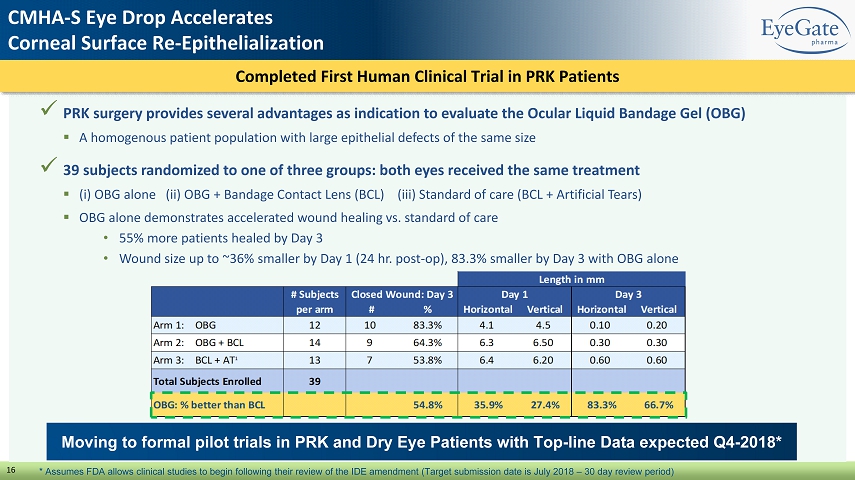

Completed First Human Clinical Trial in PRK Patients 16 x PRK surgery provides several advantages as indication to evaluate the Ocular Liquid Bandage Gel (OBG) ▪ A homogenous patient population with large epithelial defects of the same size x 39 subjects randomized to one of three groups: both eyes received the same treatment ▪ ( i ) OBG alone (ii) OBG + Bandage Contact Lens (BCL) (iii) Standard of care (BCL + Artificial Tears) ▪ OBG alone demonstrates accelerated wound healing vs. standard of care • 55% more patients healed by Day 3 • Wound size up to ~36% smaller by Day 1 (24 hr. post - op), 83.3% smaller by Day 3 with OBG alone Moving to formal pilot trials in PRK and Dry Eye Patients with Top - line Data expected Q4 - 2018* CMHA - S Eye Drop Accelerates Corneal Surface Re - Epithelialization * Assumes FDA allows clinical studies to begin following their review of the IDE amendment (Target submission date is July 2018 – 30 day review period)

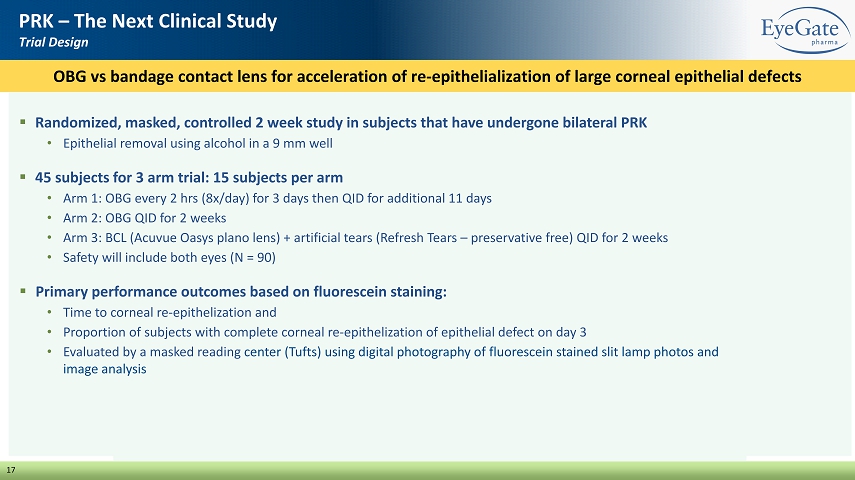

17 PRK – The Next Clinical Study Trial Design ▪ Randomized, masked, controlled 2 week study in subjects that have undergone bilateral PRK • Epithelial removal using alcohol in a 9 mm well ▪ 45 subjects for 3 arm trial: 15 subjects per arm • Arm 1: OBG every 2 hrs (8x/day) for 3 days then QID for additional 11 days • Arm 2: OBG QID for 2 weeks • Arm 3: BCL ( Acuvue Oasys plano lens) + artificial tears (Refresh Tears – preservative free) QID for 2 weeks • Safety will include both eyes (N = 90) ▪ Primary performance outcomes based on fluorescein staining: • Time to corneal re - epithelization and • Proportion of subjects with complete corneal re - epithelization of epithelial defect on day 3 • Evaluated by a masked reading center (Tufts) using digital photography of fluorescein stained slit lamp photos and image analysis OBG vs bandage contact lens for acceleration of re - epithelialization of large corneal epithelial defects

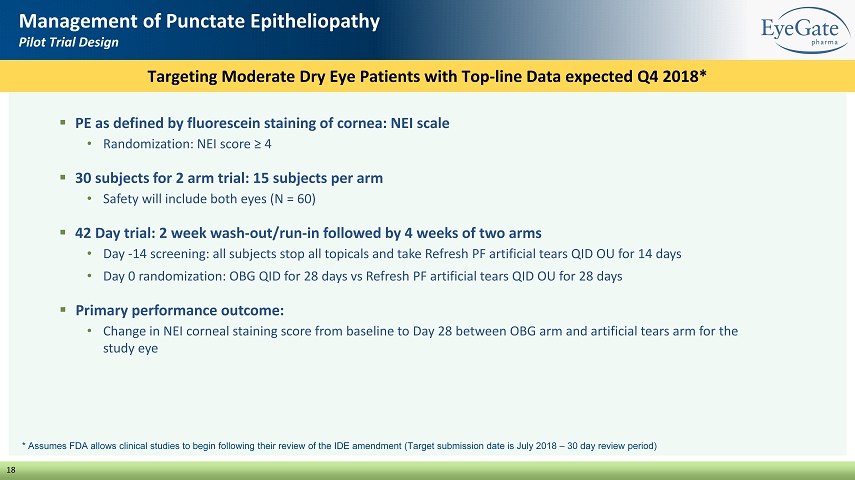

18 Management of Punctate Epitheliopathy Pilot Trial Design ▪ PE as defined by fluorescein staining of cornea: NEI scale • Randomization: NEI score ≥ 4 ▪ 30 subjects for 2 arm trial: 15 subjects per arm • Safety will include both eyes (N = 60) ▪ 42 Day trial: 2 week wash - out/run - in followed by 4 weeks of two arms • Day - 14 screening: all subjects stop all topicals and take Refresh PF artificial tears QID OU for 14 days • Day 0 randomization: OBG QID for 28 days vs Refresh PF artificial tears QID OU for 28 days ▪ Primary performance outcome: • Change in NEI corneal staining score from baseline to Day 28 between OBG arm and artificial tears arm for the study eye Targeting Moderate Dry Eye Patients with Top - line Data expected Q4 2018* * Assumes FDA allows clinical studies to begin following their review of the IDE amendment (Target submission date is July 2018 – 30 day review period)

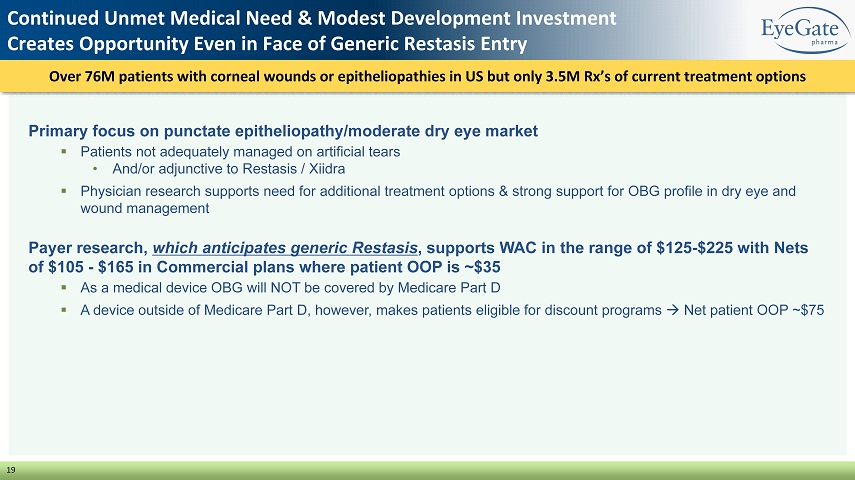

Over 76M patients with corneal wounds or epitheliopathies in US but only 3.5M Rx’s of current treatment options Continued Unmet Medical Need & Modest Development Investment Creates Opportunity Even in Face of Generic Restasis Entry 19 Primary focus on punctate epitheliopathy/moderate dry eye market ▪ Patients not adequately managed on artificial tears • And/or adjunctive to Restasis / Xiidra ▪ Physician research supports need for additional treatment options & strong support for OBG profile in dry eye and wound management Payer research, which anticipates generic Restasis , supports WAC in the range of $125 - $225 with Nets of $105 - $165 in Commercial plans where patient OOP is ~$35 ▪ As a medical device OBG will NOT be covered by Medicare Part D ▪ A device outside of Medicare Part D, however, makes patients eligible for discount programs Net patient OOP ~$75

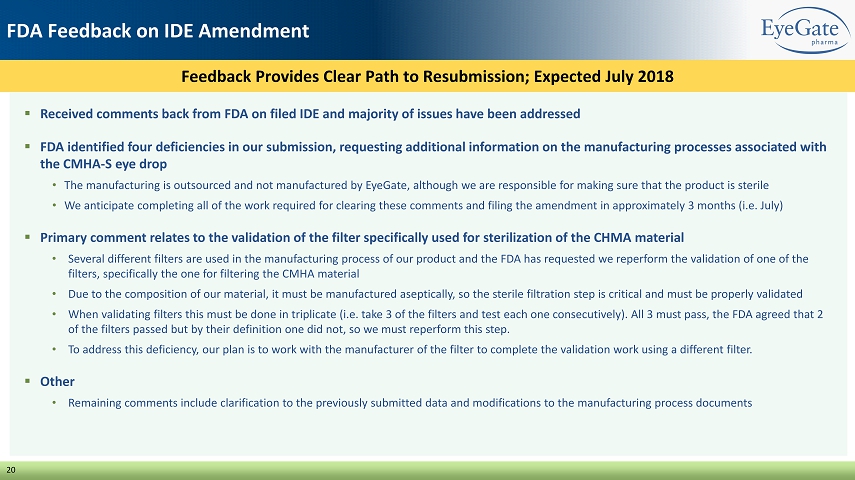

20 FDA Feedback on IDE Amendment ▪ Received comments back from FDA on filed IDE and majority of issues have been addressed ▪ FDA identified four deficiencies in our submission, requesting additional information on the manufacturing processes associat ed with the CMHA - S eye drop • The manufacturing is outsourced and not manufactured by EyeGate, although we are responsible for making sure that the product is sterile • We anticipate completing all of the work required for clearing these comments and filing the amendment in approximately 3 mon ths (i.e. July) ▪ Primary comment relates to the validation of the filter specifically used for sterilization of the CHMA material • Several different filters are used in the manufacturing process of our product and the FDA has requested we reperform the val ida tion of one of the filters, specifically the one for filtering the CMHA material • Due to the composition of our material, it must be manufactured aseptically, so the sterile filtration step is critical and m ust be properly validated • When validating filters this must be done in triplicate (i.e. take 3 of the filters and test each one consecutively). All 3 m ust pass, the FDA agreed that 2 of the filters passed but by their definition one did not, so we must reperform this step. • To address this deficiency, our plan is to work with the manufacturer of the filter to complete the validation work using a d iff erent filter. ▪ Other • Remaining comments include clarification to the previously submitted data and modifications to the manufacturing process docu men ts Feedback Provides Clear Path to Resubmission; Expected July 2018

Iontophoresis Delivery Platform

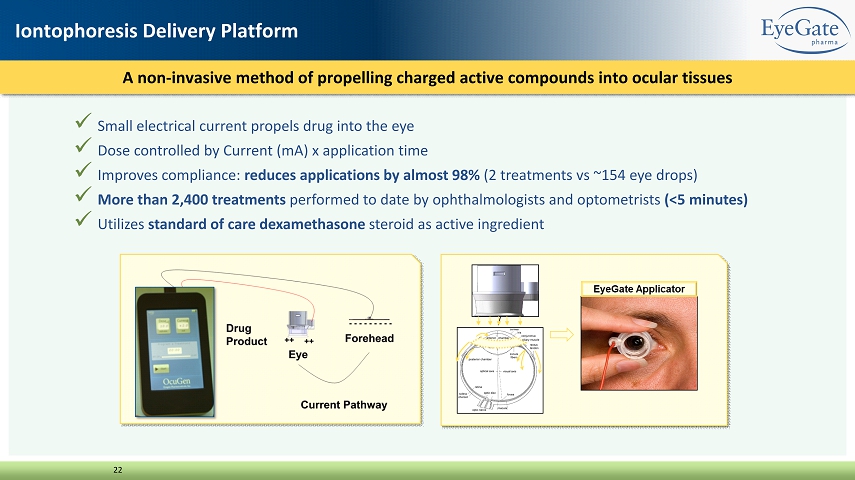

x Small electrical current propels drug into the eye x Dose controlled by Current (mA) x application time x Improves compliance: reduces applications by almost 98% (2 treatments vs ~154 eye drops) x More than 2,400 treatments performed to date by ophthalmologists and optometrists (<5 minutes) x Utilizes standard of care dexamethasone steroid as active ingredient A non - invasive method of propelling charged active compounds into ocular tissues 22 Iontophoresis Delivery Platform

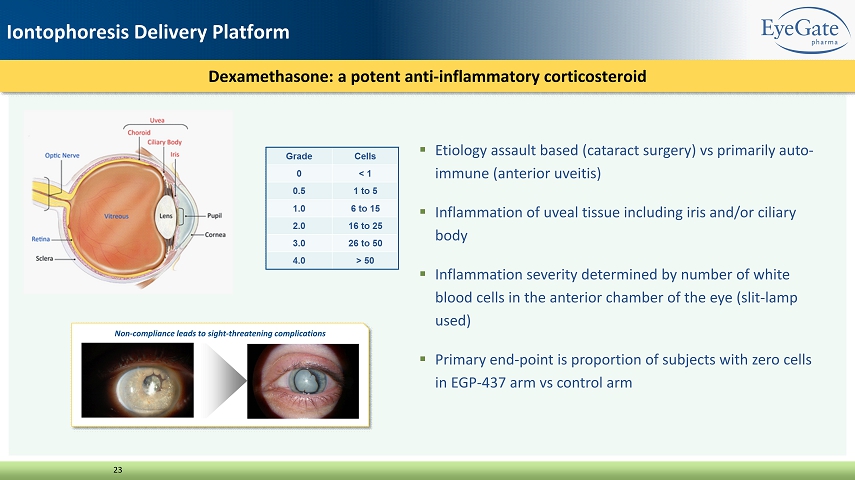

▪ Etiology assault based (cataract surgery) vs primarily auto - immune (anterior uveitis) ▪ Inflammation of uveal tissue including iris and/or ciliary body ▪ Inflammation severity determined by number of white blood cells in the anterior chamber of the eye (slit - lamp used) ▪ Primary end - point is proportion of subjects with zero cells in EGP - 437 arm vs control arm Dexamethasone: a potent anti - inflammatory corticosteroid 23 Non - compliance leads to sight - threatening complications Iontophoresis Delivery Platform

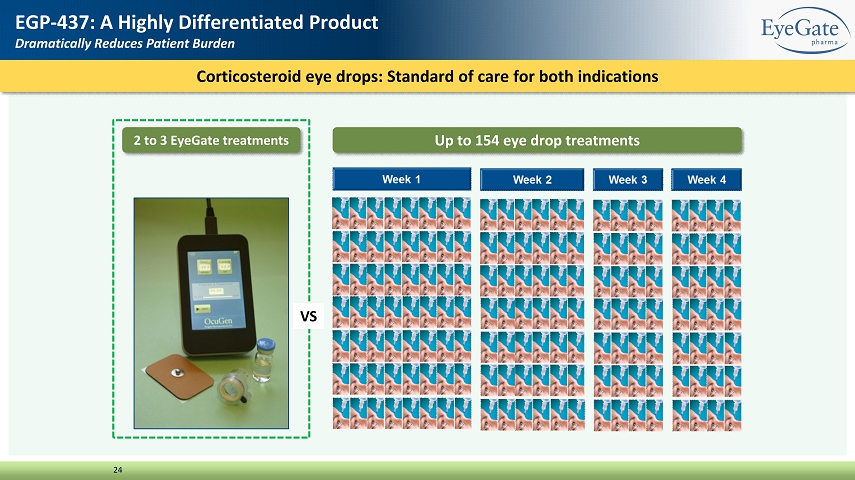

Corticosteroid eye drops: Standard of care for both indications 24 EGP - 437: A Highly Differentiated Product Dramatically Reduces Patient Burden 2 to 3 EyeGate treatments Up to 154 eye drop treatments VS

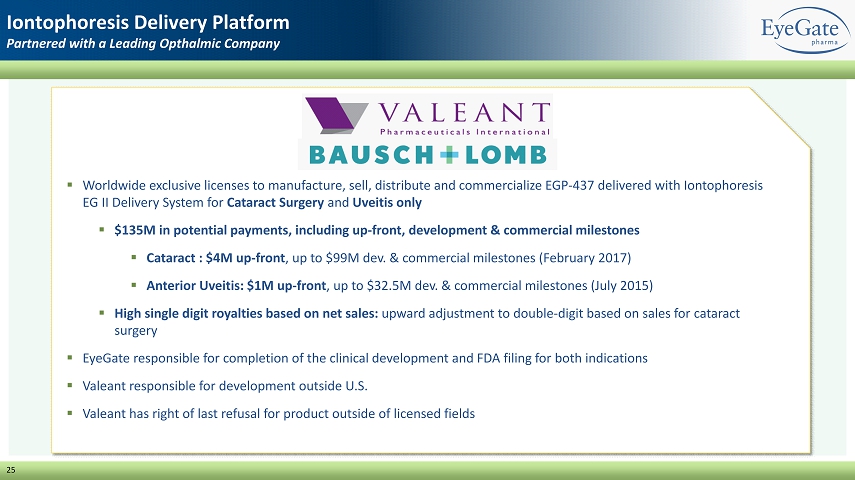

▪ Worldwide exclusive licenses to manufacture, sell, distribute and commercialize EGP - 437 delivered with Iontophoresis EG II Delivery System for Cataract Surgery and Uveitis only ▪ $135M in potential payments, including up - front, development & commercial milestones ▪ Cataract : $4M up - front , up to $99M dev. & commercial milestones (February 2017) ▪ Anterior Uveitis: $1M up - front , up to $32.5M dev. & commercial milestones (July 2015) ▪ High single digit royalties based on net sales: upward adjustment to double - digit based on sales for cataract surgery ▪ EyeGate responsible for completion of the clinical development and FDA filing for both indications ▪ Valeant responsible for development outside U.S. ▪ Valeant has right of last refusal for product outside of licensed fields 25 Iontophoresis Delivery Platform Partnered with a Leading Opthalmic Company

Cataract Surgery The most common surgical procedure performed by ophthalmic surgeons Iontophoresis Delivery Platform

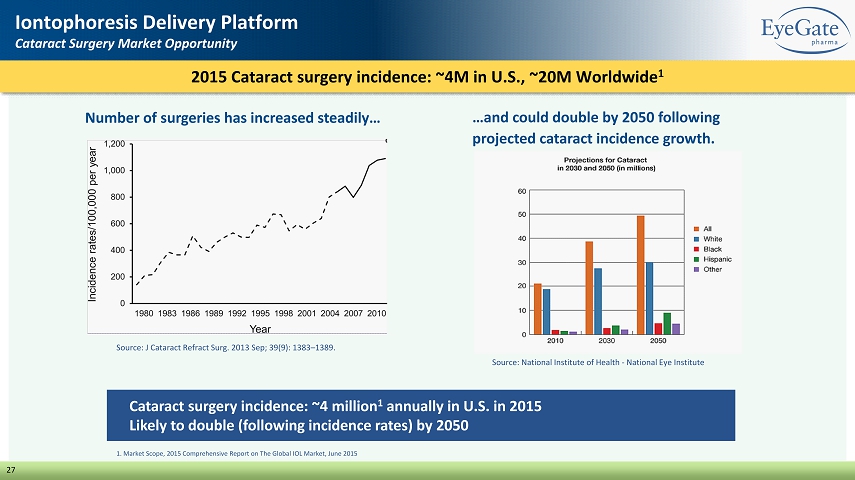

27 Iontophoresis Delivery Platform Cataract Surgery Market Opportunity Cataract surgery incidence: ~4 million 1 annually in U.S. in 2015 Likely to double (following incidence rates) by 2050 Source: National Institute of Health - National Eye Institute 1. Market Scope, 2015 Comprehensive Report on The Global IOL Market, June 2015 Source: J Cataract Refract Surg. 2013 Sep; 39(9): 1383 – 1389. 2015 Cataract surgery incidence: ~4M in U.S., ~20M Worldwide 1 Number of surgeries has increased steadily… …and could double by 2050 following projected cataract incidence growth.

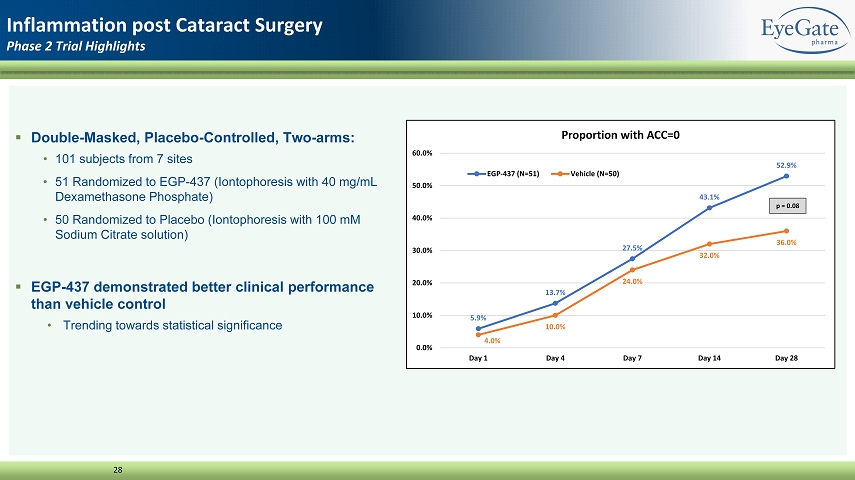

▪ Double - Masked, Placebo - Controlled, Two - arms: • 101 subjects from 7 sites • 51 Randomized to EGP - 437 (Iontophoresis with 40 mg/mL Dexamethasone Phosphate) • 50 Randomized to Placebo (Iontophoresis with 100 mM Sodium Citrate solution) ▪ EGP - 437 demonstrated better clinical performance than vehicle control • Trending towards statistical significance 28 Inflammation post Cataract Surgery Phase 2 Trial Highlights 5.9% 13.7% 27.5% 43.1% 52.9% 4.0% 10.0% 24.0% 32.0% 36.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% Day 1 Day 4 Day 7 Day 14 Day 28 Proportion with ACC=0 EGP-437 (N=51) Vehicle (N=50) p = 0.08

29 Additional Information Phase 2 Trial Highlights ▪ Secondary endpoints: change in mean cell count and change in mean pain score • EGP - 437 showed statistically significant improvements in both ACC count and pain score • ACC count = 0 on Day 7: p = 0.0096 • Pain Score = 0 on Day 1: p = 0.0149 ▪ EGP - 437 arm demonstrated a favorable safety profile with no serious adverse events reported. ▪ Greater percentage of subjects in the placebo were rescued: > 50% by Day 14 • No subjects were rescued after Day 14 in the EGP arm thus demonstrating sustainability of effect out to Day 28

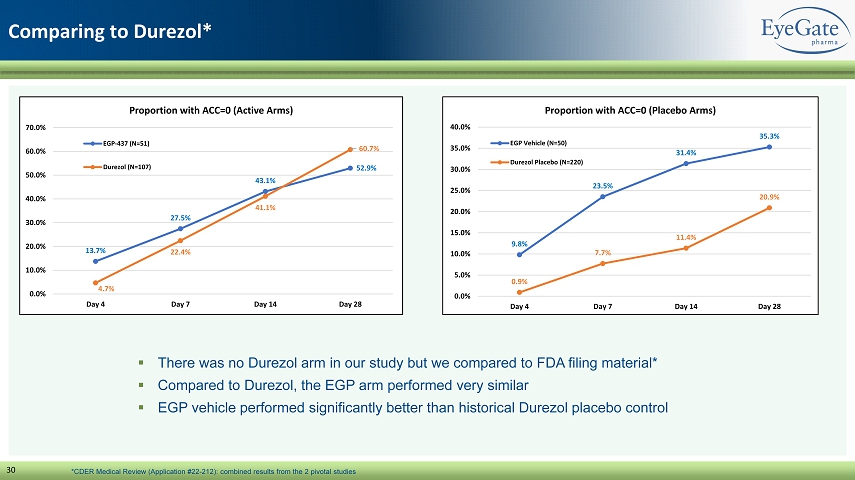

30 Comparing to Durezol * 13.7% 27.5% 43.1% 52.9% 4.7% 22.4% 41.1% 60.7% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% Day 4 Day 7 Day 14 Day 28 Proportion with ACC=0 (Active Arms) EGP-437 (N=51) Durezol (N=107) 9.8% 23.5% 31.4% 35.3% 0.9% 7.7% 11.4% 20.9% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% Day 4 Day 7 Day 14 Day 28 Proportion with ACC=0 (Placebo Arms) EGP Vehicle (N=50) Durezol Placebo (N=220) ▪ There was no Durezol arm in our study but we compared to FDA filing material* ▪ Compared to Durezol , the EGP arm performed very similar ▪ EGP vehicle performed significantly better than historical Durezol placebo control *CDER Medical Review (Application #22 - 212): combined results from the 2 pivotal studies

Anterior Uveitis Confirmatory Phase 3 Data in 2Q 2018 Iontophoresis Delivery Platform

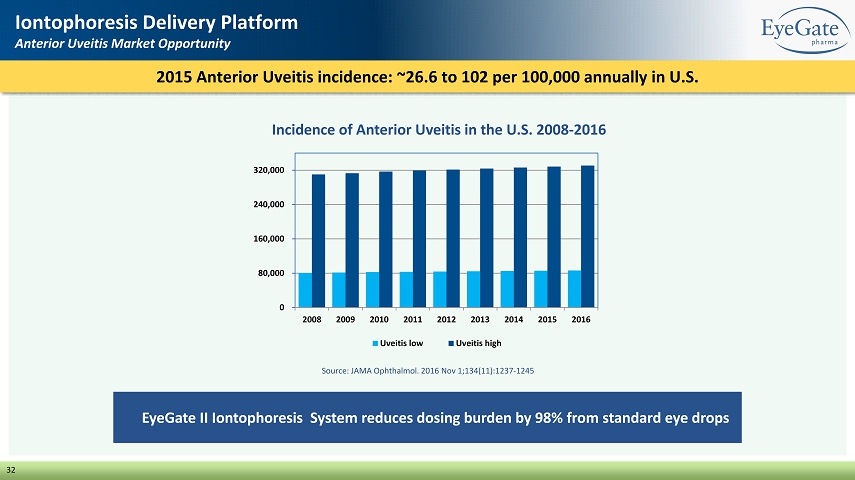

32 Iontophoresis Delivery Platform Anterior Uveitis Market Opportunity EyeGate II Iontophoresis System reduces dosing burden by 98% from standard eye drops 2015 Anterior Uveitis incidence: ~26.6 to 102 per 100,000 annually in U.S. Incidence of Anterior Uveitis in the U.S. 2008 - 2016 0 80,000 160,000 240,000 320,000 2008 2009 2010 2011 2012 2013 2014 2015 2016 Uveitis low Uveitis high Source: JAMA Ophthalmol. 2016 Nov 1;134(11):1237 - 1245

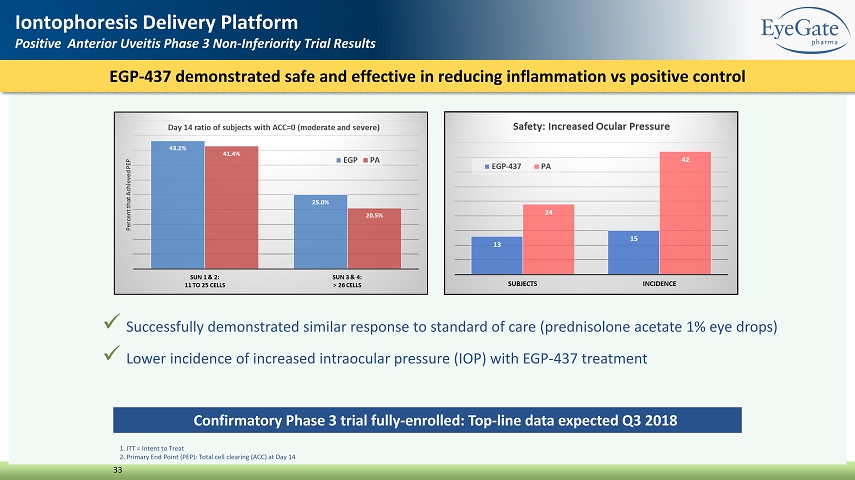

EGP - 437 demonstrated safe and effective in reducing inflammation vs positive control 33 Iontophoresis Delivery Platform Positive Anterior Uveitis Phase 3 Non - Inferiority Trial Results 1. ITT = Intent to Treat 2. Primary End Point (PEP): Total cell clearing (ACC) at Day 14 x Successfully demonstrated similar response to standard of care (prednisolone acetate 1% eye drops) x Lower incidence of increased intraocular pressure (IOP) with EGP - 437 treatment Confirmatory Phase 3 trial fully - enrolled: Top - line data expected Q3 2018

Macular Edema Efficacious Delivery to the Back of the Eye Iontophoresis Delivery Platform

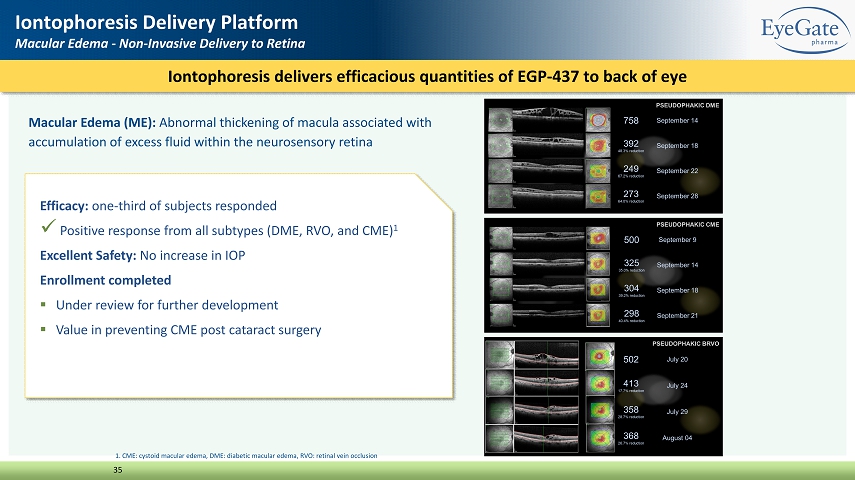

Macular Edema (ME): Abnormal thickening of macula associated with accumulation of excess fluid within the neurosensory retina Iontophoresis delivers efficacious quantities of EGP - 437 to back of eye 35 Iontophoresis Delivery Platform Macular Edema - Non - Invasive Delivery to Retina Efficacy: one - third of subjects responded x Positive response from all subtypes (DME, RVO, and CME) 1 Excellent Safety: No increase in IOP Enrollment completed ▪ Under review for further development ▪ Value in preventing CME post cataract surgery 1. CME: cystoid macular edema, DME: diabetic macular edema, RVO: retinal vein occlusion

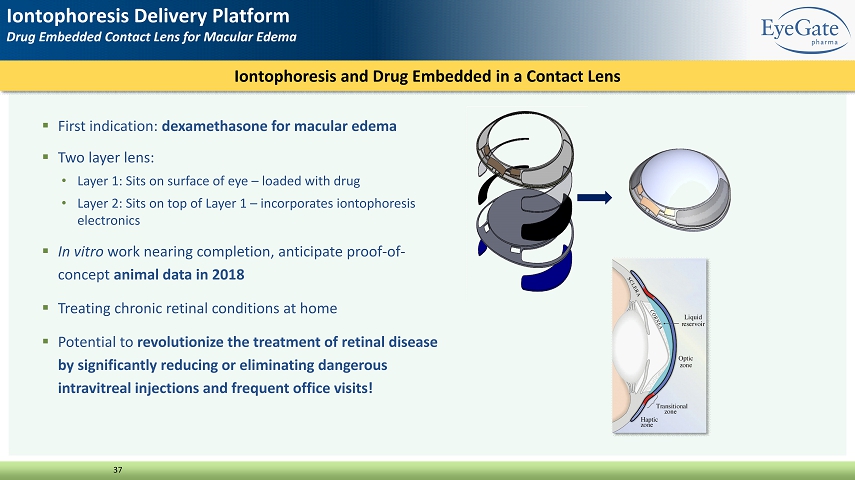

Iontophoresis Delivery Platform Drug Embedded Contact Lens The Future of Ocular Drug Delivery

37 ▪ First indication: dexamethasone for macular edema ▪ Two layer lens: • Layer 1: Sits on surface of eye – loaded with drug • Layer 2: Sits on top of Layer 1 – incorporates iontophoresis electronics ▪ In vitro work nearing completion, anticipate proof - of - concept animal data in 2018 ▪ Treating chronic retinal conditions at home ▪ Potential to revolutionize the treatment of retinal disease by significantly reducing or eliminating dangerous intravitreal injections and frequent office visits! Iontophoresis and Drug Embedded in a Contact Lens Iontophoresis Delivery Platform Drug Embedded Contact Lens for Macular Edema

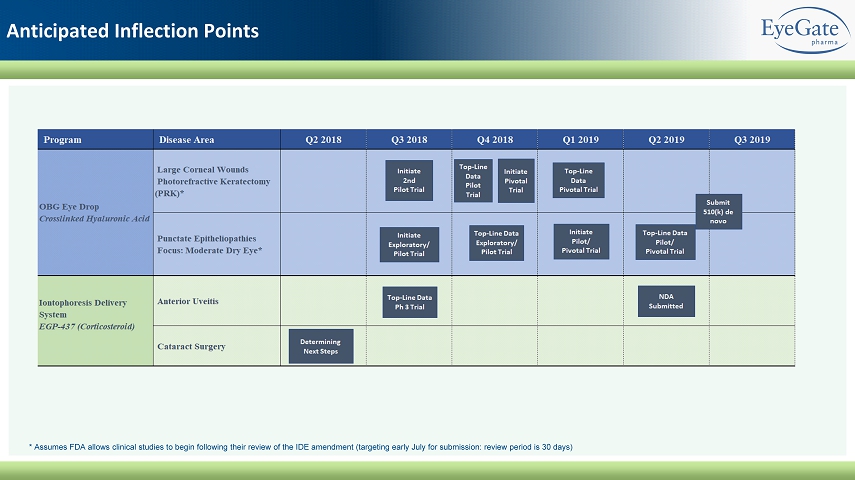

Anticipated Inflection Points * Assumes FDA allows clinical studies to begin following their review of the IDE amendment (targeting early July for submission: review period is 30 days)

EyeGate Pharmaceuticals, Inc. 271 Waverley Oaks Road, Suite 108 Waltham, MA 02452 www.eyegatepharma.com Thank You! NASDAQ: EYEG www.eyegatepharma.com Follow us on Facebook, LinkedIn and Twitter