424B4: Prospectus filed pursuant to Rule 424(b)(4)

Published on June 12, 2017

PROSPECTUS

Filed Pursuant to Rule 424(b)(4)

Registration Statement No. 333-217418

Registration Statement No. 333-218617

Up to 5,336,667 Shares of Common

Stock,

Warrants to Purchase up to 6,666,667 Shares of Common Stock and

Up to 1,995 Shares of Series B Convertible Preferred Stock

(1,330,000 shares of Common Stock underlying the Series B

Convertible Preferred Stock)

We are offering up to 5,336,667 shares of common stock, together with warrants to purchase 6,666,667 shares of common stock (and the shares issuable from time to time upon exercise of the warrants) at a combined purchase price of $1.50 per share of common stock and warrant pursuant to this prospectus. The shares and warrants will be separately issued but will be purchased together in this offering. Each warrant will have an exercise price of $1.50 per share, will be exercisable upon issuance and will expire five years from the date on which such warrants were issued.

We are also offering to those purchasers, whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if they so choose, in lieu of the shares of our common stock that would result in ownership in excess of 4.99%, shares of Series B Convertible Preferred Stock (“Series B Preferred Stock”), convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by the combined public offering price per share of common stock and warrant (the “Conversion Price”), at a public offering price of $1,000 per share of Series B Preferred Stock. Each share of Series B Preferred Stock is being sold together with the same warrants described above being sold with each share of common stock.

Our common stock is listed on The NASDAQ Capital Market under the symbol “EYEG.” On June 8, 2017, the last reported sale price of our common stock on The NASDAQ Capital Market was $1.68 per share. The warrants and any shares of Series B Preferred Stock that we issue are not and will not be listed for trading on The NASDAQ Capital Market.

Stephen From, our President and Chief Executive Officer, and Sarah Romano, our Interim Chief Financial Officer, intend to purchase up to 60,000 and 20,000 of the shares of our common stock, respectively, to be sold in this offering at the public offering price and on the same terms as the other purchasers in this offering.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company.”

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” carefully before you invest in our common stock.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share of Common Stock and Warrant | Per Share of Series B Preferred Stock and Warrants | Total | ||||||||||

| Public offering price | $ | 1.50 | $ | 1,000 | $ | 10,000,000 | ||||||

| Placement agent fees (1) | $ | 0.105 | $ | 0 | $ | 700,000 | ||||||

| Proceeds, before expenses, to us | $ | 1.395 | $ | 0 | $ | 9,300,000 | ||||||

| (1) | We have also agreed to pay the placement agent a management fee equal to 0.5% of the gross proceeds raised in this offering, a non-accountable expense allowance of $25,000 and reimbursement for legal fees and expenses of the placement agent in the amount of up to $75,000. For additional information about the compensation paid to the placement agent, see “Plan of Distribution.” |

We have retained H.C. Wainwright & Co., LLC as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above.

We expect to deliver the shares and the warrants to purchasers in this offering on or about June 14, 2017.

Rodman & Renshaw

a unit of H.C. Wainwright & Co.

Prospectus dated June 8, 2017.

TABLE OF CONTENTS

i

We have not, and the placement agent has not, authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. When you make a decision about whether to invest in our securities, you should not rely upon any information other than the information contained in or incorporated by reference in this prospectus or in any free writing prospectus that we may authorize to be delivered or made available to you. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful.

For investors outside the United States: We have not, and the placement agent has not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside the United States.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We have proprietary rights to trademarks used in this prospectus, including EyeGate®. Solely for our convenience, trademarks and trade names referred to in this prospectus may appear without the “®” or “™” symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name, or service mark of any other company appearing in this prospectus is the property of its respective holder.

ii

The following summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our securities under the heading “Risk Factors,” before investing in our securities. All references to “Company” “we,” “our” or “us” refer solely to EyeGate Pharmaceuticals, Inc. and its subsidiaries and not to the persons who manage us or sit on our Board of Directors.

Overview

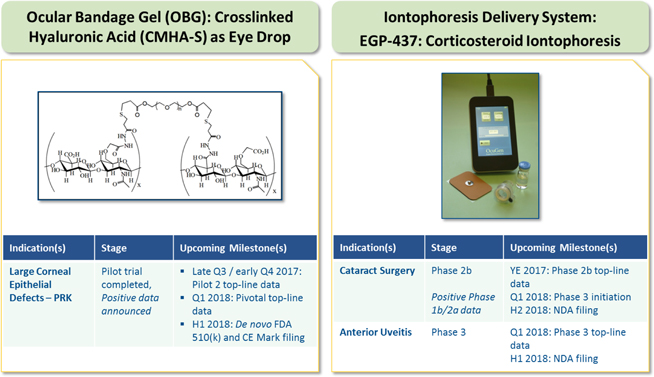

We are a clinical-stage specialty pharmaceutical company focused on developing and commercializing products using our two proprietary platform technologies, crosslinked thiolated carboxymethyl hyaluronic acid (“CMHA-S”) and iontophoresis drug delivery system for treating diseases and disorders of the eye. Our most advanced platform is based on a CMHA-S, a modified form of the natural polymer hyaluronic acid (“HA”), which is a gel that possesses unique physical and chemical properties such as hydrating and healing when applied to the ocular surface. We believe that the ability of CMHA-S to adhere longer to the ocular surface, resist degradation and protect the ocular surface makes it well-suited for treating various ocular surface injuries.

The EyeGate Ocular Bandage Gel (“OBG”) is an eye drop formulation of a CMHA-S hydrogel capable of coating the ocular surface and designed to resist degradation under conditions present in the eye. This prolongs residence time of the bandage on the ocular surface, thereby addressing the limitations of current non-crosslinked hyaluronic acid formulations. Additionally, crosslinking allows the product’s viscosity to be modified to meet optimum ocular needs. The increased viscosity and non-covalent muco-adhesive interfacial forces improve residence time in the tear film, thus providing a coating that aids and promotes re-epithelization of the ocular surface via physical protection without any optical blur.

Hyaluronic acid is a naturally occurring polymer that is important in many physiological processes, including wound healing, tissue homeostasis, and joint lubrication. To create this hydrogel, the HA is modified to create CMHA that is then crosslinked together through the thiol groups to CMHA-S. Some products employ disulfide crosslinking while others utilize a Polyethylene Glycol Diacrylate, or PEGDA, crosslinker. Crosslinking slows degradation of the HA backbone and provides a matrix for incorporating therapeutic agents. Variations in the number of thiols per molecule, the molecular weight of the polymer, the concentration of the polymer, the type of crosslinking, and incorporation of active ingredients, provides a highly versatile platform that can be tailored to a specific application and formulated as eye drops, gels, or films.

Our first CMHA-S-based product candidate, the EyeGate OBG, is a topically applied 0.75% CHMA-S eye drop formulation that has completed its first-in-man clinical trial. Preclinical studies suggest that the specific CMHA-S chemical modification comprising the EyeGate OBG creates a favorable set of attributes, including prolonged retention time on the ocular surface, and a smooth continuous clear barrier without blur that can minimize mechanical lid friction, reduce repeat injury, and mechanically protect the ocular surface, allowing accelerated corneal re-epithelization. It is intended for the management of corneal epithelial defects and to accelerate re-epithelization of the ocular surface following surgery, infections, and other traumatic and non-traumatic conditions.

EyeGate OBG is being developed pursuant to a de novo 510(k) regulatory pathway for devices submitted for marketing clearance to the U.S. Food and Drug Administration, or FDA. We believe that EyeGate OBG is the first and only eye drop being developed in the U.S. to target acceleration of corneal re-epithelization. On May 4, 2017, we submitted an Investigational Device Exemption, or IDE, with the FDA. The IDE, if accepted, will enable us to initiate a second pilot study. We anticipate initiating the second trial in the second quarter of 2017 for which we expect to report top-line data in late third quarter or early fourth quarter of 2017. Assuming positive results from this trial and a subsequent pivotal trial we expect to initiate in the second half of 2017 and to report topline data from in the first quarter of 2018, we plan to file de novo 510(k) and CE mark applications in the first half of 2018 with potential commercial launch in late 2018, initially targeting an estimated 160,000 to 240,000 photorefractive keratectomy, or PRK, procedures in the US annually.

| 1 |

The same crosslinked HA in EyeGate OBG is presently available commercially as a veterinary device indicated for use in the management of superficial noninfectious corneal ulcers. Manufactured by SentrX Animal Care and sold in the U.S. by Bayer Animal Health as Remend® Corneal Repair, the product has been used successfully for five years in dogs, cats and horses, without adverse effects. The composition of the veterinary product is identical to that of the EyeGate OBG. We have obtained a license from BioTime, Inc. for the exclusive worldwide right to commercialize CMHA-S for ophthalmic treatments in humans. We paid BioTime $50,000, and are required to pay royalties to BioTime based on revenue relating to any product incorporating the CMHA-S technology. Our license agreement expires when patent protection for the CMHA-S technology lapses, which is expected to occur in the U.S. in 2027. We do not have the rights to the CMHA-S platform for animal health or veterinary medicine.

Our first product candidate from our second platform is EGP-437, a reformulated topically active corticosteroid, dexamethasone phosphate, delivered into the ocular tissues through our proprietary innovative iontophoresis drug delivery system, the EyeGate® II Delivery System. The EyeGate® II Delivery System features a compact and easy-to-use device that we believe has the potential to deliver drugs non-invasively and quickly into the ocular tissues through the use of iontophoresis, which can accelerate the onset of action, dramatically reduce dosing frequency compared to regular eye drops, and sustain the duration of therapeutic effect. Iontophoresis employs the use of a low electrical current that promotes the migration of a charged drug substance across biological membranes. The EyeGate® II Delivery System is easy-to-use, taking only a few minutes to deliver medication. More than 2,400 treatments have been administered to date using our EyeGate® II Delivery System in clinical trials. EGP-437 is currently in clinical development for the treatment of various inflammatory conditions of the eye. Current programs include the treatment of ocular inflammation and pain in post-surgical cataract patients, with a planned Phase 2b trial expected to commence in the second quarter of 2017 and the treatment of uveitis, a debilitating form of intraocular inflammation of the anterior portion of the uvea, such as the iris and/or ciliary body, with a Phase 3 trial currently enrolling. We expect to report top-line data from the cataract surgery trial by the end of 2017, and for the uveitis trial in the first quarter of 2018.

EGP-437 is being developed pursuant to a new drug application, or NDA, under the Section 505(b)(2) pathway, which enables an applicant to rely, in part, on the FDA’s findings of safety and efficacy for an existing product, or published literature, in support of its NDA. In the case of EGP-437, the existing reference product is dexamethasone eye drops. Based on guidance provided by the FDA, we believe that if the planned confirmatory Phase 3 trial of EGP-437 in anterior uveitis meets non-inferiority criteria, the results of that trial, along with data from our previously completed Phase 3 trial in anterior uveitis, will be sufficient to support a NDA filing in the first half of 2018. We also believe, based on guidance provided by the FDA, that the design of the ongoing confirmatory Phase 3 anterior uveitis trial is acceptable and that the nonclinical work completed to date is sufficient to support a NDA filing.

Medical products containing a combination of new drugs, biological products, or medical devices may be regulated as “combination products” in the U.S. A combination product generally is defined as a product comprised of components from two or more regulatory categories, such as drug/device, device/biologic, or drug/biologic. Each component of a combination product is subject to the requirements established by the FDA for that type of component, whether a new drug, biologic, or device. In order to facilitate premarket review of combination products, the FDA designates one of its centers to have primary jurisdiction for the premarket review and regulation of both components. We expect that the Center for Drug Evaluation and Research will have primary jurisdiction over our EGP-437 combination product. The determination whether a product is a combination product or two separate products is made by the FDA on a case-by-case basis. We have had discussions with the FDA about the status of our EGP-437 combination product as a combination product and we have been advised that the FDA considers our product a combination drug/device.

We have entered into two exclusive global license agreements with subsidiaries of Valeant Pharmaceuticals International, Inc. (“Valeant”), through which we have granted Valeant exclusive, worldwide commercial and manufacturing rights to the combination of our EyeGate® II Delivery System and our EGP-437 product in the fields of uveitis and ocular iontophoretic treatment for post-operative ocular inflammation and pain in ocular surgery patients, as well as a right of last negotiation to license the combination product for other indications. We are responsible for the clinical development of the product in the U.S. for the indications licensed, together with the costs associated therewith. Valeant has the right to develop the product in the fields outside of the U.S. and has agreed to fund 100% of any costs associated therewith.

| 2 |

Ophthalmic Market Opportunity

Ophthalmology is a specialty market with commercial and regulatory dynamics that we believe make it possible for a small or medium sized company like us to develop and commercialize products on our own. We believe that the specialists in the U.S. who treat ocular diseases are sufficiently concentrated that we could effectively promote our products with a specialty sales and marketing group. We believe we can commercialize EyeGate OBG on our own given our existing partnership for the EGP-437 combination product in the ocular iontophoretic development.

Clinical Pipeline

Current Targeted Indications

Large Corneal Epithelial Defects

EyeGate OBG is initially targeting the accelerated re-epithelization of large corneal epithelial defects resulting from PRK.

PRK is an efficacious alternative to patients seeking surgical correction of refractive errors who are not suitable candidates for laser in situ keratomileusis (“LASIK”) due to inadequate corneal thickness, larger pupil size, history of keratoconjunctivitis sicca (“KCS”), or anterior basement membrane disease. PRK involves controlled mechanical removal of corneal epithelium with subsequent excimer laser photoablation of the underlying Bowman’s layer and anterior stroma, including the subepithelial nerve plexus.

The military prefers PRK as a refractive surgery due to the stability of the PRK incision and the absence of risk for flap dislocation during military active duty. Although this procedure yields desirable visual acuity results, common complications of the procedure include post-operative pain secondary to the epithelial defects, risk of corneal infection prior to re-epithelization of the large epithelial defect, corneal haze formation, decreased contrast sensitivity, and slower visual recovery.

| 3 |

Per our discussion with the FDA at the pre-submission meeting that occurred in the fourth quarter of 2016, we also plan on designing and initiating trials during the second half of 2017 that will broaden the indications for use of OBG beyond PRK, including ocular burns, microabrasions, superficial punctate keratitis and other conditions. The designs will be based on size of defect and not a specific underlying cause or indication.

Market opportunity

Large corneal epithelial defects can result from various etiologies such as ocular trauma, surgery, ocular surface disorders, systemic diseases, and epithelial injury due to exposure. We believe EyeGate OBG has the potential to treat a wide variety of ocular diseases and disorders that result from corneal epitheliopathy, and based on statistics from the National Eye Institute of the National Institutes of Health, the Centers for Disease Control, the American Academy of Ophthalmology and Market Scope, we believe such diseases and disorders potentially account for over 75,000,000 patients in the U.S. These conditions range from acute injury to chronic diseases and we believe EyeGate OBG can potentially help restore vision to these patients faster and provide better visual outcomes by accelerating corneal re-epithelization. The daily frequency for the EyeGate OBG treatments needed to treat the corneal epithelial conditions will most likely vary based on the severity, cause and chronicity of the underlying pathology. They may vary from 2-3 times a day to as frequent as 8 times during an acute and very painful episode. For patients who have undergone a PRK procedure, we believe the medical need to treat the subacute condition is quite high. Based on data from the American Academy of Ophthalmology, we estimate that the annual prevalence in the U.S. of patients who have had a PRK procedure is between 160,000 and 240,000. If approved, we believe EyeGate OBG is well positioned to capture a large market share to treat patients who have had a PRK procedure because it will be the first and only eye drop in the U.S. targeting the acceleration of re-epithelization claim. We also plan on designing and initiating clinical trials during the second half of 2017 that will broaden the indications for use of OBG beyond PRK, including ocular burns, microabrasions, superficial punctate keratitis and other conditions.

Clinical Trial Results

In January 2017, we reported topline results from the first-in-human pilot trial of EyeGate OBG, the acceleration of re-epithelialization of large corneal epithelial defects in patients having undergone PRK. The prospective, randomized, controlled study enrolled 39 subjects undergoing bilateral PRK surgery and aimed to assess the safety and performance of EyeGate OBG on its own or combined with a Bandage Contact Lens (“BCL”) compared to the current standard of care, artificial tears and BCL. The primary endpoint of the study was complete wound closure by Day 3.

The enrolled subjects were randomized into

one of three study groups, with subjects receiving the same treatment in both eyes:

|

|

• | Patients in arm 1 (n=12) received EyeGate Ocular Bandage Gel four times daily (QID) for two weeks after surgery. |

| • | Arm 2 (n=14) was comprised of EyeGate Ocular Bandage Gel QID for two weeks after surgery in combination with a BCL. |

| • | Arm 3 (n=13) was comprised of artificial tears administered four times daily and BCL. |

The study demonstrated safety and tolerability of EyeGate OBG, with encouraging potential efficacy. 83.3% of the subjects in Arm 1 (EyeGate OBG alone) achieved complete wound closure by Day 3, compared to 53.8% of patients that received the standard of care. Also, on Day 3, the average wound surface area was 94.4% smaller for the OBG arm versus the standard or care arm or 0.02mm2 vs 0.37mm2 respectively. Additionally, the average wound surface area on Day 1 (24 hours post-surgery) was 18.5 mm2 for patients in the EyeGate OBG alone arm compared to 39.5mm2 in the BCL arm, a 53.3% improvement. Based on these positive results, EyeGate plans to continue development with a double-masked, controlled trial evaluating EyeGate OBG monotherapy against BCL in the second quarter of 2017.

| 4 |

| # Subjects | Closed Wound: Day 3 | Surface Area (mm2) | ||||||||||||||||||

| per arm | # | % | Day 1 | Day 3 | ||||||||||||||||

| Arm 1: OBG | 12 | 10 | 83.3 | % | 18.5 | 0.02 | ||||||||||||||

| Arm 2: OBG + BCL | 14 | 9 | 64.3 | % | 40.7 | 0.10 | ||||||||||||||

| Arm 3: BCL + AT1 | 13 | 7 | 53.8 | % | 39.5 | 0.37 | ||||||||||||||

| Total Subjects Enrolled | 39 | |||||||||||||||||||

| OBG vs BCL: % Superior | 54.8 | % | 53.3 | % | 94.4 | % | ||||||||||||||

EyeGate® II Delivery System and EGP-437

Delivery of therapeutic agents using ocular iontophoresis is a potential means of non-invasively achieving higher drug levels rapidly within the eye by promoting the migration of a charged drug substance across biological membranes with a low electrical current. The EyeGate® II Delivery System applicator utilizes an inert electrode, which stimulates the electrolysis of water to produce ions (hydroxide or hydronium), which via electrorepulsion, drive a like-charged drug substance into the ocular tissues. The EyeGate® II Delivery System is a platform technology that requires customized pharmaceutical formulations to enable delivery efficiency and safety while allowing for potential novel intellectual property.

Many front of the eye conditions such as pain and inflammation following cataract surgery and non-infectious anterior uveitis are acute inflammatory conditions. The current standard of care to treat ocular surface and anterior segment inflammation is patient administered corticosteroids in the form of eye drops. Topical corticosteroids suffer from a number of drawbacks including poor patient compliance, low ocular bioavailability, rapid clearance, and steroid-related side effects including elevated intraocular pressure (IOP). We believe that our EGP-437 product candidate has the potential to address these unmet needs by providing in-office treatments given by the eye care provider thereby mitigating patient compliance issues and substantially reducing the burden of care. Also, the data from multiple clinical trials suggests that EGP-437 does not significantly raise IOP, at the time points evaluated during the study period.

The primary route of administration for drugs treating retinal diseases is through intravitreal injection into the vitreous of the eye. These injections must be given as frequently as once per month when treating chronic diseases like macular degeneration. Unfortunately, there are known drawbacks associated with administering intravitreal injections, including safety risks, adverse patient experience and the time and labor to administer. Data from our Phase 1b/2a proof-of-concept trial in macular edema suggests that iontophoresis can non-invasively deliver efficacious levels of EGP-437 to the back of the eye and or retina. The non-invasive delivery of EGP-437 demonstrated a positive response in some macular edema patients in the trial.

Current Targeted Indications

Cataract Surgery

Cataracts are the leading cause of blindness worldwide, and there are more than 24 million people age 40 and older who have cataracts in the U.S. alone, according to the Vision Problems in the U.S. report from Prevent Blindness. A cataract is a clouding of the lens in the eye that affects vision. Most cataracts are related to aging and are very common in older people. By age 80, more than half of the U.S. population either have a cataract or have had cataract surgery. Cataract surgery is the most common surgical procedure in the population aged over 65 years. There are approximately four million cataract surgeries performed per year in the U.S. As the technology of cataract surgery has progressed, so too, has the increased patient demand for excellent vision and safety after the procedure, but visual rehabilitation after cataract surgery is sometimes delayed by the inflammatory processes that are induced by phacoemulsification where the eye’s cloudy lens is emulsified with an ultrasonic hand piece and aspirated from the eye. Inflammation is induced in all cataract surgeries by the mechanical transmission of energy into the eye, disruption of cell membranes, and the normal healing process. Postoperative topical corticosteroids are used routinely to reduce inflammation and improve visual outcomes after cataract surgery. Despite their use, transient corneal edema is one of the major factors that can hinder the improvement of vision in the first days after surgery, and cystoid macula edema may reduce quality of vision for weeks or months after the procedure. Therefore, reducing inflammation immediately following the procedure and any potential damage to the corneal endothelium and retina are high priorities for the ophthalmic surgeon.

| 5 |

Non-Infectious Anterior Uveitis

Uveitis is a general term for inflammation of the uveal tract and encompasses a wide range of etiologies. It may be idiopathic, associated with systemic diseases or result from a variety of infectious agents. An annual estimated 17.6% of active uveitis patients experience transient or permanent loss of vision. Uveitis is responsible for more than 2.8% of cases of blindness in the U.S., making this disorder an important cause of vision loss and impairment. Non-infectious anterior uveitis is a debilitating form of intraocular inflammation of the anterior portion of the uvea, such as the iris and/or ciliary body and is the most common form of uveitis. Incidence in the U.S. ranges from approximately 26.6 to 102 per 100,000 adults annually with recent reports indicating occurrence in all age groups with the highest incidence in those over age 65. Chronic or recurrent, anterior uveitis may lead to complications such as cataracts, glaucoma, and macular edema.

Inflammation can be classified as either acute or chronic. Acute inflammation is the initial response of the body to harmful stimuli and is achieved by the increased movement of plasma and white blood cells from the blood into the injured tissues, in this case the uvea. Sometimes, the inflammation associated with anterior uveitis is in response to a real infection. This is known as infectious anterior uveitis. However, anterior uveitis often occurs for no apparent reason as the result of the immune system malfunctioning and triggering the process of inflammation even though no infection is present. This is known as non-infectious anterior uveitis. Patients that have anterior uveitis exhibit a large number of white blood cells in the anterior chamber of the eye. In order to count these cells in the anterior chamber, the physician uses a slit lamp, an instrument consisting of a high-intensity light source that can be focused to shine a thin sheet of light into the eye. The treatment objective is to eliminate the inflammation of the uvea which can be confirmed by an anterior chamber cell count of zero.

Clinical Development

We submitted an IND for EGP-437 to the FDA in April 2008, under which we have completed seven clinical trials. The first two trials were executed in parallel — a Phase 1/2 non-infectious anterior uveitis trial and a Phase 2 dry eye trial. These two trials were followed by a Phase 3 dry eye trial. Subsequently, we completed our first Phase 3 trial for non-infectious anterior uveitis. During the time that we executed the Phase 3 non-infectious anterior uveitis trial we completed a Phase 2 proof-of-concept cataract surgery trial, with prophylactic treatment of EGP-437. In December 2016, we completed a Phase 1b/2a dose ranging trial treating inflammation and pain for subjects that have undergone cataract surgery and in mid-2016 a Phase 1b/2a proof-of-concept macular edema trial, which demonstrated the ability of the EyeGate® II Delivery System to deliver a drug non-invasively to the back of the eye.

EGP-437: Cataract Surgery

We have completed two trials (Phase 2 prophylactic and Phase 1b/2a dose-ranging) and in December 2016 reported positive data for our Phase 1b/2a dose-ranging clinical trial for the treatment of ocular inflammation and pain in post-surgical cataract patients. The design of this trial is based on treating the patients post-operatively and not prophylactically. The Phase 1b/2a clinical trial was a multi-center, open-label trial enrolling 80 subjects who had undergone unilateral cataract extraction and implantation of a monofocal intra-ocular lens. The primary objective of this trial was to assess the safety and efficacy of iontophoretic EGP-437 in these patients following surgery. A positive response was achieved and the 4.5 mA-min iontophoretic dose has been determined as the optimal dose to take forward into a Phase 2 trial, to be initiated in the second quarter of 2017, with the top-line data expected by year-end.

| 6 |

EGP-437: Anterior Uveitis

We have completed two trials (Phase 1/2 and Phase 3) for anterior uveitis and have demonstrated in the completed Phase 3 non-inferiority study that two iontophoretic treatments with EGP-437 achieved the same response rate as the positive control for the primary efficacy endpoint, a complete clearing of anterior chamber cells, by Day 14. This was achieved with a lower incidence of increased IOP, which is characterized as an increase of 6 mm Hg or more from baseline. We are currently enrolling patients in an ongoing confirmatory Phase 3 trial and expect to report top-line data in the first quarter of 2018. The FDA has provided guidance that the ongoing confirmatory Phase 3 trial of EGP-437 in anterior uveitis meets non-inferiority criteria, and that data from this trial along with data from our previously completed Phase 3 trial in anterior uveitis will be sufficient to support a NDA filing. The FDA also communicated that the design of the ongoing confirmatory Phase 3 anterior uveitis trial is acceptable and that the nonclinical work completed to date is sufficient to support a NDA filing.

EGP-437: Other Indications

Although we have completed two trials (Phase 2 and Phase 3) for dry eye, at this time we are not anticipating any further development for this indication. We have completed a Phase 1/2 for macular edema and at this time we are assessing the next steps for this indication.

Our Strategy

Our goal is to become a leading specialty pharmaceutical company focused on developing and commercializing products for treating diseases and disorders of the eye. The key elements of this strategy are to:

| • | Continue clinical development of our EyeGate OBG device for the treatment of corneal epithelial defects. We have just completed our first-in-human trial enrolling subjects with a 9mm corneal wound, a large corneal epithelial defect, post PRK surgery and released positive top-line data in the first quarter of 2017. We anticipate initiating a double-masked controlled trial in the second quarter of 2017 and expect to report top-line data in late third quarter or early fourth quarter of 2017. |

| • | Continue clinical development of our EGP-437 Combination Product for the treatment of inflammation and pain post cataract surgery. We have completed an 80 subject open-label dose ranging trial and plan on initiating a randomized controlled Phase 2b trial in the second quarter of 2017. We expect to report top-line data for this trial by year-end 2017. |

| • | Continue clinical development of EGP-437 for the treatment of noninfectious anterior uveitis. We have begun enrolling patients for the confirmatory Phase 3 trial evaluating the safety and efficacy of EGP-437 for the treatment of noninfectious anterior uveitis. Based on our estimates regarding subject enrollment, we expect to report top-line data for this trial in the first quarter of 2018. |

| • | Utilize the EyeGate iontophoresis expertise to expand our drug delivery platform for the treatment of eye diseases. Our initial platform, the EyeGate® II Drug Delivery System, is an in-office treatment performed by an eye care provider. We plan to develop a system based on iontophoresis that could be applied at home by the patient. This would be ideal for the treatment of certain chronic ocular diseases, as it could reduce the required frequency of visits to the eye care provider’s office. |

| • | Utilize the EyeGate CMHA-S polymer platform to expand our drug delivery capabilities for the treatment of anterior segment eye diseases. This unique biodegradable polymer platform offers the potential to deliver drugs and molecules to the ocular surface as a delivery vehicle. OBG stays on the ocular surface for upwards of 90 minutes, which potentially enables this CMHA to enhance drug bioavailability. Furthermore, the crosslinking enables a sustained release platform. We are undertaking research to explore expanding the utility of this polymer in ophthalmology. |

| 7 |

| • | Pursue other strategic collaborations. We plan to evaluate opportunities to enter into collaborations that may contribute to our ability to advance our drug delivery platforms and product candidates and to progress concurrently a range of discovery and development programs. We also plan to evaluate opportunities to in-license or acquire the rights to other products, product candidates or technologies for the treatment of eye diseases. |

Corporate Information

Our principal executive offices are located at 271 Waverley Oaks Road, Suite 108, Waltham, MA 02452, and our telephone number is (781) 788-9043. Our website address is www.eyegatepharma.com. Our website and the information contained in, or accessible through, our website will not be deemed to be incorporated by reference into this prospectus and does not constitute part of this prospectus. You should not rely on any such information in making your decision whether to purchase our securities.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until December 31, 2020. However, if certain events occur prior to December 31, 2020, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.07 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company before such date.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

| 8 |

| Securities offered by us |

Up to 5,336,667 shares of our common stock

Warrants to purchase up to 6,666,667 shares of our common stock

Up to 1,995 shares of Series B Preferred Stock that are convertible into an aggregate of up to 1,330,000 shares of common stock, subject to certain adjustments. |

|

| Warrants | The warrants will be exercisable at an initial exercise price of $1.50 per share. The warrants are exercisable at any time for a period of five years from the date on which such warrants were issued. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. | |

| Series B Preferred Stock | Each share of Series B Preferred Stock is convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by the Conversion Price. Notwithstanding the foregoing, we shall not effect any conversion of Series B Preferred Stock, to the extent that, after giving effect to an attempted conversion, the holder of shares of Series B Preferred Stock (together with such holder’s affiliates, and any persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares of our common stock in excess of 4.99% of the shares of our common stock then outstanding after giving effect to such exercise. For additional information, see “Description of Our Capital Stock—Series B Convertible Preferred Stock” on page 21 of this prospectus. | |

| Common Stock outstanding after this offering | 17,604,778 shares, assuming that we sell all securities offered pursuant to this prospectus and assuming conversion of all shares of Series B Preferred Stock but no exercise of the warrants issued in the offering. | |

| Price per share of common stock and warrant | $1.50 | |

| Price per share of Series B Preferred Stock and warrants | $1,000 | |

| Use of proceeds | We intend to use the net proceeds from this offering to support our operations, including for clinical trials, for working capital and for other general corporate purposes, which will include the pursuit of our other research and development efforts and could also include the acquisition or in-license of other products, product candidates or technologies candidates or technologies. See “Use of Proceeds” on page 18. | |

| Risk factors | Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of information that should be considered in connection with an investment in our securities. | |

| NASDAQ Capital Market symbol | EYEG. We do not plan on applying to list the warrants or the Series B Preferred Stock on NASDAQ, any national securities exchange or any other nationally recognized trading system. Without an active trading market, the liquidity of the warrants and Series B Preferred Stock will be limited. |

| 9 |

| Insider Participation |

Stephen From, our President and Chief Executive Officer, and Sarah Romano, our Interim Chief Financial Officer, intend to purchase up to 60,000 and 20,000 of the shares of our common stock, respectively, to be sold in this offering at the public offering price and on the same terms as the other purchasers in this offering. |

The number of shares of our common stock to be outstanding after this offering is based on 10,938,111 shares of our common stock outstanding as of June 8, 2017 and assumes that the shares of Series B Preferred Stock sold in the offering have been converted, but does not include, as of such date:

| · | 1,490,755 shares of common stock issuable upon exercise of options outstanding under our 2005 Equity Incentive Plan and 2014 Equity Incentive Plan, at a weighted-average exercise price of approximately $2.92 per share; |

| · | 2,852,736 shares of our common stock issuable upon the exercise of outstanding warrants to purchase shares of our common stock with a weighted-average exercise price of $7.45 per share; |

| · | 287,961 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan; |

| · | 70,567 shares of common stock reserved under our 2014 Employee Stock Purchase Plan; and |

| · | 6,666,667 shares of common stock issuable upon the exercise of warrants to be issued to investors in this offering at an exercise price of $1.50 per share. |

| 10 |

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties and all other information contained in or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016. All of these risk factors are incorporated by reference herein in their entirety. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described herein and in the documents incorporated herein by reference.

We have broad discretion to determine how to use the proceeds raised in this offering, and we may not use the proceeds effectively.

Our management will have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering in ways with which you may not agree or that do not yield a favorable return. We intend to use the net proceeds from this offering for clinical trials, for working capital and for other general corporate purposes, which will include the pursuit of our other research and development efforts and could also include the acquisition or in-license of other products, product candidates or technologies. If we do not invest or apply the proceeds of this offering in ways that improve our operating results, we may fail to achieve expected financial results, which could cause our stock price to decline.

You will experience immediate and substantial dilution when you purchase shares in this offering.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the assumed sale by us of 5,336,667 shares of our common stock in this offering at a public offering price of $1.50 per share of common stock and warrant, assuming conversion of all 1,995 shares of Series B Preferred Stock into 1,330,000 shares of common stock, and after deducting the placement agent fees and estimated offering expenses payable by us, investors in this offering will suffer an immediate dilution of $0.82 per share.

If we issue additional common stock, or securities convertible into or exchangeable or exercisable for common stock, our stockholders, including investors who purchase shares of common stock in this offering, may experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. See “Dilution” on page 19 of this prospectus for a more detailed discussion of the dilution you will incur in connection with this offering.

You will experience immediate and substantial dilution in the net tangible book value per share of the Series B Preferred Stock you purchase.

Since the price per share of our Series B Preferred Stock being offered is substantially higher than the net tangible book per share of our underlying common stock, you will suffer substantial dilution in the net tangible book value of the shares that you purchase in this offering. Based on the combined public offering price of $1.50 per share of common stock and warrant, if you purchase Series B Preferred Stock in this offering, you will suffer immediate and substantial dilution of $0.82 per share in the net tangible book value of the shares of common stock underlying the Series B Preferred Stock. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase Series B Preferred Stock in this offering.

| 11 |

The issuance of additional equity securities may negatively impact the trading price of our common stock.

We have issued equity securities in the past, will issue equity securities in this offering and expect to continue to issue equity securities to finance our activities in the future. In addition, outstanding options and warrants to purchase our common stock may be exercised and additional options and warrants may be issued, resulting in the issuance of additional shares of common stock. The issuance by us of additional equity securities, including the shares of common stock issuable upon exercise of the warrants issued by us in this offering, would result in dilution to our stockholders, and even the perception that such an issuance may occur could have a negative impact on the trading price of our common stock.

There is no public market for the Series B preferred stock or the warrants to purchase shares of our common stock being offered by us in this offering.

There is no established public trading market for the Series B preferred stock or the warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Series B preferred stock or the warrants on any national securities exchange or other nationally recognized trading system, including The NASDAQ Capital Market. Without an active market, the liquidity of the Series B preferred stock and the warrants will be limited.

The warrants are speculative in nature.

The warrants do not confer any rights of common stock ownership on its holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price for a limited period of time. Specifically, commencing on the date of issuance, holders of the warrants may exercise their right to acquire the common stock and pay an exercise price of $1.50 per share, subject to certain adjustments, prior to five years from the date on which such warrants were issued, after which date any unexercised warrants will expire and have no further value. Moreover, following this offering, the market value of the warrants, if any, is uncertain and there can be no assurance that the market value of the warrants will equal or exceed their imputed offering price. The warrants will not be listed or quoted for trading on any market or exchange. There can be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the warrants, and consequently, whether it will ever be profitable for holders of the warrants to exercise the warrants.

A substantial number of shares of our common stock may be sold in this offering, which could cause the price of our common stock to decline.

In this offering, we will sell up to 5,336,667 shares of common stock and shares of Series B Preferred Stock convertible into up to 1,330,000 shares of common stock, collectively representing approximately 60.9% of our outstanding common stock as of June 8, 2017. This sale and any future sales of a substantial number of shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

A significant number of additional shares of our common stock may be issued upon the conversion of existing securities, including the Series B Preferred Stock, which issuances would substantially dilute existing stockholders and may depress the market price of our common stock.

As of June 8, 2017, there were 10,938,111 shares of common stock outstanding. In addition, 1,330,000 shares of common stock will be issuable upon conversion of our Series B Preferred Stock. The issuance of any such shares of common stock would substantially dilute the proportionate ownership and voting power of existing security holders, and their issuance, or the possibility of their issuance, may depress the market price of our common stock.

| 12 |

Upon conversion of the Series B Preferred Stock, holders may receive less valuable consideration than expected because the value of our common stock may decline after such holders exercise their conversion right but before we settle our conversion obligation.

Under the Series B Preferred Stock, a converting holder will be exposed to fluctuations in the value of our common stock during the period from the date such holder surrenders shares of Series B Preferred Stock for conversion until the date we settle our conversion obligation. Upon conversion, we will be required to deliver the shares of our common stock, together with a cash payment for any fractional share (if so elected by the Company), on the third business day following the relevant conversion date. Accordingly, if the price of our common stock decreases during this period, the value of the shares of common stock that you receive will be adversely affected and would be less than the conversion value of the Series B Preferred Stock on the conversion date.

We may issue additional series of preferred stock that rank senior or equally to the Series B Preferred Stock as to dividend payments and liquidation preference.

Neither our restated certificate of incorporation nor the Certificate of Designation for the Series B Preferred Stock prohibits us from issuing additional series of preferred stock that would rank senior or equally to the Series B Preferred Stock as to dividend payments and liquidation preference. Our restated certificate of incorporation provides that we have the authority to issue up to 10,000,000 shares of preferred stock. The issuances of other series of preferred stock could have the effect of reducing the amounts available to the Series B Preferred Stock in the event of our liquidation, winding-up or dissolution. It may also reduce cash dividend payments on the Series B Preferred Stock if we do not have sufficient funds to pay dividends on all Series B Preferred Stock outstanding and outstanding parity preferred stock.

Our Series B Preferred Stock will rank junior to all our liabilities to third party creditors in the event of a bankruptcy, liquidation or winding up of our assets.

In the event of bankruptcy, liquidation or winding up, our assets will be available to pay obligations on our Series B Preferred Stock only after all our liabilities have been paid. Our Series B Preferred Stock will effectively rank junior to all existing and future liabilities held by third party creditors. The terms of our Series B Preferred Stock do not restrict our ability to raise additional capital in the future through the issuance of debt. In the event of bankruptcy, liquidation or winding up, there may not be sufficient assets remaining, after paying our liabilities, to pay amounts due on any or all of our Series B Preferred Stock then outstanding.

Future issuances of preferred stock may adversely affect the market price for our common stock.

Additional issuances and sales of preferred stock, or the perception that such issuances and sales could occur, may cause prevailing market prices for our common stock to decline and may adversely affect our ability to raise additional capital in the financial markets at times and prices favorable to us.

We are not in compliance with NASDAQ’s continued listing requirements. If we are unable to comply with those listing requirements, our common stock could be delisted which would have a materially adverse effect on the marketability of our comment stock.

On April 12, 2017, we received a notice from NASDAQ that we were not in compliance with its continued listing requirements set forth in NASDAQ’s Marketplace Rule 5550(b) because (i) we did not have a minimum required stockholders’ equity of $2.5 million, (ii) the market value of our listed securities (“MVLS”) was less than $35 million, and (iii) we did not have net income from continuing operations in the latest fiscal year or in two of the last three fiscal years. In accordance with Nasdaq Listing Rule 5810(c)(3)(C), we have a period of 180 calendar days, or until October 2, 2017, to regain compliance. To regain compliance, at any time during the 180 calendar day-compliance period, our MVLS must be $35 million or more for a minimum of 10 consecutive business days or we must have stockholders' equity of at least $2.5 million.

| 13 |

In the event that we do not regain compliance with these listing requirements prior to the expiration of the compliance period, we will receive written notification that our securities are subject to delisting. At that time, we may appeal the delisting determination to a hearings panel pursuant to NASDAQ’s appeal procedures. We believe that the receipt of the net proceeds of this offering will bring us back into compliance with these listing requirements.

A delisting of our common stock would have a materially adverse effect on the market liquidity of our common stock and, as a result, the market price for our common stock could become more volatile. Further, a delisting also could make it more difficult for us to raise additional capital.

| 14 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains, and the documents incorporated herein by reference contain, forward-looking statements that involve risks and uncertainties. The forward-looking statements are contained principally in the sections of this prospectus and the documents incorporated herein by reference under the captions “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “seek,” “aim,” “think,” “optimistic,” “strategy,” “goals,” “sees,” “new,” “guidance,” “future,” “continue,” “drive,” “growth,” “long-term,” “develop,” “possible,” “emerging,” “opportunity,” “pursue,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “target,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| • | the timing and success of preclinical studies and clinical trials conducted by us and our development partners; |

| • | the ability to obtain and maintain regulatory approval of our product candidates, and the labeling for any approved products; |

| • | the scope, progress, expansion, and costs of developing and commercializing our product candidates; |

| • | the size and growth of the potential markets for our product candidates and the ability to serve those markets; |

| • | our expectations regarding our expenses and revenue, the sufficiency of our cash resources and needs for additional financing; |

| • | the rate and degree of market acceptance of any of our product candidates; |

| • | our expectations regarding competition; |

| • | our anticipated growth strategies; |

| • | our ability to attract or retain key personnel; |

| • | our ability to establish and maintain development partnerships; |

| • | our expectations regarding federal, state and foreign regulatory requirements; |

| • | regulatory developments in the U.S. and foreign countries; |

| • | our ability to obtain and maintain intellectual property protection for our product candidates; |

| • | the anticipated trends and challenges in our business and the market in which we operate; and |

| • | our use of proceeds from this offering. |

| 15 |

Any forward-looking statement made by us in this prospectus speaks only as of the date on which it is made. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

| 16 |

Our common stock is listed and has traded on The NASDAQ Capital Market under the symbol “EYEG” since July 31, 2015. From February 19, 2015, the date our initial public offering closed, to July 30, 2015, our common stock was quoted on the OTCQB Venture Marketplace (the “OTCQB”) under the symbol “EYEG”.

The following table sets forth, for the periods indicated, the range of high and low sales prices of our common stock as reported by The NASDAQ Capital Market since July 31, 2015 and the high and low bid prices of our common stock quoted on the OTCQB prior to such date. OTCQB quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions.

| High | Low | |||||||

| Fiscal Year Ending December 31, 2017 | ||||||||

|

Second quarter (through June 8, 2017) |

$ | 2.53 | $ | 1.60 | ||||

| First quarter | $ | 3.90 | $ | 1.42 | ||||

| Fiscal Year Ended December 31, 2016 | ||||||||

| Fourth quarter | $ | 2.10 | $ | 1.11 | ||||

| Third quarter | $ | 3.00 | $ | 1.31 | ||||

| Second quarter | $ | 4.00 | $ | 2.42 | ||||

| First quarter | $ | 5.10 | $ | 1.38 | ||||

| Fiscal Year Ended December 31, 2015 | ||||||||

| Fourth Quarter | $ | 5.00 | $ | 2.39 | ||||

| Third quarter | $ | 22.68 | $ | 2.78 | ||||

| Second quarter | $ | 5.09 | $ | 3.22 | ||||

| First quarter (from February 19, 2015) | $ | 6.10 | $ | 3.10 | ||||

On June 8, 2017, the last reported sale price of our common stock as reported by The NASDAQ Capital Market was $1.68 per share. As of such date, we had approximately 87 stockholders of record.

We have never declared or paid any cash dividends on our capital stock. We currently intend to retain future earnings, if any, and all currently available funds for use in the operation of our business and do not anticipate paying any cash dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our Board of Directors after considering our financial condition, results of operations, capital requirements, business prospects and other factors the Board of Directors deems relevant, and subject to the restrictions contained in our current or future financing instruments.

| 17 |

We estimate the net proceeds from this offering will be approximately $8.8 million, after deducting placement agent fees and expenses and our estimated offering expenses, and based on the combined public offering price of $1.50 per share of common stock and warrant and excluding the proceeds, if any, from the exercise of the warrants issued pursuant to this offering.

We intend to use the net proceeds from this offering, together with other available funds, to support our operations, including for clinical trials, for working capital and for other general corporate purposes, which will include the pursuit of our other research and development efforts and could also include the acquisition or in-license of other products, product candidates or technologies, though no such acquisition or in-license is current contemplated. We have not yet determined the amount of net proceeds to be used specifically for any of the foregoing purposes.

Pending use of the proceeds as described above, we intend to invest the net proceeds of this offering in short-term, interest-bearing, investment-grade securities or certificates of deposit.

The amounts and timing of our actual expenditures will depend on numerous factors, including the progress of our clinical trials, as well as the amount of cash used in our operations. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds and investors will be relying on the judgment of our management regarding the application of the net proceeds from this offering.

Based upon our historical and anticipated future growth and our financial needs, we may engage in additional financings of a character and amount that we determine as the need arises. We may raise additional capital through additional public or private financings, the incurrence of debt and other available sources.

| 18 |

If you purchase our common stock, Series B Preferred Stock, or both, in this offering, assuming the conversion of the Series B Preferred Stock into shares of our common stock, you will experience dilution to the extent of the difference between the public offering price per share in this offering and our as adjusted net tangible book value per share immediately after this offering. Net tangible book value (deficit) per share is equal to the amount of our total tangible assets, less total liabilities, divided by the number of outstanding shares of our common stock. As of March 31, 2017, our net tangible book value was $3.2 million, or approximately $0.29 per share.

After giving effect to the sale of 5,336,667 shares of common stock by us at the combined public offering price of $1.50 per share of common stock and warrant, assuming that all 1,995 shares of Series B Preferred Stock are converted into shares of common stock and after deducting estimated placement agent fees and expenses and estimated offering expenses, our as adjusted net tangible book value as of March 31, 2017 would have been approximately $12.0 million, or $0.68 per share of common stock, which excludes the warrants to purchase 6,666,667 shares of our common stock to be issued to investors in this offering. This represents an immediate increase in net tangible book value of $0.39 per share of common stock to existing stockholders and immediate dilution of $0.82 per share of common stock to investors purchasing our common stock in this offering at the public offering price. The following table illustrates this dilution on a per share basis:

| Public offering price per share of common stock and warrant | $ | 1.50 | ||||||

| Net tangible book value per share as of March 31, 2017 | $ | 0.29 | ||||||

| Increase in net tangible book value per share after giving effect to this offering | $ | 0.39 | ||||||

| As adjusted net tangible book value per share after giving effect to this offering | $ | 0.68 | ||||||

| Dilution per share to new investors | $ | 0.82 |

The above discussion and table do not take into account further dilution to investors purchasing our common stock in this offering that could occur upon the exercise of outstanding options and warrants having a per share exercise price less than the public offering price per share in this offering. To the extent that outstanding options or warrants outstanding as of March 31, 2017, are exercised or other shares are issued, investors purchasing our common stock in this offering will experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe that we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of our common stock, including through the sale of securities convertible into or exchangeable or exercisable for common stock, the issuance of these securities could result in further dilution to our stockholders, including investors purchasing our common stock in this offering.

| 19 |

The table and discussion above are based on 10,878,116 shares of our common stock outstanding as of March 31, 2017, and assumes that the shares of Series B Preferred Stock sold in the offering have been converted, but does not include, as of such date:

| · | 1,489,934 shares of common stock issuable upon exercise of options outstanding under our 2005 Equity Incentive Plan and 2014 Equity Incentive Plan, at a weighted-average exercise price of approximately $2.87 per share; |

| · | 2,852,736 shares of our common stock issuable upon the exercise of outstanding warrants to purchase shares of our common stock with a weighted-average exercise price of $7.45 per share; |

| · | 350,961 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan; |

| · | 70,567 shares of common stock reserved under our 2014 Employee Stock Purchase Plan; and |

| · | 6,666,667 shares of common stock issuable upon the exercise of warrants to be issued to investors in this offering at an exercise price of $1.50 per share. |

| 20 |

DESCRIPTION OF OUR CAPITAL STOCK

General

Our authorized capital stock consists of 100,000,000 shares of common stock, par value $0.01 per share, and 10,000,000 shares of preferred stock, par value $0.01 per share. The following description summarizes some of the terms of our restated certificate of incorporation and amended and restated bylaws, but does not purport to be complete and is qualified in its entirety by the provisions of our restated certificate of incorporation and amended and restated bylaws, copies of which have been filed as exhibits to the registration statement of which this prospectus is a part.

Common Stock

Outstanding Shares. There were 10,938,111 shares of our common stock outstanding as of June 8, 2017. As of June 8, 2017, there were 1,490,755 shares of common stock subject to outstanding options and 2,852,736 shares of common stock subject to outstanding warrants.

Voting Rights. Each holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise provided by law or our restated certificate of incorporation or bylaws, all matters other than the election of directors submitted to the stockholders at any meeting shall be decided by the affirmative vote of a majority of the outstanding shares of common stock present in person or represented by proxy at the meeting and entitled to vote thereon. Directors are elected by a plurality of the votes cast at the meeting. Our restated certificate of incorporation and amended and restated bylaws do not provide for cumulative voting rights. Because of this, the holders of a majority of the shares of common stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose.

Dividends. Subject to preferences that may be applicable to any then outstanding preferred stock, the holders of our outstanding shares of common stock are entitled to receive dividends, if any, as may be declared from time to time by our Board of Directors out of legally available funds. At present, we have no plans to issue dividends. See the section titled “Dividend Policy”.

Liquidation. In the event of our liquidation, dissolution or winding up, holders of common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities, subject to the satisfaction of any liquidation preference granted to the holders of any outstanding shares of preferred stock.

Other Rights and Preferences. Holders of our common stock have no preemptive, conversion or subscription rights, and there are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of common stock are subject to, and may be adversely affected by, the rights of the holders of shares of our Series A Preferred Stock and any series of our preferred stock that we may designate and issue in the future.

Fully Paid and Nonassessable. All of our outstanding shares of common stock are, and the shares of common stock to be issued in this offering will be, fully paid and nonassessable.

Provisions in our restated certificate of incorporation provide that our Board of Directors is authorized to issue preferred stock in one or more series, to establish the number of shares to be included in each such series and to fix the designation, powers, preferences and rights of such shares and any qualifications, limitations or restrictions thereof. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of our Company without further action by the stockholders and may adversely affect the voting and other rights of the holders of common stock. The issuance of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of common stock, including the loss of voting control to others.

| 21 |

Series B Convertible Preferred Stock

General. Our Board of Directors is authorized to issue up to 10,000,000 shares of preferred stock in one or more series without shareholder approval. Our Board of Directors may determine the designations, powers, preferences and the relative, participating, optional or other special rights, and any qualification, limitations and restrictions, of each series of preferred stock. Our Board of Directors has designated 3,750 shares of preferred stock as Series A Convertible Preferred Stock and will designate 10,000 shares of preferred stock as Series B Convertible Preferred Stock, which we refer to herein as the Series B Preferred Stock. As of June 8, 2017, there were no shares of preferred stock outstanding.

Rank. The Series B Preferred Stock ranks (1) on parity with our common stock on an “as converted” basis, (2) on parity with our Series A Convertible Preferred Stock, (3) senior to any series of our capital stock hereafter created specifically ranking by its terms junior to the Series B Preferred Stock, (4) on parity with any series of our capital stock hereafter created specifically ranking by its terms on parity with the Series B Preferred Stock, and (5) junior to any series of our capital stock hereafter created specifically ranking by its terms senior to the Series B Preferred Stock in each case, as to dividends or distributions of assets upon our liquidation, dissolution or winding up whether voluntary or involuntary.

Conversion. Each share of the Series B Preferred Stock is convertible into 666.67 shares of common stock at any time at the option of the holder, provided that the holder will be prohibited from converting Series B Preferred Stock into shares of our common stock if, as a result of such conversion, the holder would own more than 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of the shares of common stock issuable upon conversion of the Series B Preferred Stock, or, at the election of a holder, together with its affiliates, would own more than 9.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of the shares of common stock issuable upon conversion of the Series B Preferred Stock. The conversion rate of the Series B Preferred Stock is subject to proportionate adjustments for stock splits, reverse stock splits and similar events, but is not subject to adjustment based on price anti-dilution provisions.