424B3: Prospectus filed pursuant to Rule 424(b)(3)

Published on April 30, 2021

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-255311

PROSPECTUS

EYEGATE PHARMACEUTICALS, INC.

3,931,112 Shares of Common Stock

This prospectus relates to the possible resale, from time to time, by the selling stockholders identified in this prospectus of up to (i) 1,531,101 shares of our common stock, par value $0.01 per share (the “Common Stock”), initially issued in a private placement (the “Private Placement”), (ii) 1,531,101 shares of Common Stock underlying warrants issued in the Private Placement, (iii) 856,320 shares of Common Stock issued in connection with our acquisition in December 2020 of Panoptes Pharma Ges.m.b.H. (the “Panoptes Acquisition”), and (iv) 12,590 shares of Common Stock issuable upon conversion of 44.445 shares of Series D Convertible Preferred Stock issued in connection with the Panoptes Acquisition.

The selling stockholders may offer the shares from time to time as each selling stockholder may determine through public or private transactions or through other means described in the section entitled “Plan of Distribution” or a supplement to this prospectus. Each selling stockholder may also sell shares under Rule 144 under the Securities Act of 1933, as amended, if available, rather than under this prospectus.

The registration of these shares does not necessarily mean that any holders will sell any of their shares or exercise their warrants. We are not offering for sale any shares of our Common Stock pursuant to this prospectus. We will not receive any proceeds from the sale of these shares. We will, however, receive cash proceeds equal to the total exercise price of warrants that are exercised for cash.

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “EYEG.” On April 29, 2021, the closing price for our Common Stock, as reported on The Nasdaq Capital Market, was $4.10 per share.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this prospectus beginning on page 8, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is April 30, 2021.

TABLE OF CONTENTS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the securities covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the Information Incorporated by Reference herein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the captions “Where You Can Find More Information” and “Incorporation of Information by Reference” in this prospectus.

Neither we nor the selling stockholders have authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

1

The following summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our securities under the heading “Risk Factors,” before investing in our securities. All references to “Company” “we,” “our” or “us” refer solely to EyeGate Pharmaceuticals, Inc. and its subsidiaries and not to the persons who manage us or sit on our Board of Directors (the “Board”).

About EyeGate Pharmaceuticals

Overview

We are a clinical-stage pharmaceutical company developing and commercializing products for treating inflammatory and immune diseases with a focus on the eye and nervous system.

In the fourth quarter of 2020, we acquired Panoptes Pharma Ges.m.b.H. (“Panoptes”), transforming our pipeline with the addition of PP-001, a clinical stage Dihydroorotate Dehydrogenase (“DHODH”) inhibitor. PP-001 is a next-generation, non-steroidal, immuno-modulatory and small-molecule inhibitor of DHODH with what we believe to be best-in-class picomolar potency and a validated immune modulating mechanism designed to overcome the off-target side effects and safety issues typically associated with DHODH inhibitors. PP-001 has been developed in two clinical-stage ophthalmic formulations: PaniJect, an intravitreal injection for inflammatory diseases of the eye including posterior uveitis, and PaniDrop, a novel nano carrier technology eye drop for ocular surface diseases such as conjunctivitis, dry eye disease and others. Other administration routes are also in development and Investigational New Drug (“IND”) enabling studies are underway for conditions outside the ocular space.

In addition, we are developing Ocular Bandage Gel (“OBG”), a modified form of the natural polymer hyaluronic acid, designed to protect the ocular surface to permit re-epithelialization of the cornea and improve ocular surface integrity. OBG, with unique properties that help hydrate and protect the ocular surface, is in clinical evaluation for patients undergoing photorefractive keratectomy (“PRK”) surgery for corneal wound repair after refractive surgery and patients with punctate epitheliopathies (“PE”) as a result of dry eye. We are currently developing OBG as a device, but are evaluating the potential to reclassify OBG as a drug. We attended a type-B meeting with the U.S. Food and Drug Administration’s (“FDA”) Center for Drug Evaluation and Research (“CDER”) division during the first quarter of 2021 to discuss OBG’s path forward as a drug and will continue to evaluate the feedback received as we move towards reaching a decision on the reclassification.

Our Strategy

Our goal is to continue developing products for treating disorders of the eye and to expand development to indications outside of ophthalmology. The key elements of this strategy are to:

| • | Evaluate the current clinical development programs in ophthalmology of the newly acquired small molecule, PP-001. This includes PaniJect for retinal diseases and PaniDrop for diseases of the ocular surface, which have completed dose-ascending human clinical safety studies in Europe. |

| • | Evaluate the research and development programs for other routes of administration of PP-001, specifically outside of ophthalmology. We are assessing a broad range of potential therapeutic areas including oncology, autoimmune disease, and viral infection. |

| • | Finalize the evaluation to determine reclassification of OBG from a device to a drug. This includes assessing the feedback from a type-B meeting with the FDA’s CDER division during the first quarter of 2021. |

| • | Continue clinical development of OBG for the treatment of dry eye disease. In the first quarter of 2020, we announced positive topline data in our follow-on pilot study, which evaluated several different exploratory endpoints. |

| • | We completed clinical development as a device for the indication of wound healing in patients who have undergone PRK surgery. We will assess the path forward for this indication if OBG is reclassified as a drug. |

| • | Pursue strategic collaborations. We plan to evaluate opportunities to enter collaborations that may contribute to our ability to advance our product candidates and to progress concurrently a range of discovery and development programs. We also plan to evaluate opportunities to in-license or acquire the rights to other products, product candidates, or technologies. |

2

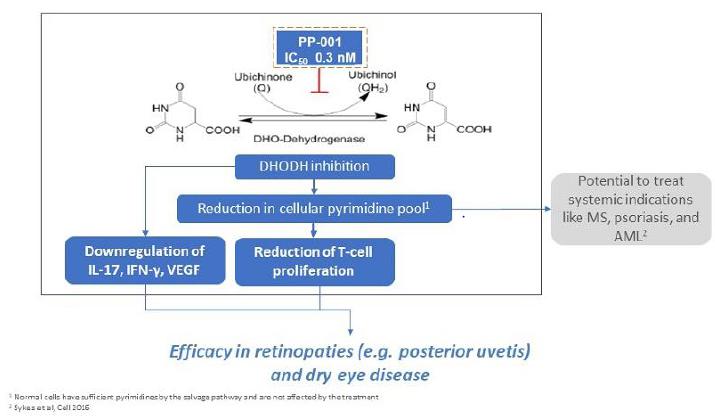

PP-001 Overview

PP-001 is a third-generation small molecule DHODH inhibitor. DHODH is extensively exploited as potential drug targets for immunological disorders, oncology, and infectious diseases. DHODH is a key enzyme in the de novo pyrimidine synthesis pathway. This enzyme is located in the mitochondria and catalyzes the conversion of dihydroorotate (“DHO”) to orotate as the fourth step in the de novo synthesis of pyrimidines that are ultimately used in the production of nucleotides.

Nucleotides are required for cell growth and replication. Nucleotides are the activated precursors of nucleic acids and are necessary for the replication of the genome and the transcription of the genetic information into RNA. Nucleotides also serve as an energy source for a more select group of biological processes (ATP and GTP). They also play a role in the formation of glycogen, signal-transduction pathways, and as components of co-enzymes (NAD and FAD). An ample supply of nucleotides in the cell is essential for all cellular processes.

There are two pathways for the biosynthesis of nucleotides: salvage and de novo. The main difference is where the nucleotide bases come from. In the salvage pathway, the bases are recovered (salvaged) from RNA and DNA degradation. In the de novo pathway, the bases are assembled from simple precursor molecules (made from scratch).

One critical requirement of fast-growing or proliferating cells, such as the expansion of activated B and T-cells, cancer cells, and pathogen infected host cells, is the requirement of an abundance of nucleotide bases. These metabolic activities will predominately utilize the de novo pathway for nucleotide biosynthesis. A key advantage of DHODH inhibition is the selectivity towards metabolically activated cells (with a high need for RNA and DNA production), which should mitigate any negative impact on normal cells. Depletion of cellular pyrimidine pools through the selective inhibition of DHODH has been shown to be a successful approach for therapeutic development.

Currently, two first generation DHODH inhibitors have been approved in the U.S. and abroad and are marketed by Sanofi as leflunomide (Arava®) and the active metabolite teriflunomide (Aubagio®). These oral tablets are approved for the treatment of rheumatoid and psoriatic arthritis and multiple sclerosis (“MS”), respectively. Both diseases are autoimmune disorders. One potential explanation for the therapeutic effects of Arava® in arthritis is the reduction in the numbers or reactivity of activated T-cells, which are involved in the pathogenesis of arthritis. The generally accepted view of human MS pathogenesis implicates peripheral activation of myelin-specific autoreactive T-cells that lead to inflammatory disease in the central nervous system (“CNS”). By blocking the de novo pyrimidine synthesis pathway via DHODH inhibition, it is suggested that Aubagio® reduces T-cell proliferation in the periphery. Arava® and Aubagio® are formulated as oral drugs and it is established that leflunomide will be metabolized in the liver to the active metabolite teriflunomide. Hepatotoxicity was reported as a major side effect after oral administration, possibly as a result of extensive liver metabolization. Moreover, it was shown that apart from DHOHD, a series of protein kinases are inhibited by Arava® and Aubagio®.

3

PP-001 was identified as a promising novel third generation DHODH inhibitor, with a half-maximal inhibitory concentration IC50-value of 0.3 nM. Based on internal work completed, we believe that this is more than 1,000-fold more potent than teriflunomide (IC50 DHODH 415 nM). Furthermore, PP-001 represses the expression of key pro-inflammatory cytokines such as IL-17, IFN-g,VEGF and others, potentially as a consequence of inhibiting DHODH. IL-17 and IFN-g are the hallmark cytokines expressed by Th1 and Th17 T-cells, respectively, and play a crucial role in initiating the inflammatory processes in several ocular diseases, including non-noninfectious uveitis and dry eye disease. PP-001 is structurally and mechanistically different from Arava®. The IC50 of PP-001 on selected tyrosine kinases, such as PI3K, AKT and JAK, is more than 10,000-fold above the IC50 of PP-001 for DHODH. In general, side effects are not expected and have not been observed to date in animal and human studies after PP-001 administration.

Despite the fact that the DHODH protein is ubiquitously expressed in most cells, malignant cells seem to be more metabolically dependent on de novo pyrimidine production, forming the potential basis of a therapeutic window. Inhibiting DHODH alone or in combination with standard-of-care has been shown to be very active in a series of different in vivo cancer models for AML, breast, lung, and others.

Additionally, viral replication and viral cell metabolism is dependent on a large nucleotide pool. Therefore, PP-001 demonstrates antiviral efficacy, which is likely due to pyrimidine depletion caused by DHODH inhibition. The postulated DHODH directed mode of action of PP-001 is underlined by reversibility of the antiviral activity by co-application of uridine or other pyrimidine precursors.

The postulated mode of action of PP-001 is depicted below.

4

OBG Overview

OBG is a synthetic modified hyaluronic acid (“HA”) capable of coating the ocular surface and designed to resist degradation under conditions present in the eye. This prolongs residence time of the bandage on the ocular surface, thereby addressing the limitations of current non-cross-linked hyaluronic acid formulations. Additionally, cross-linking allows the product’s viscosity to be modified to meet optimum ocular needs. The increased viscosity and non-covalent muco-adhesive interfacial forces improve residence time in the tear film, thus providing a coating that aids and promotes re-epithelization of the ocular surface via physical protection. If OBG is approved by the FDA, we expect that it will be the only prescription eye drop available in the U.S. based on HA.

OBG exhibits significant shear thinning properties. This feature allows the modified HA to act as a more concentrated, viscous barrier at low shear rates in a resting tear film, but also as a lower resistance fluid (therefore thinned) during high shear events such as blinking. This property enables better residence time and a more favorable ocular surface coating with less optical blur. We have demonstrated in animal studies that OBG remains on the ocular surface for up to two hours and further demonstrated in a human clinical study that OBG does not cause blurriness while on the ocular surface. This enhances ocular surface protection and patient comfort.

OBG has been shown to provide a mechanical barrier that aids in the management of corneal epithelial defects and re-epithelization in both preclinical studies and in clinical ophthalmic veterinary use. As such, PRK surgery was chosen as the subject population which is best suited to demonstrate this effect. PRK is an efficacious alternative to patients seeking surgical correction of refractive errors who are not suitable candidates for laser in situ keratomileusis (“LASIK”) due to inadequate corneal thickness, larger pupil size, history of keratoconjunctivitis sicca (“KCS”), or anterior basement membrane disease. OBG has demonstrated statistical significance in a pivotal clinical study for its ability to accelerate wound healing against the current standard-of-care, a bandage contact lens.

We believe that OBG can be used for the management of a variety of large and small corneal epithelial defects including PE, which also includes dry eye. PE is an early sign of epithelial compromise and is associated with a variety of pathologic ocular inflammatory conditions including ocular causes, as well as systemic diseases. This ocular surface condition is common and may represent areas of epithelial cell damage and loss and therefore stain positively with fluorescein. Causes can include dry eye, acute and chronic bacterial and viral conjunctivitis, trauma, contact lens wear (tight lens syndrome), chemical irritation and burns, diabetic and infectious neuropathies, chemotherapy, and corneal abrasion. OBG demonstrated its ability to reduce corneal staining, which occurs when the compromised corneal epithelial defects heal, in a pilot study in dry eye patients when compared against Refresh® lubricating eye drops.

Corporate Information

Our principal executive offices are located at 271 Waverley Oaks Road, Suite 108, Waltham, MA 02452, and our telephone number is (781) 788-8869. Our website address is www.eyegatepharma.com. Our website and the information contained in, or accessible through, our website will not be deemed to be incorporated by reference into this prospectus and does not constitute part of this prospectus. You should not rely on any such information in making your decision whether to purchase our securities.

Recent Developments

Panoptes Acquisition

On December 18, 2020, we entered into a Share Purchase Agreement (the “Purchase Agreement”) with the shareholders of Panoptes Pharma Ges.m.b.H. (“Panoptes”). Pursuant to and simultaneously with the execution of the Purchase Agreement, we acquired all of the outstanding equity interests of Panoptes, and Panoptes became our wholly-owned subsidiary (the “Panoptes Acquisition”).

The consideration paid by us to the former shareholders of Panoptes at closing in connection with the Panoptes Acquisition, after adjustment as provided in the Purchase Agreement and including consideration paid to Panoptes’ financial advisor, was comprised of (i) 884,222 shares of Common Stock, (ii) 45.8923 shares of Series D Convertible Preferred Stock convertible, subject to stockholder approval, into an aggregate of 13,000 shares of Common Stock, and (iii) cash payments in an aggregate amount of approximately $220,577 to certain former Panoptes shareholders. Additionally, 1,500 shares of Series D Convertible Preferred Stock convertible into an aggregate of approximately 424,685 shares of Common Stock will be issued after a period of 18 months subject to adjustments for potential post-closing working capital and/or indemnification claims relating to breaches of representations, warranties and covenants contained in the Purchase Agreement.

5

The Series D Convertible Preferred Stock has a stated value of $1,000 per share and a conversion price of $3.5321 per share, but may not be converted until stockholder approval is obtained. The Series D Preferred Stock is only entitled to dividends in the event dividends are paid on shares of Common Stock and does not have any preferences over shares of our Common Stock or any voting rights, except in limited circumstances.

In addition to the consideration set forth above, the former Panoptes shareholders are eligible to receive up to $9.5 million in milestone payments, with $4.75 million being payable upon the enrollment and randomization of a first patient into the first Phase III pivotal study of a Panoptes product with the U.S. Food and Drug Administration (the “FDA”) and $4.75 million being payable upon approval of the first New Drug Application by the FDA with respect to a Panoptes product, subject to certain set-off rights as descried in the Purchase Agreement. In each case, we may elect to pay the applicable milestone payment either (i) in cash, or (ii) by issuing shares of Series D Convertible Preferred Stock.

Private Placement

On January 6, 2021, we completed a private placement of 1,531,101 shares of Common Stock and warrants to purchase up to 1,531,101 shares of Common Stock (the “Private Placement”) to Armistice Capital Master Fund, Ltd. (“Armistice”), with a combined purchase price per share and warrant of $5.225. The total gross proceeds from the Private Placement were approximately $8.0 million. The warrants have an exercise price of $5.225 per share, subject to adjustments as provided under the terms of the warrants, and will be exercisable on the six month anniversary of their issuance date. The warrants are exercisable for five years from the issuance date.

The shares of Common Stock, the warrants and the shares of Common Stock issuable upon the exercise of the warrants issued in the Private Placement, and the shares of Common Stock, Series D Convertible Preferred Stock and shares of common stock issuable upon conversion of the Series D Convertible Preferred Stock issued in the Panoptes Acquisition, were in each case sold and issued without registration under the Securities Act in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and Rule 506 promulgated under the Securities Act as sales to accredited investors, and in reliance on similar exemptions under applicable state laws.

This prospectus relates to the resale of (i) 1,531,101 shares of Common Stock issued in the Private Placement, (ii) 1,531,101 shares of Common Stock underlying warrants issued in the Private Placement, (iii) 856,320 shares of Common Stock issued in connection with the Panoptes Acquisition, and (iv) 12,590 shares of Common Stock issuable upon conversion of 44.445 shares of Series D Convertible Preferred Stock issued in connection with the Panoptes Acquisition.

6

We are registering for resale by the selling stockholders named herein an aggregate of 3,931,112 shares of our Common Stock as described below.

| Securities being offered: | 3,931,112 shares of our Common Stock, including (i) 1,531,101 shares of Common Stock issued to Armistice in the Private Placement, (ii) 1,531,101 shares of Common Stock underlying warrants issued to Armistice in the Private Placement, (iii) 856,320 shares of Common Stock issued to certain selling stockholders in connection with the Panoptes Acquisition, and (iv) 12,590 shares of Common Stock issuable upon conversion of 44.445 shares of Series D Convertible Preferred Stock issued to certain selling stockholders in connection with the Panoptes Acquisition. | |

| Use of proceeds: | We will not receive any of the proceeds from the sale or other disposition of shares of our Common Stock by the selling stockholder. We may receive proceeds upon any exercise for cash of outstanding warrants, in which case such proceeds will be used for working capital and other general corporate purposes. See “Use of Proceeds” on page 11. | |

| Market for common stock: | Our Common Stock is listed on The Nasdaq Capital Market under the symbol “EYEG.” On April 29, 2021, the last reported sale price of our Common Stock on The Nasdaq Capital Market was $4.10. | |

| Risk Factors | This investment involves a high degree of risk. See the information contained in or incorporated by reference under “Risk Factors” beginning on page 8 of this prospectus and in the documents incorporated by reference into this prospectus. |

7

Investing in our securities involves a high degree of risk. You should carefully consider the risks described herein and in the documents incorporated by reference in this prospectus and any prospectus supplement, as well as other information we include or incorporate by reference into this prospectus and any applicable prospectus supplement, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described herein and in the documents incorporated herein by reference, including (i) our most recent annual report on Form 10-K which is on file with the SEC and is incorporated herein by reference and (ii) other documents we file with the SEC that are deemed incorporated by reference into this prospectus.

8

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains, and the documents incorporated herein by reference contain, forward-looking statements that involve risks and uncertainties. The forward-looking statements are contained principally in the sections of this prospectus and the documents incorporated herein by reference under the captions “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” In some cases, you can identify forward-looking statements by terms such as “may,” “might,” “will,” “objective,” “intend,” “should,” “seek,” “aim,” “think,” “optimistic,” “strategy,” “goals,” “sees,” “new,” “guidance,” “future,” “continue,” “drive,” “growth,” “long-term,” “develop,” “possible,” “emerging,” “opportunity,” “pursue,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “target,” “design,” “estimate,” “predict,” “potential,” “plan” or the negative of these terms, and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| • | the timing and success of preclinical studies and clinical trials conducted by us and our development partners; | |

| • | the ability to obtain and maintain regulatory approval of our product candidates, and the labeling for any approved products; | |

| • | the scope, progress, expansion, and costs of developing and commercializing our product candidates; | |

| • | the size and growth of the potential markets for our product candidates and the ability to serve those markets; | |

| • | our expectations regarding our expenses and revenue, the sufficiency of our cash resources and needs for additional financing; | |

| • | the rate and degree of market acceptance of any of our product candidates; | |

| • | our expectations regarding competition; | |

| • | our anticipated growth strategies; | |

| • | our ability to attract or retain key personnel; | |

| • | our ability to establish and maintain development partnerships; | |

| • | our expectations regarding federal, state and foreign regulatory requirements; | |

| • | regulatory developments in the U.S. and foreign countries; | |

| • | our ability to obtain and maintain intellectual property protection for our product candidates; | |

| • | the anticipated trends and challenges in our business and the market in which we operate; | |

| • | the impact of the evolving COVID-19 pandemic and the global response thereto; and | |

| • | our use of proceeds from this offering. |

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

Any forward-looking statement made by us in this prospectus speaks only as of the date on which it is made. Except as required by law, we assume no obligation to update these statements publicly, or to update the reasons actual results could differ materially from those anticipated in these statements, even if new information becomes available in the future. These forward-looking statements represent our estimates and assumptions only as of the date of this prospectus.

Unless required by U.S. federal securities laws, we do not intend to update any of these forward-looking statements to reflect circumstances or events that occur after the statement is made.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

9

We will receive no proceeds from the sale of shares of Common Stock by the selling stockholders.

A portion of the shares of Common Stock covered by this prospectus are issuable upon exercise of warrants issued to Armistice. The exercise price of the outstanding warrants is $5.225 per share. The exercise price and number of shares of Common Stock issuable upon exercise of the warrants may be adjusted in certain circumstances, including stock splits or dividends, mergers, or reclassifications or similar events. Upon any exercise of outstanding warrants, the applicable selling stockholder will pay us the exercise price.

To the extent we receive proceeds from the cash exercise of outstanding warrants, we intend to use the proceeds for working capital and other general corporate purposes.

10

The table below sets forth information concerning the resale of our shares by the selling stockholders. Armistice acquired its securities being registered hereunder in the Private Placement. All other stockholders acquired their securities being registered hereunder in connection with the Panoptes Acquisition. The total number of shares of Common Stock sold under this prospectus may be adjusted to reflect adjustments due to stock dividends, stock distributions, splits, combinations or recapitalizations with regard to the Common Stock and warrants. Unless otherwise stated below in the footnotes, to our knowledge, neither the selling stockholders, nor any affiliate of such stockholders: (i) has held any position or office with us during the three years prior to the date of this prospectus; or (ii) is a broker-dealer, or an affiliate of a broker-dealer.

Armistice may exercise its warrants at any time in its sole discretion. Set forth below is the name of each selling stockholder and the amount and percentage of Common Stock owned by such selling stockholder (including shares which such stockholder has the right to acquire within 60 days, including upon exercise of warrants) prior to the offering, the shares to be sold in the offering, and the amount and percentage of Common Stock to be owned by each selling stockholder (including shares which such stockholder has the right to acquire within 60 days, including upon exercise of warrants) after the offering assuming all shares are sold. The footnotes provide information about persons who have voting and dispositive power with respect to shares held by the selling stockholder.

We have registered up to 3,931,112 shares of our Common Stock, including 1,531,101 shares of Common Stock underlying warrants to purchase Common Stock issued to Armistice in connection with the Private Placement and 12,590 shares of Common Stock issuable upon conversion of 44.445 shares of Series D Convertible Preferred Stock issued to certain selling stockholders in connection with the Panoptes Acquisition. See “Prospectus Summary” above.

11

The following table is based on information provided to us by the selling stockholders and is as of April 1, 2021. Each selling stockholder may sell all or some of the shares of Common Stock it is offering, and may sell, unless indicated otherwise in the footnotes below, shares of our Common Stock otherwise than pursuant to this prospectus. The tables below assume that each selling stockholder sells all of the shares offered by it in offerings pursuant to this prospectus, and does not acquire any additional shares. We are unable to determine the exact number of shares that will actually be sold or when or if these sales will occur.

|

Name of Selling Stockholders |

Shares Beneficially Owned Pre- Offering (1) |

Common Stock Offered in this Offering |

Number of Shares Post- Offering |

% of Shares Post-Offering (2) |

||||||||||||

| Armistice Capital Master Fund Ltd. (3) | 4,799,101 | 3,062,202 | 3,268,000 | 38.2 | % | |||||||||||

| Franz Obermayr (4) | 103,106 | 103,106 | — | — | ||||||||||||

| Stefan Sperl (5) | 101,408 | 101,408 | — | — | ||||||||||||

| Bernd Mühlenweg (6) | 12,903 | 12,903 | — | — | ||||||||||||

| Dr. Wilfried Scheschy Beratung und Beteiligungen GmbH (7) | 12,644 | 12,644 | — | — | ||||||||||||

| Werner Lanthaler (8) | 31,941 | 31,941 | — | — | ||||||||||||

| Philipp Harmer (9) | 7,949 | 7,949 | — | — | ||||||||||||

| Johannes Gobertus Meran (10) | 7,732 | 7,732 | — | — | ||||||||||||

| Aws Gründerfonds Beteiligungs GmbH & Co KG (11) | 247,898 | 247,898 | — | — | ||||||||||||

| unicornio GmbH (12) | 12,749 | 12,749 | — | — | ||||||||||||

| Perpetuum Mobile GmbH (13) | 26,312 | 26,312 | — | — | ||||||||||||

| ACP2015.eins GmbH & Co KG (14) | 72,220 | 72,220 | — | — | ||||||||||||

| ACP2016 GmbH & Co KG (15) | 102,955 | 102,955 | — | — | ||||||||||||

| ACP2016.eins GmbH & Co KG (16) | 67,059 | 67,059 | — | — | ||||||||||||

| ACP2017 GmbH & Co KG (17) | 62,034 | 62,034 | — | — | ||||||||||||

| TOTAL | 5,668,011 | 3,931,112 | 3,268,000 | 38.2 | % | |||||||||||

| * |

Less than one percent of shares outstanding.

|

| (1) | Beneficial ownership includes shares of Common Stock as to which a person or group has sole or shared voting power or dispositive power. Shares of Common Stock registered hereunder, as well as shares of common stock subject to options, warrants or convertible preferred stock that are exercisable or convertible within 60 days of April 1, 2021, are deemed outstanding for purposes of computing the number of shares beneficially owned and percentage ownership of the person or group holding such shares of Common Stock, options, warrants or convertible securities, but are not deemed outstanding for computing the percentage of any other person |

| (2) | Percentages are based on 7,097,912 shares of Common Stock outstanding as of April 1, 2021. |

| (3) | This information is based solely upon an amended Schedule 13D filed jointly by Armistice Capital, LLC (“Armistice Capital”), Armistice Capital Master Fund, Ltd. (“Armistice”) and Steven Boyd with Securities and Exchange Commission on January 12, 2021 and (ii) a Form 4 filed jointly by Armistice Capital, Armistice and Steven Boyd with the Securities and Exchange Commission on January 8, 2021. Consists of (i) 3,346,601 shares owned by Armistice, (ii) 600,000 currently exercisable warrants held by Armistice (which amount does not include 1,531,101 warrants issued in the Private Placement that become exercisable on June 18, 2021 and an additional 1,602,085 warrants that are subject to blocker provisions that prevent Armistice from exercising the warrants if it would be more than a 4.99% or 9.99% (as applicable) beneficial owner of the Common Stock following any such exercise); and (iii) 4,092 shares of Series C Convertible Preferred Stock held by Armistice that are currently convertible into 852,500 shares of Common Stock. Armistice Capital and Steven Boyd have voting and investment power with respect to such shares. Mr. Boyd is a member of our Board of Directors. Armistice Capital, LLC and Steven Boyd disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. |

12

| (4) | Includes 101,613 shares of Common Stock and 1,493 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (5) | Includes 99,939 shares of Common Stock and 1,469 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (6) | Includes 12,715 shares of Common Stock and 188 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (7) | Includes 12,460 shares of Common Stock and 184 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (8) | Includes 31,478 shares of Common Stock and 463 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (9) | Includes 7,833 shares of Common Stock and 116 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (10) | Includes 7,619 shares of Common Stock and 113 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (11) | Includes 244,310 shares of Common Stock and 3,588 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (12) | Includes 12,563 shares of Common Stock and 186 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (13) | Includes 25,930 shares of Common Stock and 382 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (14) | Includes 71,174 shares of Common Stock and 1,046 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (15) | Includes 101,464 shares of Common Stock and 1,491 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (16) | Includes 66,087 shares of Common Stock and 972 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

| (17) | Includes 61,135 shares of Common Stock and 899 shares of Common Stock that are issuable upon the conversion of shares of Series D Convertible Preferred Stock. |

Participation of Directors and Officers

Certain of the selling stockholders currently serve as officers and/or

members of our Board of Directors, including Franz Obermayr, our Acting Chief Executive Officer, Stefan Sperl, our Executive Vice President

– CMC and Operations, and each of Steven Boyd and I. Keith Maher, members of the Board. Mr. Boyd is the Chief Investment Officer

of Armistice Capital, and as such Mr. Boyd may be deemed to beneficially own shares held by Armistice. Additionally, I. Keith Maher, a

member of our Board of Directors, is a Managing Director of Armistice Capital

13

The selling stockholders, which for this purpose includes donees, pledgees, transferees or other successors-in-interest selling shares of Common Stock or interests in shares of Common Stock received after the date of this prospectus from the selling stockholders as a gift, pledge, dividend, distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded, or in private transactions. These sales or other dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders may use any one or more of the following methods when selling our shares or interests in our shares:

| • | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| • | block trades in which a broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| • | on any national securities exchange or quotation service on which the shares may be listed or quoted at the time of sale; |

| • | privately negotiated transactions; |

| • | short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| • | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| • | broker-dealers may agree with a selling stockholder to sell a specified number of such shares at a stipulated price per share; |

| • | a combination of any such methods of sale; and |

| • | any other method permitted by applicable law. | ||

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of our shares owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders may also transfer our shares in other circumstances, in which case the transferees, pledgees or other successors will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our shares of Common Stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our shares in the course of hedging the positions they assume. The selling stockholders may also sell shares of our Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

14

The aggregate proceeds to the selling stockholders from the sale of the Common Stock offered by them will be the purchase price of the Common Stock less discounts or commissions, if any. The selling stockholders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents. We will not receive any of the proceeds from sales of shares by the selling stockholders.

The selling stockholders may also resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or under Section 4(a)(1) of the Securities Act, if available, rather than by means of this prospectus.

In connection with the sale of shares of Common Stock covered by this prospectus, broker-dealers may receive commissions or other compensation from the selling stockholders in the form of commissions, discounts or concessions. Broker-dealers may also receive compensation from purchasers of the shares of Common Stock for whom they act as agents or to whom they sell as principals or both. Compensation as to a particular broker-dealer may be in excess of customary commissions or in amounts to be negotiated. In connection with any underwritten offering, underwriters may receive compensation in the form of discounts, concessions or commissions from a selling stockholder or from purchasers of the shares for whom they act as agents. Underwriters may sell the shares of Common Stock to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents. Any underwriters, broker-dealers, agents or other persons acting on behalf of a selling stockholder that participate in the distribution of the shares of Common Stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any profit on the sale of the shares of Common Stock by them and any discounts, commissions or concessions received by any of those underwriters, broker-dealers, agents or other persons may be deemed to be underwriting discounts and commissions under the Securities Act. The aggregate amount of compensation in the form of underwriting discounts, concessions, commissions or fees and any profit on the resale of shares by the selling stockholders that may be deemed to be underwriting compensation pursuant to Financial Industry Regulatory Authority, Inc., rules and regulations will not exceed applicable limits.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the Common Stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(a)(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities, including but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act.

To the extent required, the shares of our Common Stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agent, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Common Stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Common Stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act. All of the foregoing may affect the marketability of the Common Stock and the ability of any person or entity to engage in market-making activities with respect to our Common Stock.

15

We will pay all expenses of the registration of the Common Stock for resale by the selling stockholders, including, without limitation, filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that the selling stockholders will pay all underwriting discounts and selling commissions, if any, and any related legal expenses incurred by them.

DETERMINATION OF OFFERING PRICE

The prices at which the shares of Common Stock covered by this prospectus may actually be sold will be determined by the prevailing public market price for shares of Common Stock, by negotiations between the selling stockholders and buyers of our Common Stock in private transactions or as otherwise described in “Plan of Distribution.”

16

General

Our authorized capital stock consists of 50,000,000 shares of Common Stock, par value $0.01 per share, and 10,000,000 shares of preferred stock, par value $0.01 per share, of which 3,750 are designated as Series A Convertible Preferred Stock, 10,000 are designated as Series B Convertible Preferred Stock, 10,000 are designated as Series C Convertible Preferred Stock and 20,000 are designated as Series D Convertible Preferred Stock. The following description summarizes some of the terms of our restated certificate of incorporation and amended and restated bylaws, but does not purport to be complete and is qualified in its entirety by the provisions of our restated certificate of incorporation and amended and restated bylaws, copies of which have been filed as exhibits to the registration statement of which this prospectus is a part.

There were 7,097,912 shares of our Common Stock, no shares of our Series A Preferred Stock or Series B Preferred Stock, and 4,092 shares of our Series C Convertible Preferred Stock (convertible into an aggregate of 852,500 shares of Common Stock) and 45.8923 shares of our Series D Convertible Preferred Stock (convertible into an aggregate of 13,000 shares of Common Stock) outstanding as of April 29, 2021, assuming no exercise of outstanding options or warrants. There were approximately 61 holders of record of our Common Stock as of April 29, 2021. This number does not include beneficial owners whose shares are held in street name.

As of April 29, 2021, there were 377,857 shares of Common Stock subject to outstanding options and 4,247,384 shares of Common Stock subject to outstanding warrants.

Common Stock

Voting Rights. Each holder of Common Stock is entitled to one vote for each share of Common Stock held on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise provided by law or our restated certificate of incorporation or bylaws, all matters other than the election of directors submitted to the stockholders at any meeting shall be decided by the affirmative vote of a majority of the outstanding shares of Common Stock present in person or represented by proxy at the meeting and entitled to vote thereon. Directors are elected by a plurality of the votes cast at the meeting. Our restated certificate of incorporation and amended and restated bylaws do not provide for cumulative voting rights. Because of this, the holders of a majority of the shares of Common Stock entitled to vote in any election of directors can elect all of the directors standing for election, if they should so choose.

Dividends. Subject to preferences that may be applicable to any then outstanding preferred stock, the holders of our outstanding shares of Common Stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of legally available funds. At present, we have no plans to issue dividends.

Liquidation. In the event of our liquidation, dissolution or winding up, holders of Common Stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities, subject to the satisfaction of any liquidation preference granted to the holders of any outstanding shares of preferred stock.

Other Rights and Preferences. Holders of our Common Stock have no preemptive, conversion or subscription rights, and there are no redemption or sinking fund provisions applicable to our Common Stock. The rights, preferences and privileges of the holders of Common Stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of our preferred stock that we may designate and issue in the future.

Fully Paid and Nonassessable. All of our outstanding shares of Common Stock are fully paid and nonassessable.

17

Forum Selection. Our Restated Certificate of Incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim for breach of a fiduciary duty owed by any of our directors, officers or employees to us or our stockholders, (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, our Restated Certificate of Incorporation or our bylaws or (iv) any action asserting a claim governed by the internal affairs doctrine. This provision would not apply to suits brought to enforce a duty or liability created by the Exchange Act, Securities Act, or, in each case, the rules and regulations thereunder, or any other claim for which the U.S. federal courts have exclusive jurisdiction.

Provisions in our restated certificate of incorporation provide that our board of directors is authorized to issue preferred stock in one or more series, to establish the number of shares to be included in each such series and to fix the designation, powers, preferences and rights of such shares and any qualifications, limitations or restrictions thereof. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of our company without further action by the stockholders and may adversely affect the voting and other rights of the holders of Common Stock. The issuance of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of Common Stock, including the loss of voting control to others. At present, we have no plans to issue any additional preferred stock.

Anti-Takeover Effects of Delaware Law and Our Certificate of Incorporation and Bylaws

Some provisions of Delaware law, our restated certificate of incorporation and our amended and restated bylaws contain provisions that could make the following transactions more difficult: an acquisition of us by means of a tender offer; an acquisition of us by means of a proxy contest or otherwise; or the removal of our incumbent officers and directors. It is possible that these provisions could make it more difficult to accomplish or could deter transactions that stockholders may otherwise consider to be in their best interest or in our best interests, including transactions which provide for payment of a premium over the market price for our shares.

These provisions, summarized below, are intended to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors. We believe that the benefits of the increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging these proposals because negotiation of these proposals could result in an improvement of their terms.

Undesignated Preferred Stock. The ability of our board of directors, without action by the stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with voting or other rights or preferences as designated by our board of directors could impede the success of any attempt to change control of us. These and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of our company.

Stockholder Meetings. Our amended and restated bylaws provide that a special meeting of stockholders may be called only by our chairman of the board or chief executive officer (or president, if there is no chief executive officer), or by a resolution adopted by a majority of our board of directors.

Requirements for Advance Notification of Stockholder Nominations and Proposals. Our amended and restated bylaws establish advance notice procedures with respect to stockholder proposals to be brought before a stockholder meeting and the nomination of candidates for election as directors, other than nominations made by or at the direction of the board of directors or a committee of the board of directors.

Elimination of Stockholder Action by Written Consent. Our restated certificate of incorporation and amended and restated bylaws eliminate the right of stockholders to act by written consent without a meeting.

Staggered Board. Our board of directors is divided into three classes. The directors in each class serve for a three-year term, one class being elected each year by our stockholders. This system of electing and removing directors may tend to discourage a third-party from making a tender offer or otherwise attempting to obtain control of us, because it generally makes it more difficult for stockholders to replace a majority of the directors.

18

Removal of Directors. Our restated certificate of incorporation provides that no member of our board of directors may be removed from office by our stockholders except for cause and, in addition to any other vote required by law, upon the approval of not less than two-thirds (2/3) of the total voting power of all of our outstanding voting stock then entitled to vote in the election of directors.

Stockholders Not Entitled to Cumulative Voting. Our restated certificate of incorporation does not permit stockholders to cumulate their votes in the election of directors. Accordingly, the holders of a majority of the outstanding shares of our Common Stock entitled to vote in any election of directors can elect all of the directors standing for election, if they choose, other than any directors that holders of our preferred stock may be entitled to elect.

Delaware Anti-Takeover Statute. We are subject to Section 203 of the Delaware General Corporation Law, which prohibits persons deemed to be “interested stockholders” from engaging in a “business combination” with a publicly held Delaware corporation for three years following the date these persons become interested stockholders unless the business combination is, or the transaction in which the person became an interested stockholder was, approved in a prescribed manner or another prescribed exception applies. Generally, an “interested stockholder” is a person who, together with affiliates and associates, owns, or within three years prior to the determination of interested stockholder status did own, 15% or more of a corporation’s voting stock. Generally, a “business combination” includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. The existence of this provision may have an anti-takeover effect with respect to transactions not approved in advance by the board of directors.

Amendment of Charter Provisions. The amendment of any of the above provisions, except for the provision making it possible for our board of directors to issue preferred stock, would require approval by holders of at least 66 2/3% of the total voting power of all of our outstanding voting stock.

The provisions of Delaware law, our restated certificate of incorporation and our amended and restated bylaws could have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they may also inhibit temporary fluctuations in the market price of our Common Stock that often result from actual or rumored hostile takeover attempts. These provisions may also have the effect of preventing changes in the composition of our board and management. It is possible that these provisions could make it more difficult to accomplish transactions that stockholders may otherwise deem to be in their best interests.

Transfer Agent and Registrar

The transfer and warrant agent and registrar for our Common Stock is VStock Transfer, LLC.

Listing

Our shares of Common Stock are quoted on The Nasdaq Capital Market under the symbol “EYEG.”

19

Certain legal matters in connection with this offering will be passed upon for us by Burns & Levinson LLP, Boston, Massachusetts.

The consolidated balance sheets of EyeGate Pharmaceuticals, Inc. and subsidiary as of December 31, 2020 and 2019, and the related consolidated statements of operations and comprehensive loss, stockholders’ equity (deficit), and cash flows for each of the years then ended, have been audited by EisnerAmper LLP, independent registered public accounting firm, as stated in their report, which is incorporated herein by reference, which report includes an explanatory paragraph about the existence of substantial doubt concerning the Company’s ability to continue as a going concern. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Exchange Act and, in accordance therewith, file annual, quarterly and special reports, proxy statements and other information with the SEC. These documents may be accessed through the SEC’s electronic data gathering, analysis and retrieval system, or EDGAR, via electronic means, including the SEC’s home page on the Internet (www.sec.gov).

We have the authority to designate and issue more than one class or series of stock having various preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends, qualifications, and terms and conditions of redemption. We will furnish a full statement of the relative rights and preferences of each class or series of our stock which has been so designated and any restrictions on the ownership or transfer of our stock to any shareholder upon request and without charge. Written requests for such copies should be directed to EyeGate Pharmaceuticals, Inc., 271 Waverley Oaks Road, Suite 108, Waltham, MA 02452, or by telephone request to (781) 788-8869. Our website is located at http://www.eyegatepharma.com. Information contained on our website is not incorporated by reference into this prospectus and, therefore, is not part of this prospectus or any accompanying prospectus supplement.

20

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate by reference the information and reports we file with them under File No. 001-36672, which means that we can disclose important information to you by referring you to those publicly available documents. The information incorporated by reference is an important part of this prospectus supplement, and information that we file later with the SEC will automatically update and supersede the information already incorporated by reference. We are incorporating by reference the documents listed below, which we have already filed with the SEC, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of any future report or document that is not deemed filed under such provisions, until we sell all of the securities:

| • | Our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 25, 2021; | |

| • | Our Current Reports on Form 8-K filed with the SEC on December 21, 2020 (and the amendment thereto filed with the SEC on March 5, 2021), January 6, 2021, February 1, 2021 and April 1, 2021; and | |

| • | The description of our Common Stock contained in our registration statement on Form 8-A12B filed with the SEC on July 28, 2015 and amended on July 30, 2015 |

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus is modified or superseded for purposes of the prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement.

Upon request, we will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered a copy of the documents incorporated by reference into this prospectus. You may request a copy of these filings, and any exhibits we have specifically incorporated by reference as an exhibit in this prospectus, at no cost by writing or telephoning us at the following address:

EyeGate Pharmaceuticals, Inc.

271 Waverley Oaks Road, Suite 108

Waltham, MA 02452

Telephone: (781) 788-8869.

This prospectus is part of a registration statement we filed with the SEC. We have incorporated exhibits into this registration statement. You should read the exhibits carefully for provisions that may be important to you.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or in the documents incorporated by reference is accurate as of any date other than the date on the front of this prospectus or those documents.

21

EYEGATE PHARMACEUTICALS, INC.

3,931,112 Shares of Common Stock

PROSPECTUS

April 30, 2021