PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 20, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant x | Filed by a Party other than the Registrant ¨ |

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EyeGate Pharmaceuticals, Inc.

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

EYEGATE PHARMACEUTICALS, INC.

271 Waverley Oaks Road, Suite 108

Waltham, MA 02452

May 5, 2021

Dear Stockholder:

I am pleased to invite you to attend the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of EyeGate Pharmaceuticals, Inc. (“EyeGate”) to be held on Thursday, June 24, 2021 at 1:00 p.m. Eastern Time, at the offices of EyeGate at 271 Waverley Oaks Road, Suite 108, Waltham, MA 02452.

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and Proxy Statement. All stockholders are normally invited to attend the Annual Meeting in person. However, based on the ongoing coronavirus pandemic and related government guidelines, we urge stockholders not to attend the Annual Meeting this year and to instead vote by proxy.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet or in person at the Annual Meeting or, if you receive your proxy materials by U.S. mail, you also may vote by mailing a proxy card or voting by telephone. Please review the instructions on the Notice or on the proxy card regarding your voting options.

Thank you for your ongoing support of EyeGate. We look forward to your participation our Annual Meeting.

Sincerely,

Stephen From

Executive Chairman

EYEGATE PHARMACEUTICALS, INC.

271 Waverley Oaks Road, Suite 108

Waltham, MA 02452

(781) 788-8869

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 24, 2021

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of EyeGate Pharmaceuticals, Inc. (the “Company”) will be held on Thursday, June 24, 2021, at 1:00 p.m. Eastern Time at the offices of the Company, 271 Waverley Oaks Road, Suite 108, Waltham, MA 02452, for the following purposes:

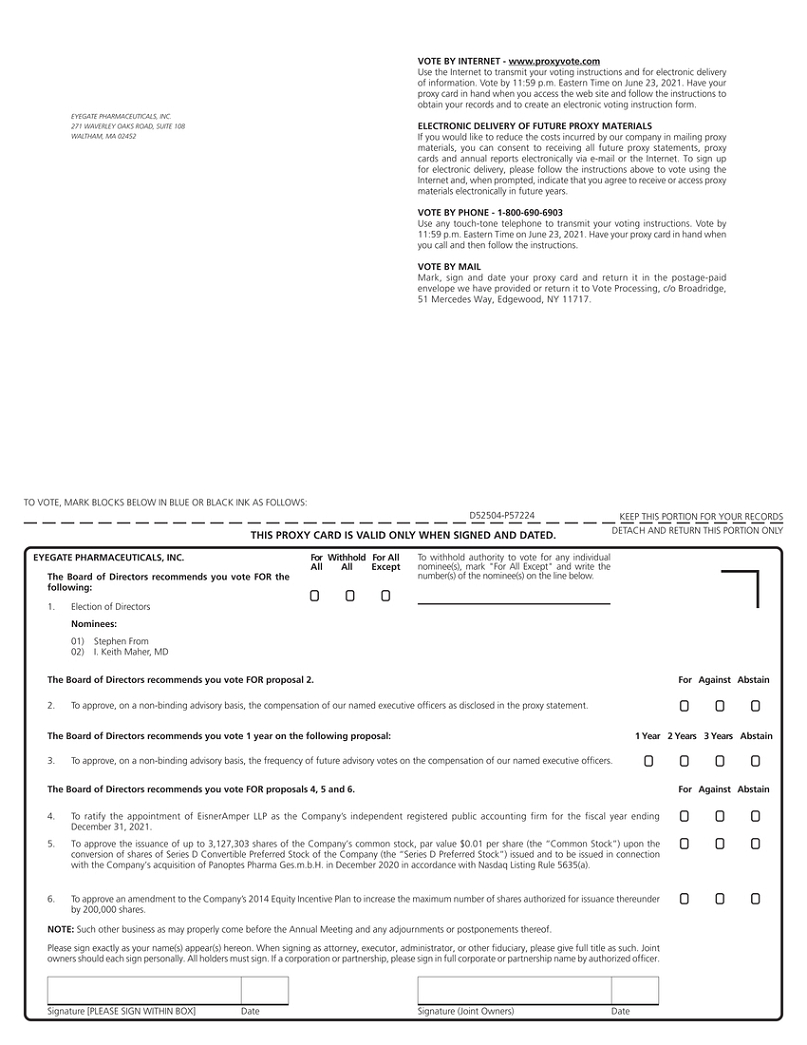

| 1. | To elect two director nominees as Class III Directors, nominated by the board of directors, for a three-year term, such term to continue until the annual meeting of stockholders in 2024 or until such directors’ successors are duly elected and qualified or until their earlier resignation or removal; | |

| 2. | To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the proxy statement; | |

| 3. | To approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of our named executive officers; | |

| 4. | To ratify the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021; | |

| 5. | To approve the issuance of up to 3,127,303 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) upon the conversion of shares of Series D Convertible Preferred Stock of the Company (the “Series D Preferred Stock”) issued and to be issued in connection with the Company’s acquisition of Panoptes Pharma Ges.m.b.H. in December 2020 in accordance with Nasdaq Listing Rule 5635(a); | |

| 6. | To approve an amendment to the Company’s 2014 Equity Incentive Plan to increase the maximum number of shares authorized for issuance thereunder by 200,000 shares; and | |

| 7. |

Such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

Stockholders may attend the Annual Meeting in person. However, based on the ongoing coronavirus pandemic and related government guidelines, we urge stockholders not to attend the Annual Meeting this year and to instead vote over the Internet or, if a stockholder receives proxy materials by U.S. mail, by mailing a proxy card or voting by telephone.

The board of directors has fixed the close of business on May 4, 2021 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Only holders of record of our common stock at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Each of the items of business listed above is more fully described in the proxy statement that accompanies this notice.

In the event there are not sufficient shares to be voted in favor of any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

The board of directors of EyeGate Pharmaceuticals, Inc. recommends that you vote “FOR” the election of the nominees of the board of directors as directors of EyeGate Pharmaceuticals, Inc., “FOR” the proposal to approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in this proxy statement, “1 YEAR” for the proposal to approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of our named executive officers, “FOR” the proposal to ratify the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm, “FOR” the proposal to approval of the issuance of up to 3,127,303 shares of Common Stock upon the conversion of shares of Series D Preferred Stock, and “FOR” the proposal to approve an amendment to the Company’s 2014 Equity Incentive Plan to increase the maximum number of shares authorized for issuance thereunder by 200,000.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on Thursday, June 24, 2021: The Proxy Statement and 2020 Annual Report to Stockholders, which includes the Annual Report on Form 10-K for the year ended December 31, 2020, are available at www.proxyvote.com. The Annual Report, however, is not part of the proxy solicitation material.

By order of the board of directors,

Stephen From

Executive Chairman

Waltham, Massachusetts

May 5, 2021

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE CAST YOUR VOTE ONLINE, BY TELEPHONE OR BY COMPLETING, DATING, SIGNING AND PROMPTLY RETURNING YOUR PROXY CARD OR VOTING INSTRUCTIONS CARD IN THE POSTAGE-PAID ENVELOPE (WHICH WILL BE PROVIDED TO THOSE STOCKHOLDERS WHO REQUEST TO RECEIVE PAPER COPIES OF THESE MATERIALS BY MAIL) BEFORE THE ANNUAL MEETING SO THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING.

EyeGate Pharmaceuticals, Inc.

Notice of 2021 Annual Meeting of Stockholders,

Proxy Statement and Other Information

Contents

EYEGATE PHARMACEUTICALS, INC.

271 Waverley Oaks Road, Suite 108

Waltham, MA 02452

(781) 788-8869

Annual Meeting of Stockholders to Be Held on Thursday, June 24, 2021

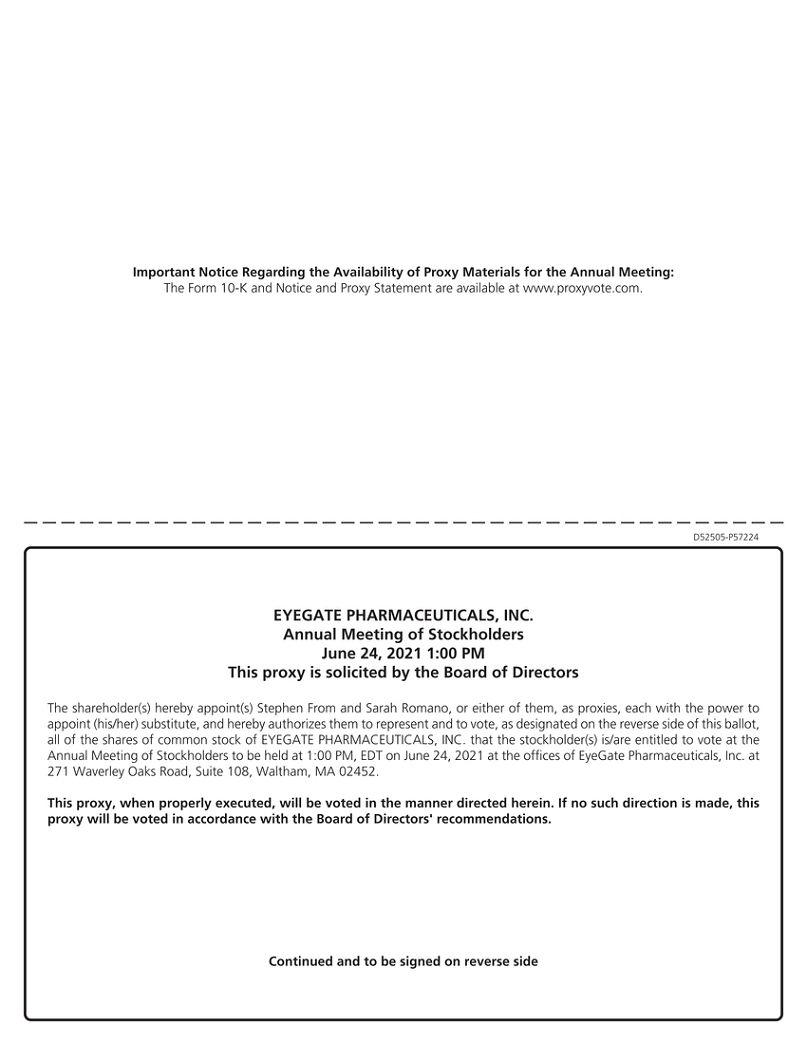

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of EyeGate Pharmaceuticals, Inc. (the “Company” or “we”) for use at the Annual Meeting of Stockholders of the Company to be held on June 24, 2021, at 1:00 p.m. Eastern Time, at the offices of the Company, 271 Waverley Oaks Road, Suite 108, Waltham, MA 02452, and any adjournments or postponements thereof. You may obtain directions to the Annual Meeting at www.proxyvote.com. At the Annual Meeting, the stockholders of the Company will be asked to consider and vote upon:

| 1. | The election of two director nominees as Class III directors, nominated by the board of directors (or the “board”), for a three-year term, such term to continue until the annual meeting of stockholders in 2024 or until such directors’ successors are duly elected and qualified or until their earlier resignation or removal; | |

| 2. | The approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement; | |

| 3. | The approval, on a non-binding advisory basis, of the frequency of future advisory votes on the compensation of our named executive officers; | |

| 4. | The ratification of the appointment of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021; | |

| 5. | The approval of the issuance of up to 3,127,303 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) upon the conversion of shares of Series D Convertible Preferred Stock of the Company (the “Series D Preferred Stock”) issued and to be issued in connection with the Company’s acquisition of Panoptes Pharma Ges.m.b.H. in December 2020 in accordance with Nasdaq Listing Rule 5635(a); | |

| 6. | The approval of an amendment to the Company’s 2014 Equity Incentive Plan to increase the maximum number of shares authorized for issuance thereunder by 200,000 shares; and | |

| 7. | Such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

Stockholders may attend the Annual Meeting in person. However, based on the ongoing coronavirus pandemic and related government guidelines, we urge stockholders not to attend the Annual Meeting this year and to instead vote over the Internet or, if a stockholder receives proxy materials by U.S. mail, by mailing a proxy card or voting by telephone.

Under rules and regulations of the Securities and Exchange Commission, or SEC, instead of mailing a printed copy of our proxy materials to each shareholder of record or beneficial owner of our common stock, we are now furnishing proxy materials, which include our Proxy Statement and Annual Report, to our shareholders over the Internet and providing a Notice of Internet Availability of Proxy Materials by mail. The Notice of Internet Availability of Proxy Materials is first being mailed to stockholders of the Company on or about May 5, 2021, in connection with the solicitation of proxies for the Annual Meeting. The board of directors has fixed the close of business on May 4, 2021 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting (the “Record Date”). Only holders of record of common stock, par value $0.01 per share, of the Company (the “Common Stock”) at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. As of April 29, 2021, there were ___________ shares of Common Stock outstanding. As of April 29, 2021, there were approximately __ stockholders of record. Each holder of a share of Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held of record with respect to each matter properly submitted at the Annual Meeting.

1

The presence, in person or by proxy, of holders of at least a majority of the voting power of the outstanding shares of the Company entitled to vote generally in the election of directors is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Shares held of record by stockholders or their nominees who do not return a signed and dated proxy, properly deliver proxies via the Internet or telephone, or attend the Annual Meeting in person will not be considered present or represented at the Annual Meeting and will not be counted in determining the presence of a quorum. Consistent with applicable law, we intend to count abstentions and broker non-votes only for the purpose of determining the presence or absence of a quorum for the transaction of business. A broker “non-vote” refers to shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter. Applicable rules no longer permit brokers to vote in the election of directors if the broker has not received instructions from the beneficial owner. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares.

With respect to the election of two Class III directors in Proposal 1, such directors are elected by a plurality of the votes cast if a quorum is present. Votes may be cast for the directors or withheld. In a plurality election, votes may only be cast in favor of or withheld from the nominee; votes that are withheld will be excluded entirely from the vote and will have no effect. This means that the persons receiving the highest number of “FOR” votes will be elected as a director. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on the election of directors, except to the extent that the failure to vote for an individual results in another individual receiving a larger percentage of votes.

Approval of Proposal No. 2 regarding the approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement requires the affirmative vote of a majority of the voting power of the outstanding voting stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on Proposal No. 2.

Approval of Proposal No. 3 regarding the approval, on a non-binding advisory basis, of the frequency of future advisory votes on the compensation of our named executive officers requires the affirmative vote of a majority of the voting power of the outstanding voting stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. However, because stockholders have several voting choices with respect to this proposal, it is possible that no single choice will receive a majority vote. In light of the foregoing, the board will consider the outcome of the vote when determining the frequency of future non-binding votes on executive compensation. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on Proposal No. 3.

Approval of Proposal No. 4 regarding the ratification of EisnerAmper LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 requires the affirmative vote of a majority of the voting power of the outstanding voting stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on Proposal No. 4.

Approval of Proposal No. 5 regarding the approval of the issuance of up to 3,127,303 shares of Common Stock upon the conversion of shares of Series D Preferred Stock requires the affirmative vote of a majority of the voting power of the outstanding voting stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on Proposal No. 5.

Approval of Proposal No. 6 regarding the amendment to the Company’s 2014 Equity Incentive Plan to increase the maximum number of shares authorized for issuance thereunder by 200,000 shares requires the affirmative vote of a majority of the voting power of the outstanding voting stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on Proposal No. 6.

The corporate actions described in this Proxy Statement will not afford stockholders the opportunity to dissent from the actions described herein or to receive an agreed or judicially appraised value for their shares.

2

You will not receive a printed copy of the proxy materials unless you request to receive these materials in hard copy by following the instructions provided in the Notice of Internet Availability of Proxy Materials. Instead, the Notice of Internet Availability of Proxy Materials will instruct you how you may access and review all of the important information contained in the proxy materials. The Notice of Internet Availability of Proxy Materials also instructs you how you may submit your proxy via the Internet or mail. To the extent you receive a proxy card, such proxy card will also contain instructions on how you may also vote by telephone. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

We encourage you to vote either online, by telephone or by completing, signing, dating and returning a proxy card or if you hold your shares through a brokerage firm, bank or other financial institution, by completing and returning a voting instruction form. This ensures that your shares will be voted at the Annual Meeting and reduces the likelihood that we will be forced to incur additional expenses soliciting proxies for the Annual Meeting.

Voting over the Internet, by telephone or mailing a proxy card will not limit your right to vote in person or to attend the Annual Meeting in person. Any record holder as of the Record Date may attend the Annual Meeting and may revoke a previously provided proxy at any time by: (i) executing and delivering a later-dated proxy to the corporate secretary at EyeGate Pharmaceuticals, Inc., 271 Waverley Oaks Road, Suite 108, Waltham, MA 02452; (ii) delivering a written revocation to the corporate secretary at the address above before the meeting; or (iii) voting in person at the Annual Meeting.

Beneficial holders who wish to change or revoke their voting instructions should contact their brokerage firm, bank or other financial institution for information on how to do so. Beneficial holders who wish to attend the Annual Meeting and vote in person should contact their brokerage firm, bank or other financial institution holding shares of Common Stock on their behalf in order to obtain a “legal proxy”, which will allow them to vote in person at the meeting. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

Our board of directors recommends a vote of “1 YEAR” for the proposal to approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of our named executive officers, and an affirmative vote on all other proposals specified in the notice for the Annual Meeting. Proxies will be voted as specified. If your proxy is properly submitted, it will be voted in the manner you direct. If you do not specify instructions with respect to any particular matter to be acted upon at the meeting, proxies will be voted in favor of the board of directors’ recommendations.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on Thursday, June 24, 2021: The Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 are available at www.proxyvote.com. The Annual Report, however, is not part of the proxy solicitation material.

3

PROPOSAL 1

ELECTION OF DIRECTORS

The board of directors of the Company currently consists of seven members and is divided into three classes of directors, with two directors in Class I, three directors in Class II and two directors in Class III. Directors serve for three-year terms with one class of directors being elected by our stockholders at each annual meeting to succeed the directors of the same class whose terms are then expiring.

At the Annual Meeting, two Class III directors, nominated by the board of directors, will stand for election to serve until the 2024 annual meeting of stockholders or until their successors are duly elected and qualified or until their earlier resignation or removal.

At the recommendation of the nominating and corporate governance committee, the board of directors has nominated Stephen From and I. Keith Maher, MD for election as the Class III directors of the Company. Unless otherwise specified in the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy “FOR” the election of Stephen From and I. Keith Maher, MD. The nominees have agreed to stand for election and, if elected, to serve as a directors. However, if any such person nominated by the board of directors is unable to serve or will not serve, the proxies will be voted for the election of such other person or persons as the nominating and corporate governance committee and the board of directors may recommend.

Vote Required

The affirmative vote of a plurality of the votes cast by holders of shares of Common Stock present or represented by proxy and entitled to vote on the matter at the Annual Meeting is required for the election of each of the nominees as a Class III director of the Company.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE FOLLOWING NOMINEES OF THE BOARD OF DIRECTORS: STEPHEN FROM AND I. KEITH MAHER, MD. PROPERLY AUTHORIZED PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE VOTED “FOR” THE NOMINEES UNLESS INSTRUCTIONS TO WITHHOLD OR TO THE CONTRARY ARE GIVEN.

4

INFORMATION REGARDING DIRECTORS

Set forth below is certain information regarding the directors and director nominee of the Company based on information furnished to the Company by each director and director nominee. The biographical description below for each director and director nominee includes his age, all positions he holds with the Company, his principal occupation and business experience over the past five years, and the names of other publicly-held companies for which he currently serves as a director or has served as a director during the past five years. The biographical description below for each director and director nominee also includes the specific experience, qualifications, attributes and skills that led to the conclusion by the board of directors that such person should serve as a director of the Company. In addition to such specific information, we also believe that all of our directors and director nominee have a reputation for integrity, honesty and adherence to high ethical standards. Further, they have each demonstrated business acumen and an ability to exercise sound judgment as well as a commitment of service to the Company and our board.

On April 1, 2021, Thomas E. Hancock, Morton F. Goldberg, MD and Bernard Malfroy-Camine resigned from the board of directors. On April 1, 2021, the board of directors appointed Kenneth Gayron and Aron Shapiro as Class II directors.

The board of directors has determined that all the incumbent directors listed below are “independent” as such term is currently defined by applicable NASDAQ rules, except for Mr. Boyd, Dr. Maher and Mr. From, who is the Executive Chairman of the board of directors.

The following information is current as of April 1, 2021, based on information furnished to the Company by each director:

Directors of EyeGate Pharmaceuticals, Inc.

| Name | Age | Position with the Company |

Director Since |

|||||

| Class III Directors – Term expires 2021; nominated to Serve a Term Expiring 2024 | ||||||||

| Stephen From* | 57 | Executive Chairman | October 2005 | |||||

| I. Keith Maher, MD* | 53 | Director | January 2020 | |||||

| Class I Directors – Term expires 2022 | ||||||||

| Paul Chaney(2)(3) | 63 | Lead Independent Director | September 2007 | |||||

| Steven J. Boyd | 40 | Director | May 2018 | |||||

| Class II Directors – Term expires 2020; nominated to Serve a Term Expiring 2023 | ||||||||

| Kenneth Gayron(1)(3) | 51 | Director | April 2021 | |||||

| Aron Shapiro(1)(2) | 43 | Director | April 2021 | |||||

| Praveen Tyle(1)(2)(3) | 61 | Director | June 2008 | |||||

| * | Nominee for election |

| (1) | Member of the compensation committee |

| (2) | Member of the nominating and corporate governance committee |

| (3) | Member of the audit committee |

5

Nominees for Election as Class III Directors — Term to expire 2024

Stephen From, Executive Chairman, has served as our Executive Chairman since February 2021, and prior to then served as our President, Chief Executive Officer, and director since October 2005. Mr. From was formerly the Chief Financial Officer at Centelion SAS, an independent biotechnology subsidiary of Sanofi-Aventis. Prior to this, Mr. From spent several years as an investment banker specializing in the biotechnology and medical device sectors. He served as Director in the Global Healthcare Corporate and Investment Banking Group and Head of European Life Sciences for Bank of America Securities. Mr. From holds a BSc from the University of Western Ontario, an accounting diploma from Wilfred Laurier University and has qualified as a Chartered Accountant in Ontario, Canada.

We believe Mr. From’s qualifications to sit on our board of directors include his executive leadership experience, financial expertise and the knowledge and understanding he has gained from serving as our President and Chief Executive Officer from 2005 through 2021.

I. Keith Maher, MD, Director, has served as a director since January 2020. Dr. Maher has worked at Armistice Capital covering healthcare since 2019. From 2013 through 2018, Dr. Maher served as the North American healthcare analyst for Schroder Investment Management. Prior to joining Schroder, Dr. Maher held senior roles at Omega Advisors, Gracie Capital and Paramount BioCapital. Prior to joining Paramount, Dr. Maher was a Managing Director at Weiss, Peck & Greer (WPG) Investments. He joined WPG from Lehman Brothers, where he worked as an equity research analyst covering medical device and technology companies. Dr. Maher has served on the board of directors of Vaxart, Inc., a Nasdaq-listed clinical stage company developing tablet vaccines, since November 2019. Dr. Maher completed his clinical training in medicine at the Mount Sinai Medical Center in New York City and earned an MBA from Northwestern University’s Kellogg Graduate School of Management.

We believe Dr. Maher’s qualifications to sit on our board of directors include his medical training, investment expertise and experience serving as a board member in the pharmaceutical industry.

Class I Directors — Term expires 2022

Paul Chaney, Lead Independent Director, has served as a director since September 2007 and as lead independent director since April 2021. He is co-founder, President & CEO of PanOptica, Inc, a private venture-backed biopharmaceutical company that licenses and develops drugs for the treatment of important ophthalmic conditions, and has held such positions since March 2009. Prior to founding PanOptica, Mr. Chaney was Executive Vice President and President of OSI-Eyetech Pharmaceuticals Inc., the wholly-owned eyecare biopharmaceutical subsidiary of OSI Pharmaceuticals, Inc. (OSI).. Prior to its acquisition by OSI,, Mr. Chaney served as Chief Operating Officer of Eyetech, Inc., where he was responsible for the launch of Macugen, the first anti-VEGF treatment for neovascular age-related macular degeneration (wet-AMD), and was part of the executive team which led Eyetech’s initial public offering in 2004. Mr. Chaney has over 30 years of experience in the biopharmaceutical and ophthalmic medical device industry, including a variety of senior management positions at Pharmacia Corporation. He began his career as a sales representative for The Upjohn Company in 1980. Mr. Chaney has also served as a member of the board of directors of Sesen Bio, Inc. (formerly Eleven Biotherapeutics, Inc.), a biologics company focusing on targeted protein therapeutics, from February 2014 to August 2018. Mr. Chaney earned a double BA in English and Biological Sciences from the University of Delaware.

We believe Mr. Chaney’s qualifications to sit on our board of directors include his executive leadership experience, including 20 years leading major ophthalmology businesses both in the U.S. and globally for both a large public pharmaceutical company and privately held start-ups. Mr. Chaney’s responsibilities have spanned commercial operations, manufacturing, regulatory, business development, non-clinical and clinical development functions. He was responsible for building and leading the commercial organizations responsible for the launches of major glaucoma and retina therapeutics, and commercializing the ophthalmic device business for Pharmacia Corporation.

6

Steven J. Boyd, Director, has served as a director since May 15, 2018. He is the Chief Investment Officer of Armistice Capital, a long-short equity hedge fund focused on the health care and consumer sectors based in New York City. Previously, Mr. Boyd had been a Research Analyst at Senator Investment Group, York Capital, and SAB Capital Management, where he focused on health care. Mr. Boyd began his career as an Analyst at McKinsey & Company. Mr. Boyd has served as a member of the board of directors of Cerecor Inc., an integrated biopharmaceutical company focused on pediatric healthcare, since April 2017. Mr. Boyd received a B.S. in Economics as well as a B.A. in Political Science from The Wharton School of the University of Pennsylvania.

We believe Mr. Boyd’s qualifications to sit on our board of directors include his experience in the capital markets and strategic transactions, and his focus on the healthcare industry.

Class I Directors — Term expires 2023

Kenneth Gayron, Director, has served as a director since April 2021. Mr. Gayron has served as Chief Financial Officer and Executive Vice President of Avid Technology, Inc., a leading technology provider for the media and entertainment industry, since May 2018. Mr. Gayron previously served as CFO and interim CEO for Numerex Corporation, a single source, leading provider of managed enterprise solutions enabling the Internet of Things, from March 2016 to February 2018. Prior to his tenure with Numerex, Mr. Gayron served as CFO of Osmotica Pharmaceutical Corp., a global specialty pharmaceutical company, from October 2013 to February 2016. Prior to Osmotica, Mr. Gayron acted as Vice President - Finance and Treasurer for Sensus, Inc., a global smart grid communications company, from February 2011 until September 2013. From April 2009 until January 2011, Mr. Gayron served as Treasurer of Nuance Communications, a software/services company. From 1992 until 2009, Mr. Gayron held positions of increasing responsibility with investment banks, including UBS, Bank of America and CIBC. Mr. Gayron received a BS in Finance from Boston College and an MBA from Cornell University.

We believe that Mr. Gayron’s qualifications to sit on our board of directors include his executive leadership experience, financial experience and track record for enhancing operational capabilities to drive growth.

Aron Shapiro, Director, has served as a director since April 2021. Mr. Shapiro has served in positions of increasing responsibility at Ora, Inc., the world’s leading full-service ophthalmic drug and device development firm, since July 1999, most recently serving as Senior Vice President and Partner, Asset Development and Partnering since August 2019, as Senior Vice President and Chief Commercial Officer between August 2017 and August 2019, and as Vice President between October 2010 and August 2017. At Ora, Mr. Shapiro is responsible for investment and strategic partnering was previously responsible for worldwide business development and sales activities. Mr. Shapiro received a BS in Biological Chemistry from Bates College.

We believe that Mr. Shapiro’s qualifications to sit on our board of directors include his extensive clinical-regulatory strategy and business development experience in the ophthalmology space.

Praveen Tyle, PhD, Director, has served as a director since June 2008. Since May 2016, Dr. Tyle has served as Executive Vice President of Research and Development of Lexicon Pharmaceuticals. Dr. Tyle was previously a member of the executive management team at Osmotica Pharmaceutical Corp., serving as President and Chief Executive Officer from January 2013 through April 2016 and as Executive Vice President and Chief Scientific Officer from August 2012 to December 2012. He is also a member of the board of Orient EuroPharma Co., Ltd. of Taiwan and of GI Dynamics, Boston. Dr. Tyle has nearly 30 years of experience in the pharmaceutical industry with the majority of his tenure in senior executive leadership positions in areas of research and development, manufacturing, quality, business development and operations. Prior to joining Osmotica Pharmaceutical Corp., Dr. Tyle served as Executive Vice President (from January 2012 to August 2012) and Chief Scientific Officer (from October 2011 to August 2012) for the United States Pharmacopeia, or USP. Prior to joining USP, Dr. Tyle from 2008 to 2011, served as the Senior Vice President and Global Head of Business Development and Licensing at Novartis Consumer Health from March 2009 to September 2011. At Novartis Consumer Health, Dr. Tyle also served as Senior Vice President & Global Head of Research and Development from March 2009 to February 2010. Dr. Tyle holds a doctorate in pharmaceutics and pharmaceutical chemistry from the Ohio State University and a BS in Pharmacy (honors) from the Institute of Technology, Banaras Hindu University in India.

We believe Dr. Tyle’s qualifications to sit on our board of directors include his executive research and development leadership experience and significant mergers and acquisitions and business development and licensing experience.

7

INFORMATION REGARDING THE BOARD OF DIRECTORS AND ITS COMMITTEES

During the year ended December 31, 2020, our board of directors held six meetings. Each of the directors except for Steven Boyd attended at least 75% of the total number of meetings of the board of directors and of the committees of which he was a member. The board of directors encourages directors to attend in person the Annual Meeting of Stockholders of the Company, or Special Meeting in lieu thereof, or, if unable to attend in person, to participate by other means, if practicable. In recognition of this policy, the board of directors typically schedules a regular meeting of the board of directors to be held on the date of, and immediately following, the Annual Meeting of Stockholders.

Board Leadership Structure

On February 1, 2021, Mr. From was appointed by our board of directors as Executive Chairman and Dr. Obermayr was appointed by the Board as our Acting Chief Executive Officer. Our board of directors has nominated Mr. From for election to the board at the Annual Meeting.

With the roles of Executive Chairman and Acting Chief Executive Officer separated between Mr. From and Dr. Obermayr, respectively, our board of directors believes our leadership structure enhances the accountability of our Acting Chief Executive Officer to the board and encourages balanced decision making. In addition, our board of directors believes that this structure provides an environment in which the independent directors are fully informed, have significant input into the content of board meetings, and can provide objective and thoughtful oversight of management. Our board of directors also separated the rules in recognition of the differences in responsibilities. As an additional element of its leadership structure, our board of directors has appointed Mr. Chaney to serve as lead independent director. The non-employee directors meet regularly in executive sessions outside the presence of management. While our Acting Chief Executive Officer is responsible for our day-to-day leadership and operations, the Executive Chairman of the board of directors and the lead independent director provide guidance to our board and set the agenda for board meetings. Our lead independent director serves under a lead independent director charter approved by our board, pursuant to which, among other things, he presides over executive sessions of the board, has authority to call meetings of independent directors, approves the frequency of board meetings, recommends committee membership to our nominating and corporate governance committee, and serves as a liaison between the Executive Chairman and the independent directors.

Our board of directors also considered that our audit, compensation, and nominating and corporate governance committees, which oversee critical matters such as the integrity of our financial statements, the compensation of executive officers, the selection and evaluation of directors, the development and implementation of corporate governance policies, and the oversight of our compliance with laws and regulations, each consist entirely of independent directors. Our board of directors does not have a current requirement that the roles of Chief Executive Officer and Chairman of the board be either combined or separated, because the board currently believes it is in the best interests of our Company to make this determination based on the position and direction of our Company and the constitution of the board and management team. From time to time, the board will evaluate whether the roles of Chief Executive Officer and Chairman of the board should be combined or separated. The board has determined that having separate roles of our Company’s Chief Executive Officer and Chairman is in the best interest of our stockholders at this time.

Independent Directors

Our board of directors is currently composed of eight members. Under the published listing requirements of Nasdaq, independent directors must comprise a majority of a listed company’s board of directors within twelve months of the completion of an initial public offering. All of the members of our board except for Mr. Boyd, Dr. Maher and Mr. From qualify as independent directors in accordance with the published listing requirements of Nasdaq.

8

Classified Board

Our board of directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our directors are divided among the three classes as follows:

| • | The Class III directors are Stephen From and I. Keith Maher, MD, and their terms expire at this Annual Meeting (and, if re-elected, the annual meeting of stockholders to be held in 2024); |

| • | The Class I directors are Paul Chaney, Bernard Malfroy-Camine and Steven J. Boyd, and their terms expire at the annual meeting of stockholders to be held in 2022; and | |

| • | The Class II directors are Kenneth Gayron, Aron Shapiro and Praveen Tyle and their terms expire at the annual meeting of stockholders to be held in 2023. |

The authorized number of directors may be changed only by resolution of the board of directors. This classification of the board of directors into three classes with staggered three-year terms may have the effect of delaying or preventing changes in our control or management.

Role of Board in Risk Oversight Process

Our board of directors has responsibility for the oversight of the company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board to understand the company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The audit committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The compensation committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The nominating and corporate governance committee manages risks associated with the independence of the board, corporate disclosure practices, and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board as a whole.

Corporate Governance

We believe our corporate governance initiatives comply with the Sarbanes-Oxley Act and the rules and regulations of the SEC adopted thereunder. In addition, we believe our corporate initiatives comply with the rules of The Nasdaq Capital Market. Our board of directors continue to evaluate our corporate governance principles and policies.

Our board of directors have adopted a code of business conduct that applies to each of our directors, officers and employees. The code addresses various topics, including:

| • | compliance with applicable laws, rules and regulations; |

| • | conflicts of interest; |

| • | public disclosure of information; |

| • | insider trading; |

| • | corporate opportunities; |

9

| • | competition and fair dealing; |

| • | gifts; |

| • | discrimination, harassment and retaliation; |

| • | health and safety; |

| • | record-keeping; |

| • | confidentiality; |

| • | protection and proper use of company assets; |

| • | payments to government personnel; and |

| • | reporting illegal and unethical behavior. |

The code of business conduct is posted on our website. Any waiver of the code of business conduct for an executive officer or director may be granted only by our board of directors or a committee thereof and must be timely disclosed as required by applicable law. The code of business conduct will implement whistleblower procedures that establish format protocols for receiving and handling complaints from employees. Any concerns regarding accounting or auditing matters reported under these procedures will be communicated promptly to the audit committee.

Board Committees

Our board of directors has established an audit committee, a compensation committee and nominating and corporate governance committee, each of which operate under a charter that has been approved by our board. The directors serving as members of these committees meet the criteria for independence under, and the functioning of these committees complies with, the applicable requirements of the Sarbanes-Oxley Act and SEC rules and regulations. In addition, we believe that the functioning of these committees complies with the rules of The Nasdaq Capital Market. Each committee has the composition and responsibilities described below.

Audit Committee

Our board of directors has established an audit committee, which is comprised of Kenneth Gayron, Paul Chaney and Praveen Tyle, each of whom is a non-employee member of the board of directors. Kenneth Gayron serves as the chair of the audit committee. Thomas Hancock served as chair of the audit committee prior to his resignation from the board of directors in April 2021. The audit committee met five times during 2020. The audit committee’s main function is to oversee our accounting and financial reporting processes, internal systems of control, independent registered public accounting firm relationships and the audits of our financial statements. Pursuant to the audit committee charter, the functions of the committee include, among other things:

| • | appointing, approving the compensation of, and assessing the independence of our registered public accounting firm; |

| • | overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm; |

| • | reviewing and discussing with management and the registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| • | monitoring our internal control over financial reporting and our disclosure controls and procedures; |

| • | meeting independently with our registered public accounting firm and management; |

| • | preparing the audit committee report required by SEC rules; |

10

| • | reviewing and approving or ratifying any related person transactions; and |

| • | overseeing our risk assessment and risk management policies. |

All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC. Our board of directors has determined that Kenneth Gayron is an “audit committee financial expert” as defined by applicable SEC rules. In addition, our board of directors has also determined that Mr. Gayron has the requisite financial sophistication under applicable Nasdaq rules and regulations.

Compensation Committee

Our board of directors has established a compensation committee, which is comprised of Praveen Tyle, Kenneth Gayron and Aron Shapiro. Praveen Tyle serves as the chair of the compensation committee. Thomas Hancock and Bernard Malfroy-Camine served as members of the compensation committee prior to their resignations from the board of directors in April 2021. The compensation committee met two times during 2020. Our compensation committee reviews and recommends policies relating to compensation and benefits of our officers and employees. Pursuant to the compensation committee charter, the functions of this committee include:

| • | evaluating the performance of our chief executive officer and determining the chief executive officer’s salary and contingent compensation based on performance and other relevant criteria; |

| • | identifying the corporate and individual objectives governing the chief executive officer’s compensation; |

| • | in consultation with the chief executive officer, determining the compensation of our other officers; |

| • | making recommendations to our board with respect to director compensation; |

| • | reviewing and approving the terms of material agreements with our executive officers; |

| • | overseeing and administering our equity incentive plans and employee benefit plans; |

| • | reviewing and approving policies and procedures relating to the perquisites and expense accounts of our executive officers; |

| • | if and as applicable, furnishing the annual compensation committee report required by SEC rules; and |

| • | conducting a review of executive officer succession planning, as necessary, reporting its findings and recommendations to our board of directors, and working with the Board in evaluating potential successors to executive officer positions. |

Our board of directors has determined that each of the members of the Compensation Committee is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act and is an “outside director” as that term is defined in Section 162(m) of the United States Internal Revenue Code of 1986, as amended, or Section 162(m).

Governance Committee

Our board of directors has established a nominating and corporate governance committee, which is comprised of Paul Chaney, Aron Shapiro and Praveen Tyle. Paul Chaney serves as the chair of the nominating and corporate governance committee. Thomas Hancock served as a member and Bernard Malfroy-Camine served as the chair of the Compensation Committee prior to their resignations from the board of directors in April 2021. The nominating and corporate governance committee met two times during 2020. Pursuant to the governance committee charter, the functions of this committee include, among other things:

| • | identifying, evaluating, and making recommendations to our board of directors and our stockholders concerning nominees for election to our board, to each of the board’s committees and as committee chairs; |

| • | annually reviewing the performance and effectiveness of our board and developing and overseeing a performance evaluation process; |

11

| • | annually evaluating the performance of management, the board and each board committee against their duties and responsibilities relating to corporate governance; |

| • | annually evaluating adequacy of our corporate governance structure, policies, and procedures; and |

| • | providing reports to our board regarding the committee’s nominations for election to the board and its committees. |

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is or has in the past served as an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

12

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate this Proxy Statement or any future filing with the Securities and Exchange Commission, in whole or in part, the following report shall not be deemed incorporated by reference into any such filing.

The undersigned members of the audit committee of the board of directors of the Company submit this report in connection with the committee’s review of the financial reports of the Company for the fiscal year ended December 31, 2020 as follows:

| 1. | The audit committee has reviewed and discussed with management the audited financial statements of the Company for the fiscal year ended December 31, 2020. |

| 2. | The audit committee has discussed with representatives of EisnerAmper LLP the matters required to be discussed with them by applicable requirements of Public Company Accounting Oversight Board Auditing Standard AS 1301: Communications with Audit Committees. |

| 3. | The audit committee has received the written disclosures and the letter from the independent accountant required by the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence. |

Based on the review and discussions referred to above, the audit committee recommended to the board of directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 for filing with the Securities and Exchange Commission.

Submitted by the audit committee:

Kenneth Gayron, Chairman

Paul Chaney

Praveen Tyle

13

Biographical information regarding our executive officers is set forth below. Each executive officer is elected annually by our board and serves until his or her successor is appointed and qualified, or until such individual’s earlier resignation or removal.

| Name | Age | Position | ||||

| Stephen From | 57 | Executive Chairman | ||||

| Franz Obermayr, Ph.D. | 52 | Acting Chief Executive Officer | ||||

| Sarah Romano | 41 | Chief Financial Officer | ||||

| Michael Manzo | 61 | Vice President of Engineering | ||||

Stephen From, Executive Chairman—Please refer to "Proposal No. 1—Election of Directors" section of this proxy statement for Mr. From’s biographical information.

Franz Obermayr, Ph.D., Acting Chief Executive Officer, has served as our Acting Chief Executive Officer since February 1, 2021 and previously served as our EVP Clinical Development from December 2020 through February 2021. Dr. Obermayr is a Managing Director of Panoptes Pharma Ges.m.b.H. (“Panoptes”), our wholly-owned subsidiary. He served as Co-Founder and CEO of Panoptes since its founding in 2013. Prior to Panoptes, Dr. Obermayr was Head of Clinical Development at Nabriva Therapeutics AG from 2009 to 2013, where he was responsible for all clinical programs, and also served as Program Manager from 2007 to 2009. His earlier career involved various positions at GPC-Biotech, most recently as Director Drug Discovery. Dr. Obermayr played a key role in the commercialization of these programs by managing large collaborations with pharmaceutical companies. Prior to GPC-Biotech, he completed his postdoctoral studies at the Max-Planck Institute for Immunobiology in Freiburg. Dr. Obermayr earned his Ph.D. in biochemistry at the Imperial Cancer Research Fund in London.

Sarah Romano, CPA, Chief Financial Officer, has served as our Chief Financial Officer since January 1, 2018 and previously served as our Interim Chief Financial Officer between February 2017 and January 2018. Ms. Romano joined us as Corporate Controller in 2016, and has been responsible for our accounting, tax, financial reporting, and internal controls. Prior to joining EyeGate, Ms. Romano served as Assistant Controller at TechTarget from June 2015 through August 2016 and Corporate Controller at Bowdoin Group, a healthcare-focused executive recruiting firm, from September 2013 through May 2015. Previously, she held financial reporting positions of increasing responsibility at SoundBite Communications from 2008 until its acquisition by Genesys in 2013, serving as Senior Financial Reporting Analyst from 2008 to 2010, as Financial Reporting Supervisor from 2010 to 2011 and as Financial Reporting Manager from 2011 to 2013. Ms. Romano also served as a Senior Financial Reporting Analyst at Cognex Corporation, a publicly-traded manufacturer of machine vision systems, software and sensors, from 2004 through 2008. Ms. Romano began her career as an Auditor in the Boston office of PricewaterhouseCoopers. A licensed CPA in Massachusetts, she holds a Bachelor of Arts in Accounting from College of the Holy Cross and a Masters of Accounting from Boston College.

Michael Manzo, Vice President of Engineering, has been with us since October 2006 and has served as Vice President of Engineering for the last seven years. Mr. Manzo has over 30 years of experience in product development and manufacturing in the medical device industry. Prior to working at EyeGate, Mr. Manzo held positions of President and Chief Operating Officer (2002 – 2006) at Jenline Industries, Ltd., which is now part of Helix Medical, LLC. He has been part of multiple start-up companies over the years, ranging in medical specialties from cardiology, radiology, urology and laparoscopic surgery. Mr. Manzo holds a Masters in Business Administration Degree from Suffolk University and a Bachelor of Science Degree in engineering from University of Massachusetts, Lowell.

14

We are a “smaller reporting company” under Rule 405 of the Securities Act of 1933, as amended. As a result, we have elected to comply with the reduced disclosure requirements applicable to smaller reporting companies in accordance with SEC rules. We had only three executive officers during the fiscal year ended December 31, 2020, Stephen From, our former President and Chief Executive Officer, Sarah Romano, our Chief Financial Officer, and Michael Manzo, our Vice President of Engineering, who are our named executive officers. Stephen From was appointed as the Executive Chairman of our board of directors effective February 1, 2021, and ceased serving as President and Chief Executive Officer as of that date.

Summary Compensation Table

The following table sets forth information concerning the compensation of our named executive officers during our fiscal years ended December 31, 2020 and December 31, 2019.

| Name and Principal Position | Year | Salary ($) |

Bonus ($)(1) |

Stock Awards(2) ($) |

Option Awards(2) ($) |

All

Other Compensation ($) |

Total ($) |

|||||||||||||||||||||

| Stephen From

Executive Chairman; |

2020 | 400,000 | 160,000 | 129,282 | 193,923 | — | 883,205 | |||||||||||||||||||||

| Former President and Chief Executive Officer (3) | 2019 | 400,000 | 106,600 | — | 94,740 | — | 601,340 | |||||||||||||||||||||

| Sarah Romano | 2020 | 264,361 | 60,000 | 64,641 | 64,641 | — | 453,643 | |||||||||||||||||||||

| Chief Financial Officer | 2019 | 250,000 | 86,010 | — | 23,685 | — | 359,695 | |||||||||||||||||||||

| Michael Manzo | 2020 | 250,000 | 60,000 | 48,481 | 48,481 | — | 406,962 | |||||||||||||||||||||

| Vice President of Engineering | 2019 | 250,000 | 94,167 | — | 23,685 | — | 367,852 | |||||||||||||||||||||

| (1) | The amounts in this column represent discretionary bonus payments granted by the board in the applicable fiscal year. |

| (2) |

The amounts in this column represent the aggregate grant date fair value of option awards or stock awards granted to the officer in the applicable fiscal year, computed in accordance with FASB ASC Topic 718. See Note 9 to our consolidated financial statements included elsewhere in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 for a discussion of the assumptions made by us in determining the grant date fair value of our equity awards. In accordance with SEC rules, the grant date fair value of an award subject to performance conditions is based on the probable outcome of the conditions.

|

|

| (3) | Mr. From was appointed as the Executive Chairman of our board of directors effective February 1, 2021, and ceased serving as President and Chief Executive Officer as of that date. |

15

Narrative Disclosure to Compensation Tables

Employment Agreements

Stephen From

We originally entered into an amended and restated employment agreement with our President and Chief Executive Officer, Stephen From, effective as of April 28, 2006. Pursuant to this agreement, Mr. From received an annual base salary of $275,078 and he was entitled to receive a bonus of up to 50% of his annual base salary for the applicable fiscal year, and which was $130,000 for the year ended December 31, 2014.

In February 2016, we entered into a second amended and restated employment agreement with Mr. From that became effective upon our listing on the NASDAQ Capital Market on July 31, 2015. Pursuant to this agreement, Mr. From received an annual base salary of $400,000 and was entitled to receive a bonus of up to 50% of his annual base salary for the applicable fiscal year.

On November 29, 2017, we entered into a Third Amended and Restated Employment Agreement with Mr. From, which was amended on November 26, 2019 (as amended, the “Third A&R Agreement”). The Third A&R Agreement provided for a severance payment to Mr. From upon the occurrence of a Change of Control (as defined in the agreement) of the Company, with the payment amount to be determined based on the value of the transaction that results in the Change of Control, up to a maximum of 1.5% of the transaction value. Additionally, the Third A&R Agreement increased the benefits that would have been realized by Mr. From upon termination by us without Cause or by Mr. From for Good Reason (as such terms are defined in the Third A&R Agreement) to include (i) 18 months of salary continuation payments, (ii) an amount equal to 1.5 multiplied by the maximum performance bonus that he would have been eligible to receive in the year of termination, assuming achievement of all applicable performance metrics at target level, (iii) 18 months of COBRA subsidy payments, and (iv) 18 months of accelerated vesting of stock options and/or restricted stock awards that are unvested at the time of termination.

In connection with Mr. From’s appointment as Executive Chairman, on January 29, 2021, we entered into a Fourth Amended and Restated Employment Agreement with Mr. From, with a term extending until January 31, 2022 unless earlier terminated in accordance with its terms (the “Fourth A&R Agreement”). Pursuant to the Fourth A&R Agreement, Mr. From receives a monthly base salary of $20,000 for the first through sixth months and $17,550 for the sixth through twelfth months. If Mr. From’s employment is terminated, then, conditioned upon executing a release in favor of us, Mr. From will be eligible to receive (i) monthly payments of $33,333.33 for eighteen months following the termination date, (ii) a lump sum cash payment of $300,000 payable on date of the last monthly payment under clause (i), (iii) 18 months of COBRA subsidy payments, and (iv) 18 months of accelerated vesting of stock options and/or restricted stock awards that are unvested at the time of termination, provided that if Mr. From is terminated for Cause (as defined in the Fourth A&R Agreement), he will not be entitled to receive the severance benefits described in clauses (ii), (iii) and (iv).

Sarah Romano

We originally entered into an offer letter with our Chief Financial Officer, Sarah Romano, effective as of January 1, 2018. Pursuant to the letter, Ms. Romano initially received an annual base salary of $200,000 and she was entitled to receive a bonus with an annual target of up to 25% of her annual base salary.

On March 23, 2020, we entered into an Employment Agreement with Ms. Romano that superseded her offer letter. Pursuant to this agreement, Ms. Romano currently receives an annual base salary of $275,000 and is entitled to receive a bonus with an annual target of up to 30% of her annual base salary. The agreement also provides that upon termination of Ms. Romano by us without Cause or by Ms. Romano for Good Reason (as such terms are defined in the agreement), Ms. Romano will be eligible to receive (i) six months of salary continuation payments, (ii) an amount equal to 0.5 multiplied by the maximum performance bonus that she would have been eligible to receive in the year of termination, assuming achievement of all applicable performance metrics at target level, (iii) six months of COBRA subsidy payments, and (iv) six months of accelerated vesting of stock options and/or restricted stock awards that are unvested at the time of termination.

16

Michael Manzo

In July 2014, our board of directors approved an amended and restated offer letter with Mr. Manzo that became effective upon our listing on the NASDAQ Capital Market on July 31, 2015. Pursuant to this letter, Mr. Manzo receives an annual base salary of $250,000 and is entitled to receive a bonus of up to 30% of his annual base salary for the applicable fiscal year.

Change of Control

Each of our named executive officers is eligible to receive certain benefits in the event of a change in control or if his employment is terminated under certain circumstances, as described under “Potential Payments Upon Termination or Change in Control” below.

Equity Compensation

We grant stock options and restricted shares to our named executive officers as the long-term incentive component of our compensation program. Stock options allow employees to purchase shares of our Common Stock at a price per share equal to the fair market value of our Common Stock on the date of grant and may or may not be intended to qualify as “incentive stock options” for United States federal income tax purposes. Generally, one third of the equity awards we grant vest on the first year anniversary, with the remainder vesting in equal monthly installments over 24 months, subject to the employee’s continued employment with us on the vesting date and our board of directors has discretion to provide that granted options will vest on an accelerated basis if a change of control of our company occurs, either at the time such award is granted or afterward.

Potential Payments Upon Termination or Change in Control

Stephen From

Pursuant to his employment agreement, if Mr. From’s employment is terminated for any reason, he will be entitled to receive monthly payments of $33,333.33 for 18 months following the termination date. Additionally, if Mr. From’s termination is terminated for any reason other than by us for Cause, he will be eligible to receive:

| • | a lump sum cash payment of $300,000 payable on date of the last monthly payment described above; |

| • |

payment by us of the monthly premiums under COBRA for Mr. From for up to 18 months following the termination; and

|

|

| • | 18 months of accelerated vesting of stock options and/or restricted stock awards that are unvested at the time of termination. |

“Cause” means (i) the officer’s conviction (including a guilty plea or a no contest plea) of a felony, or of any other crime involving fraud, embezzlement, dishonesty or moral turpitude, or (ii) a material breach of any of the officer’s obligations under the employment agreement that would reasonably be expected to have a material adverse effect on our business, results of operations, or financial condition, as reasonably determined by our board of directors, in each case after we have provided the officer with at least 30 days written notice of the same and with the opportunity to cure within such 30 day period, to the extent curable.

17

Sarah Romano

Pursuant to her employment agreement, if we terminate the employment of Sarah Romano without Cause or if she resigns for Good Reason, then she will be eligible to receive:

| • | continued payment of base salary for six months; |

| • | a lump-sum cash payment equal to 0.5 multiplied by the maximum performance bonus that she would have been eligible to receive in the year of termination, assuming achievement of all applicable performance metrics at target level; |

| • | payment by us of the monthly premiums under COBRA for Ms. Romano for up to six months following the termination; and | |

| • | six months of accelerated vesting of stock options and/or restricted stock awards that are unvested at the time of termination. |

“Cause” means the officer’s unlawful or dishonest conduct, or a breach of any of her obligations made under her employment agreement, including, but to limited to, the confidentiality provisions thereof.

“Good Reason” means a resignation after one of the following conditions has come into existence without the officer’s consent: (i) a material reduction in duties, authority or responsibility; (ii) a material reduction in annual base salary; (iii) a relocation of principal place of employment that increases her one-way commute by more than 50 miles; or (iv) a material breach by us of her employment agreement.

Upon a Change in Control, as defined in Ms. Romano’s employment agreement, all of Ms. Romano’s outstanding unvested stock options and/or restricted stock awards will become fully vested and immediately exercisable.

Michael Manzo

Pursuant to his offer letter, if we terminate the employment of Michael Manzo without Cause or if he resigns for Good Reason, then he will be eligible to receive:

| · | continued payment of base salary for six months; and |

| · | a lump-sum cash payment equal to his target bonus payment for the year in which the termination occurs. |

“Cause” means the officer’s unlawful or dishonest conduct, or a breach of any of his obligations made under his offer letter, including, but to limited to, obligations under a separate agreement relating to inventions, non-competition and non-solicitation.

“Good Reason” means a resignation after one of the following conditions has come into existence without the officer’s consent: (i) a material reduction in duties, authority or responsibility; (ii) a material reduction in annual base salary; (iii) a relocation of principal place of employment that increases his one-way commute by more than 50 miles; or (iv) a material breach by us of his offer letter.

Change in Control Severance Plan

On November 27, 2017, we adopted the EyeGate Pharmaceuticals, Inc. Change in Control Severance Plan, which we amended and restated on November 26, 2019 (as amended and restated, the “Change in Control Severance Plan”). The Change in Control Severance Plan provides us with assurance that we will have the continued dedication of, and the availability of objective advice and counsel from, executives and other employees and promotes certainty and minimize potential disruption for our employees in the event we are faced with or undergo a change in control. All of our full-time employees are participants in the Change in Control Severance Plan, with the exception of Mr. From. Under the Change in Control Severance Plan, upon a termination of employment without Cause by us or for Good Reason by the employee (as such terms are defined in the Change in Control Severance Plan), in either case during the period starting on the date when the definitive agreement for a Change in Control (as defined in the Change in Control Severance Plan) is executed and ending on the six-month anniversary following the consummation of such Change in Control transaction, subject to the execution of a release of claims, our full-time employees (other than Mr. From) would be entitled to the following compensation and benefits:

18

| · | a lump sum severance payment equal to three weeks of such employee’s then-effective base salary rate for each year of service completed by the employee, subject to the following minimum and maximum amounts: |

| · | for all participants that are executive officers or have the title of vice president or higher, a minimum amount equal to 26 weeks of base salary and a maximum amount equal to 52 weeks of base salary, and |

| · | for all other participants, a minimum amount equal to eight weeks of base salary and a maximum amount equal to 26 weeks of base salary; |

| · | a lump sum payment of the employee’s prorated annual incentive award for the year of termination, determined assuming achievement of target performance; |

| · | the payment of any annual incentive that has been earned but not yet paid in respect of any performance period that has concluded as of the executive officer’s termination of employment; and |

| · | payment of health insurance premiums under COBRA for six months following the date of termination, provided that all such premium payments will cease if the executive officer becomes entitled to receive health insurance coverage under another employer-provided plan. |

In the event that any payments under the plan are subject to Section 280G of the Internal Revenue Code, such payments will be reduced, unless not reducing the amount would result in an after-tax benefit to the employee of at least 5% greater than the reduced amount. The Change in Control Severance Plan does not provide excise tax gross-ups on payments to participants.

Employee Benefits and Perquisites

Our named executive officers are eligible to participate in our health and welfare plans to the same extent as all full-time employees. We do not provide our named executive officers with perquisites or other personal benefits other than reimbursement of their healthcare premiums (prior to our offering health plans), as described in the Summary Compensation Table.

19

Outstanding Equity Awards at 2020 Fiscal Year-End

The following table shows certain information regarding outstanding equity awards held by our named executive officers as of December 31, 2020.

Generally, one-third of the options and shares of restricted stock granted to our named executive officers vest on the one-year anniversary of grant, with the remaining options or shares, as applicable, vesting monthly for two years thereafter, subject to our repurchase right in the event that the executive’s service terminates before vesting in such shares. For information regarding the vesting acceleration provisions applicable to the options held by our named executive officers, please see “Employment Agreements” above.

Option Awards

| Name | Grant Date | Number of Securities Underlying Unexercised Options (#) Vested |

Number of Securities Underlying Unexercised Options (#) Unvested |

Option Exercise Price ($) |

Option Expiration Date |

|||||||||||

| Stephen From | 14-Jan-11 | 303 | — | 9.75 | 14-Jan-21 | |||||||||||

| 14-Jan-11 | 3,162 | — | 9.75 | 14-Jan-21 | ||||||||||||

| 23-Dec-12 | 728 | — | 9.75 | 23-Dec-22 | ||||||||||||

| 19-Feb-15 | 242 | — | 90.00 | 19-Feb-25 | ||||||||||||

| 24-Feb-15 | 11,665 | — | 86.25 | 24-Feb-25 | ||||||||||||

| 28-Aug-15 | 3,333 | — | 53.85 | 28-Aug-25 | ||||||||||||

| 25-Jan-16 | 1,333 | — | 25.50 | 25-Jan-26 | ||||||||||||

| 29-Mar-16 | 3,568 | — | 45.75 | 29-Mar-26 | ||||||||||||

| 18-Jul-16 | 4,610 | — | 36.30 | 18-Jul-26 | ||||||||||||

| 18-May-17 | 1,666 | — | 27.00 | 18-May-27 | ||||||||||||

| 21-Jun-17 | 8,333 | — | 20.25 | 21-Jun-27 | ||||||||||||

| 28-Feb-18 | 9,444 | 556 | (1) | 8.55 | 28-Feb-28 | |||||||||||

| 1-Feb-19 | 3,333 | 8,148 | (1) | 7.20 | 1-Feb-29 | |||||||||||

| 14-Feb-20 | — | 30,000 | (1) | 6.55 | 1-Feb-30 | |||||||||||

| Sarah Romano | 24-Oct-16 | 500 | — | 24.30 | 24-Oct-26 | |||||||||||

| 12-Dec-16 | 500 | — | 25.80 | 12-Dec-26 | ||||||||||||

| 21-Jun-17 | 2,666 | — | 20.25 | 21-Jun-27 | ||||||||||||

| 28-Feb-18 | 1,573 | 93 | (1) | 8.55 | 28-Feb-28 | |||||||||||

| 1-Feb-19 | 2,037 | 1,296 | (1) | 7.20 | 1-Feb-29 | |||||||||||

| 14-Feb-20 | — | 10,000 | (1) | 6.55 | 1-Feb-30 | |||||||||||

| Michael Manzo | 14-Jan-11 | 91 | — | 9.75 | 14-Jan-21 | |||||||||||

| 14-Jan-11 | 426 | — | 9.75 | 14-Jan-21 | ||||||||||||

| 23-Dec-12 | 728 | — | 9.75 | 23-Dec-22 | ||||||||||||

| 19-Feb-15 | 212 | — | 90.00 | 19-Feb-25 | ||||||||||||

| 24-Feb-15 | 3,332 | — | 86.25 | 24-Feb-25 | ||||||||||||

| 28-Aug-15 | 665 | — | 53.85 | 28-Aug-25 | ||||||||||||

| 25-Jan-16 | 332 | — | 25.50 | 25-Jan-26 | ||||||||||||

| 29-Mar-16 | 800 | — | 45.75 | 29-Mar-26 | ||||||||||||

| 18-Jul-16 | 1,037 | — | 36.30 | 18-Jul-26 | ||||||||||||

| 06-Feb-17 | 1,000 | — | 22.80 | 06-Feb-27 | ||||||||||||

| 18-May-17 | 533 | — | 27.00 | 18-May-27 | ||||||||||||

| 21-Jun-17 | 1,333 | — | 20.25 | 21-Jun-27 | ||||||||||||

| 28-Feb-18 | 1,574 | 93 | (1) | 8.55 | 28-Feb-28 | |||||||||||

| 1-Feb-19 | 2,037 | 1,296 | (1) | 7.20 | 1-Feb-29 | |||||||||||

| 14-Feb-20 | — | 10,000 | (1) | 6.55 | 1-Feb-30 | |||||||||||

| (1) | One-third of these options vest on the one-year anniversary of the grant date, with the remainder vesting in equal monthly installments over the remaining two years. |

20

All option awards were granted under our 2005 Equity Incentive Plan, or the 2005 Plan, and our 2014 Equity Incentive Plan, or the 2014 Plan.

Limitations of Liability and Indemnification Matters

Our restated certificate of incorporation and our amended and restated bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by the Delaware General Corporation Law, which prohibits our restated certificate of incorporation from limiting the liability of our directors for the following:

| • | any breach of the director’s duty of loyalty to us or our stockholders; |

| • | acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; |

| • | unlawful payment of dividends or unlawful stock repurchases or redemptions; or |

| • | any transaction from which the director derived an improper personal benefit. |

Our restated certificate of incorporation and our amended and restated bylaws also provide that if Delaware law is amended to authorize corporate action further eliminating or limiting the personal liability of a director, then the liability of our directors will be eliminated or limited to the fullest extent permitted by Delaware law, as so amended. This limitation of liability does not apply to liabilities arising under the federal securities laws and does not affect the availability of equitable remedies such as injunctive relief or rescission.